A recent Cannamonitor report on the UK medical cannabis market highlights a dynamic landscape showing continued growth across various product categories, especially THC-dominant flower. Based on analysis of over 300,000 privately prescribed medical cannabis items in 2022 and 2023, the report predicts the market will double again by the end of 2024, further solidifying the UK as one of Europe’s largest medical cannabis markets. This article explores key market trends, examining their implications for operators and patients and the potential trajectory of the UK market.

Download Report

Table of Contents

Exceptional Growth Trends: A Market on the Rise

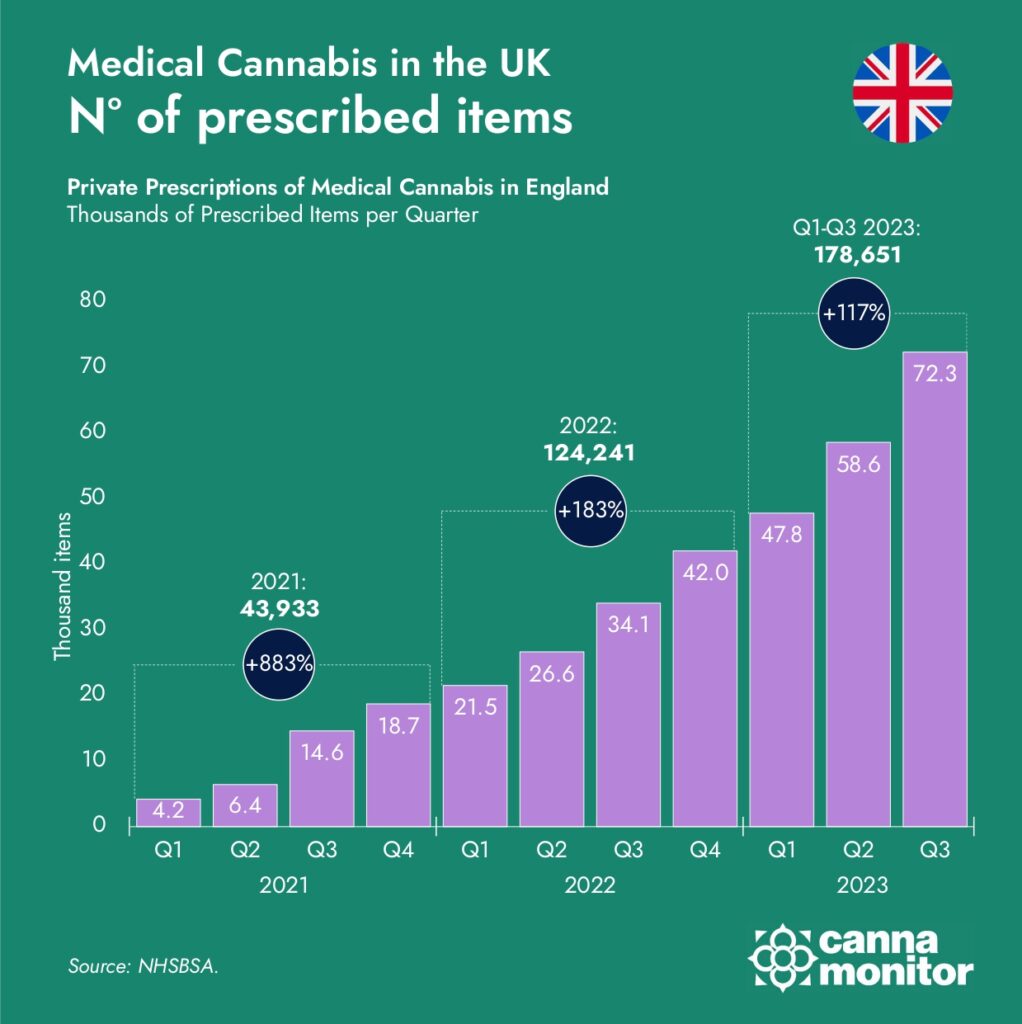

The UK medical cannabis market has seen remarkable growth, with prescribed items more than doubling annually since legalisation in 2018. From just 278 items in 2019, prescribed products rose to 43,933 in 2021 and surged to over 120,000 in 2022. Data from 2023 suggests this figure could exceed 250,000 items. With patient demand still accelerating, the market is poised for another doubling in 2024, potentially surpassing 1 million items supplied to patients by 2025.

