Germany has rapidly become Europe’s most significant medical cannabis market, and one of the most influential worldwide. In 2024, medical cannabis imports reached an unprecedented 71.6 tonnes, more than doubling the previous year’s figure of 32.5 tonnes. This marked acceleration—driven by regulatory liberalisation, rapid growth in patient demand, and an expanding supply chain—has positioned Germany as a global benchmark for cannabis policy and commerce. The stakes are now high as the market faces a new political landscape, regulatory uncertainty, and decisions that will shape its trajectory for years to come.

Table of Contents

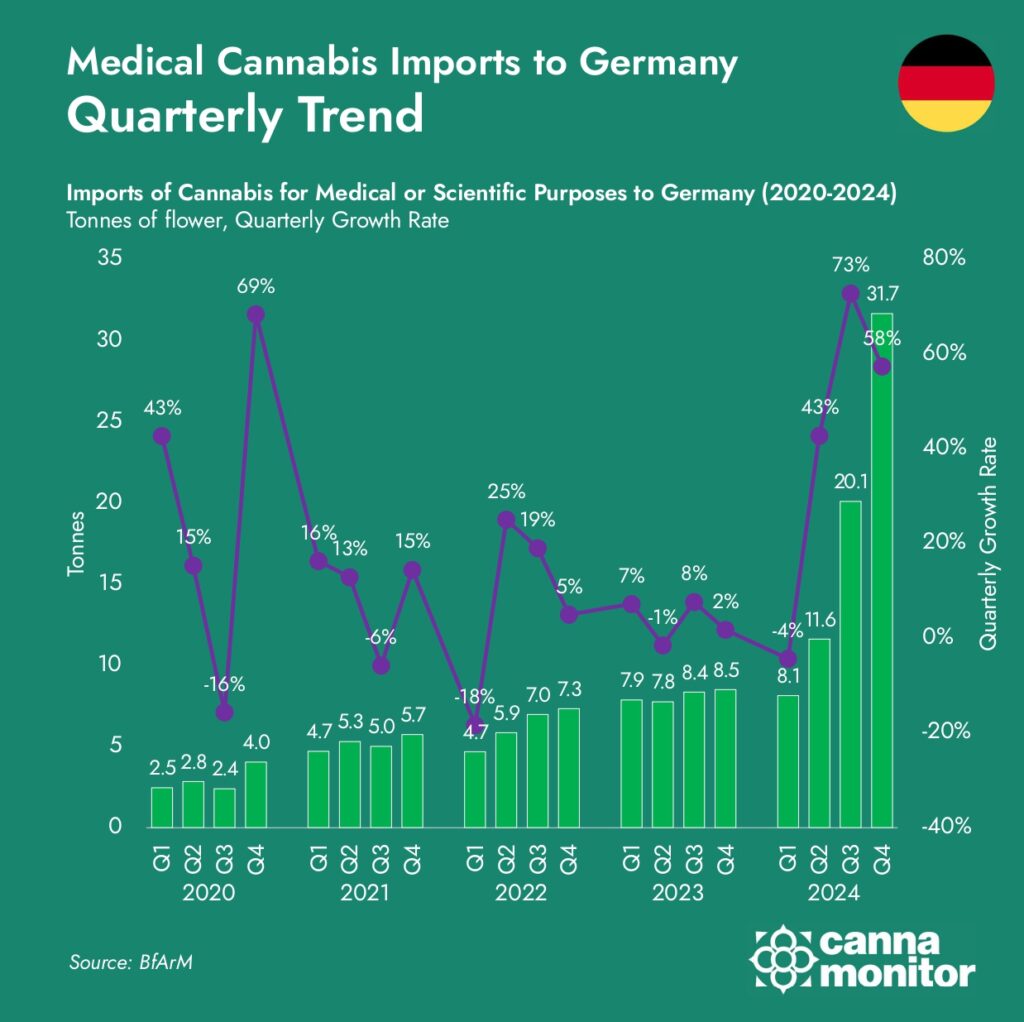

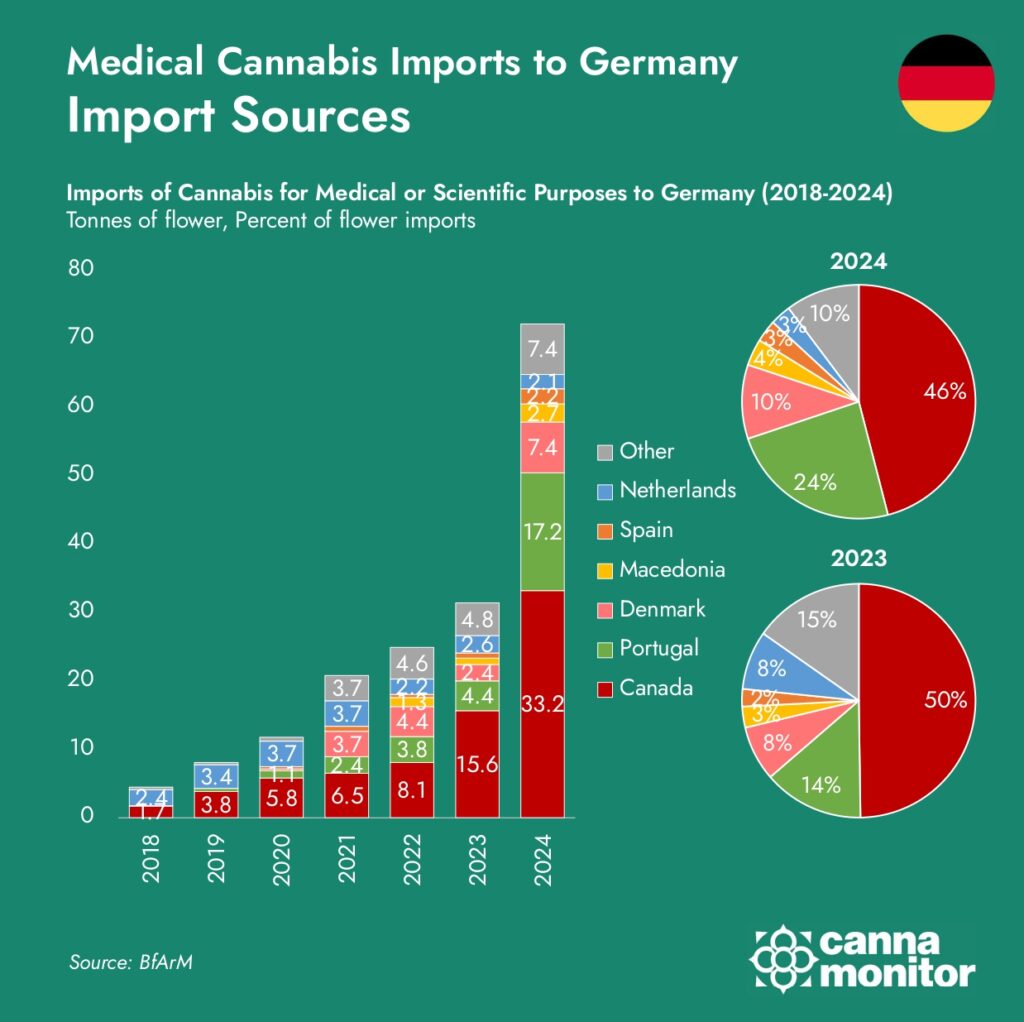

This explosive growth represents the culmination of a six-year trend, during which imports multiplied more than sixteenfold, rising from just 4.5 tonnes in 2018. The sharpest increase occurred in the second half of 2024, when over 31.7 tonnes were imported in Q4 alone, nearly half the annual volume. This surge was triggered by a series of transformative legal reforms.