Due to limited NHS involvement and a low number of prescribers, the market has been shaped by private prescriptions and a rise in specialised private clinics, which have lowered barriers to treatment and expanded patient options. Economies of scale have improved affordability, driving demand as a growing range of suppliers make higher-quality medical cannabis more accessible. The diversity of product offerings—from flower and oils to vapes and capsules—has enabled patients to find treatments that best meet their needs.

Unlike other state-led models in Europe, the UK’s liberalised, private-sector-driven approach has raised concerns over access inequities and high treatment costs, especially for patients with serious conditions like certain forms of childhood epilepsy.

Diverse Product Landscape: Flower, Oils, and More

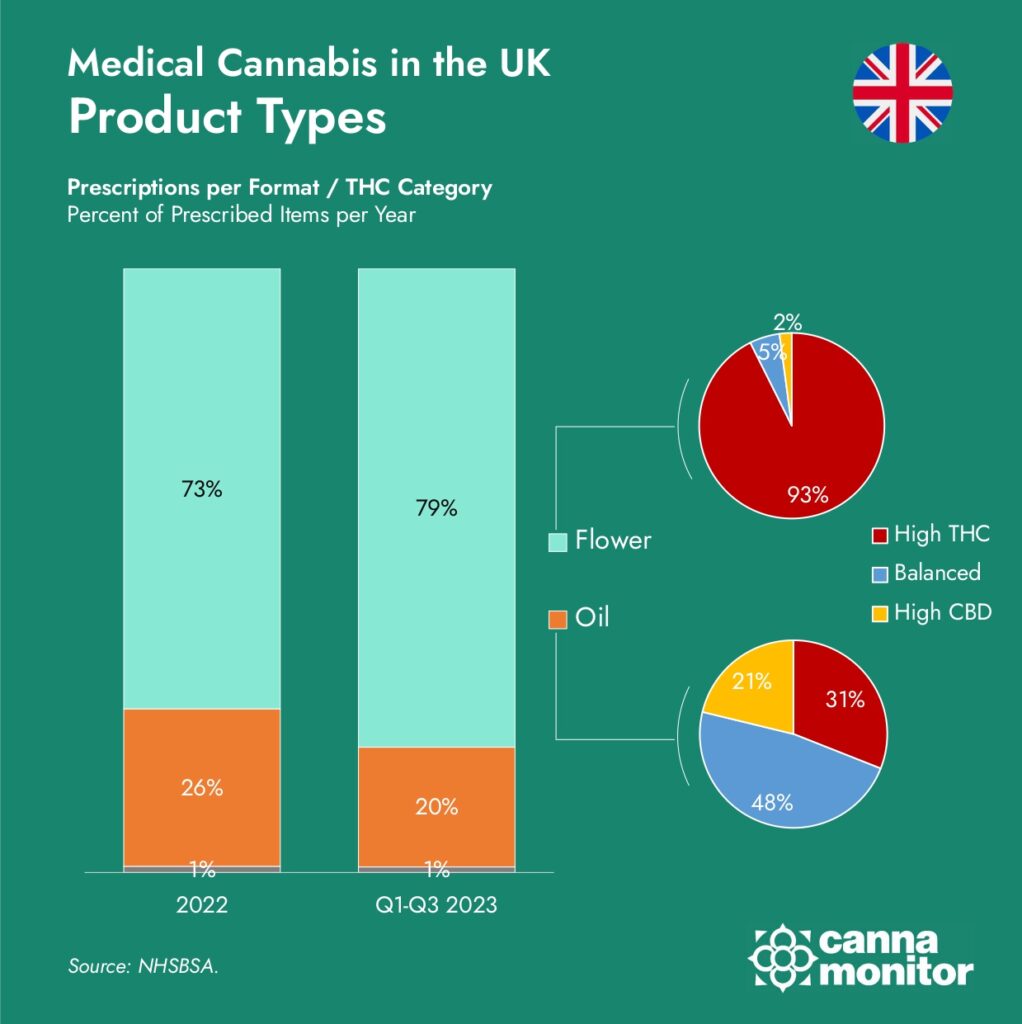

Despite a variety of product types available, the UK medical cannabis market has been notably driven by flower, with 79% of all prescriptions in 2023 for inflorescences—93% of which were THC-dominant varieties. Additionally, higher-potency flowers are gaining popularity.