Most notably, Germany removed medical cannabis from the narcotics list, eliminating key barriers to prescribing and dispensing. This was followed by a major reimbursement reform, which allowed specialist physicians to prescribe cannabis without needing prior health insurance approval, significantly easing patient access.

Unprecedented Import Growth and the Drivers Behind It

Annual imports of medical cannabis

Quarterly imports of medical cannabis

As a result of these changes, the number of medical cannabis patients rose to more than 300,000 by the end of 2024, up from under 200,000 the previous year. Annual sales climbed to over €450 million, and operators across the supply chain began scaling their operations to meet rising demand. One of the key enablers of this expansion has been telemedicine, which facilitated thousands of new prescriptions through online consultations and digital platforms. Cannabis-specific services enabled patients to obtain treatment through simple questionnaires and pharmacy delivery, leading to a 1,000% increase in prescriptions between March and December. However, this rapid growth has prompted scrutiny, with medical authorities warning that some platforms are prescribing without sufficient medical oversight. The situation escalated in early 2025 when a court ruling banned certain telemedical cannabis platforms from advertising and operating under current practices, citing risks to patient safety.

Political developments are adding further complexity. In February 2025, Germany’s federal elections brought the CDU/CSU back to power, a party that has pledged to roll back parts of the cannabis liberalisation law. While a full repeal is unlikely due to the need to form coalitions with parties supportive of reform, the new government is expected to tighten regulations on telemedicine and potentially delay the rollout of adult-use pilot projects, which are central to the second phase of cannabis legalisation. These scientific pilots, allowed under Section 2(4) of the cannabis law, were due to launch in cities like Berlin, Hannover and Frankfurt. The agriculture ministry has already received 26 applications for such pilot programs, many backed by leading cannabis operators and universities, but their fate is now uncertain.