While high-THC flower dominates, other product formats remain steady. Oils, which comprised 20% of prescriptions in 2023, lost some share to the fast-growing flower segment, despite growth in absolute terms. Split evenly across THC:CBD ratios, oils offer a versatile option for patients seeking non-inhaled delivery methods.

However, newer products like vape cartridges, capsules, and pastilles have yet to make a significant impact, with a combined 1% market share in 2023. There is potential for growth as these formats become more familiar to prescribers and patients.

European Supply Dominates as Canada Gains Ground

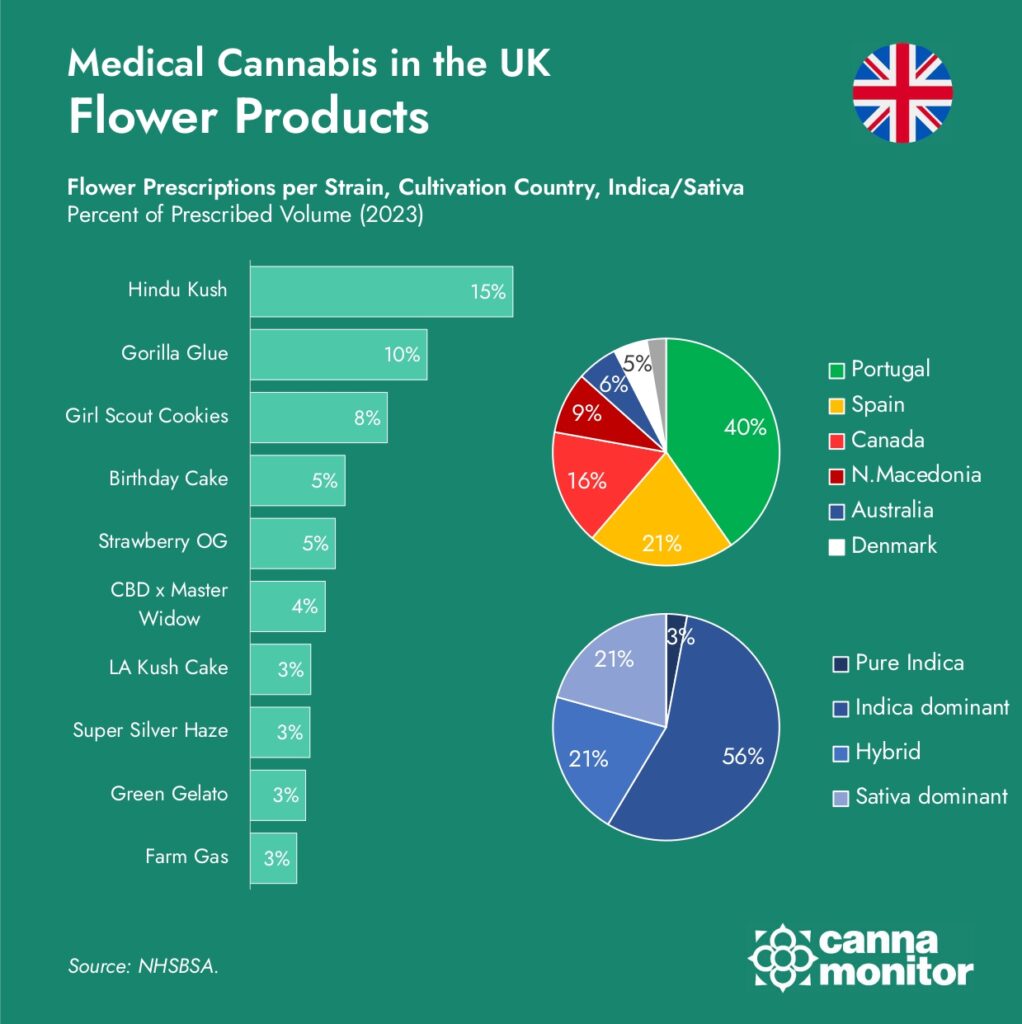

The UK supply chain relies heavily on European imports, with 75% of prescribed cannabis products sourced from countries like Portugal, Spain, Macedonia, and Denmark. This contrasts with other international markets, such as Australia or Germany, where Canadian products are more dominant.