Shifting Supply Chains, Domestic Production, and the Road Ahead

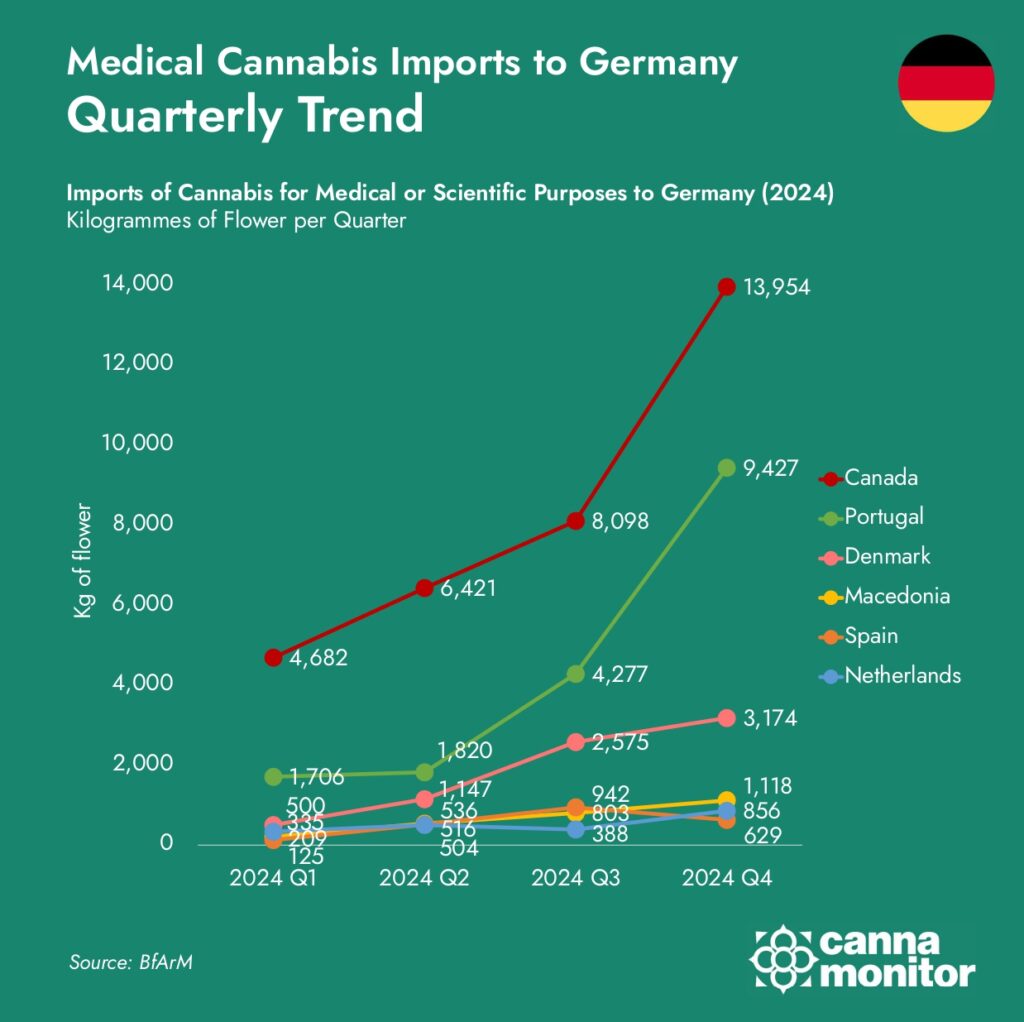

As demand has scaled, so too has Germany’s international sourcing network. In 2024, the country imported over 33 tonnes from Canada, making it the single largest supplier and accounting for 46% of total volume. Portugal followed with 17.2 tonnes, reflecting its emergence as Europe’s leading production and processing hub, thanks to competitive cultivation costs, clear licensing pathways, and a favourable regulatory climate. Denmark returned as a major player with 7.4 tonnes, rebounding from a production lull in 2023. Smaller contributors included Macedonia, Spain, and the Netherlands, as well as new entrants like the Czech Republic, which shipped over 1 tonne in its first year of export activity (data).

While Germany remains dependent on imports, a new era of domestic cultivation has begun. In mid-2024, Tilray’s German subsidiary, Aphria RX, harvested and released the first medical cannabis grown under the new legal regime, from its facility in Neumünster. This milestone followed the abolition of the restrictive BfArM tender system, allowing more producers to enter the cultivation market. Other companies, like DEMECAN, also launched German-grown varieties, helping to diversify the supply base and offering alternatives to patients seeking locally produced medicine. These developments mark the early stages of a shift toward self-sufficiency, which could play a larger role in the coming years.

Interestingly, while the global cannabis sector saw record-breaking M&A activity in 2024—from Canada to Australia and the UK—German firms have taken a more cautious path, focusing instead on organic growth. Cantourage surpassed €100 million in annual run-rate sales by the end of 2024, Enua tripled its revenue to €20 million, and WEECO, after being acquired by SynBiotic, revised its revenue projections upward. This conservative approach is intentional: operators are choosing to scale operational capacity, deepen distribution networks, and refine product offerings before engaging in acquisitions. The widespread view is that consolidation will follow once valuations stabilise and the regulatory outlook becomes clearer.

Annual imports by source country

Quarterly imports by source country

Germany at a Crossroads: Sustaining Leadership Under a New Government

Looking ahead, the market’s trajectory will depend on the interaction between policy enforcement and commercial readiness. If the legal framework remains broadly intact, Germany could exceed 100 tonnes of imports in 2025, with domestic production rising and strategic partnerships maturing. However, if political pressure leads to a rollback of telemedical access or pilot project delays, growth could slow, and capital could withdraw. Conversely, should pilot programs succeed and domestic production scale efficiently, Germany may become the model for integrated, scalable cannabis regulation in Europe, with ripple effects on policy across the EU.

What is clear is that Germany has already set a new global standard for what a regulated cannabis market can become—data-driven, medically anchored, and commercially viable. The challenge now is to sustain this momentum while navigating a shifting political terrain and maturing public expectations.