However, Canadian products are quickly gaining traction in the UK, with prescriptions doubling between 2022 and 2023, driven largely by demand for high-THC options. Currently, 56% of UK products exceeding 24% THC are sourced from Canada, indicating strong demand for potent varieties from Canadian suppliers.

High-THC Flower Demand Leads Market Growth

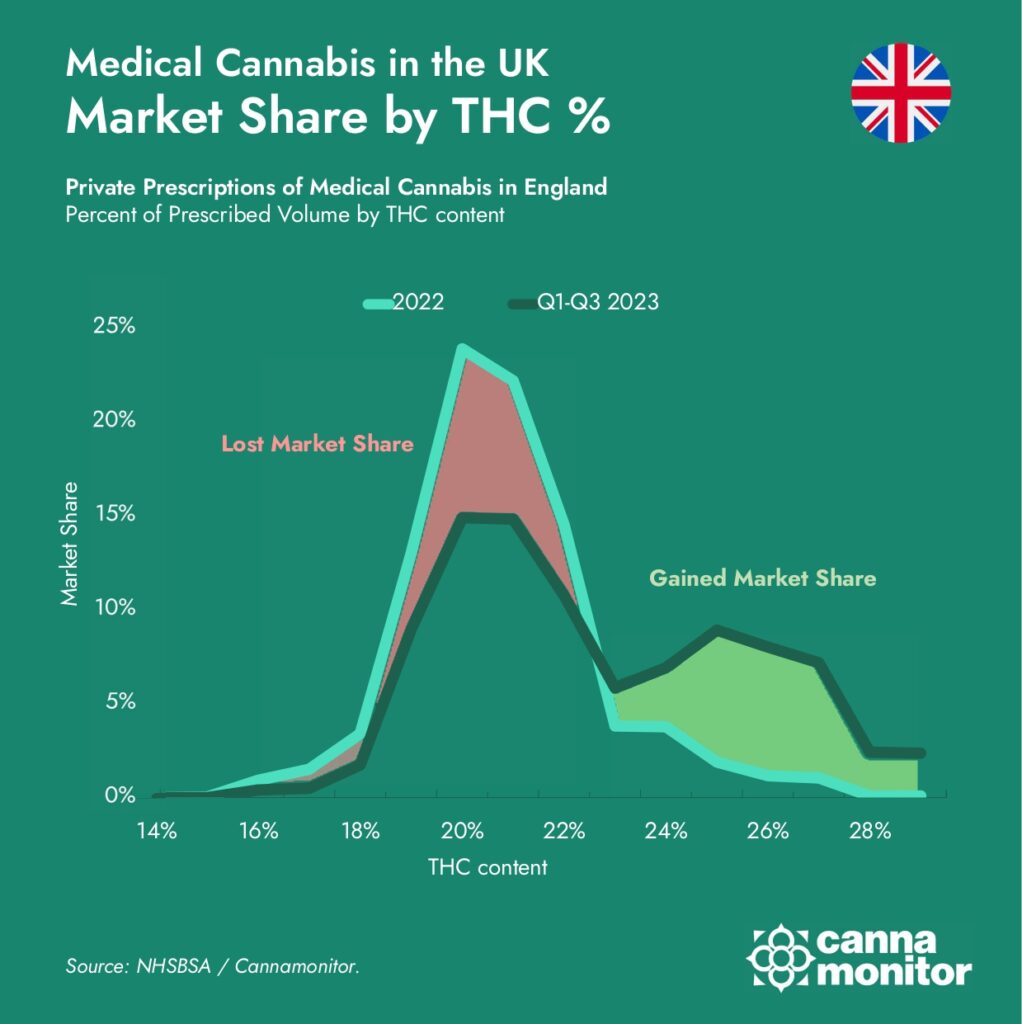

The preference for high-THC flower highlights a distinct trend in patient demand, raising concerns about the market’s evolution away from a pharmaceutical, patient-focused model and towards a more quasi-recreational approach.

This shift is reflected in the growing popularity of ultra-potent strains. In 2022, only 3% of flower prescriptions were for products over 24% THC, but this figure surged to 22% in 2023, indicating an increasingly potency-focused market. While all THC categories grew in absolute terms in 2023, flowers with over 23% THC led the market’s growth.

The concentration of flower products is another indicator of market maturity: of over 110 varieties available, the top 10 strains make up 60% of the total market, while the top 20 account for 80%. Indica-leaning hybrids such as GG#4 and GSC are especially popular.

Get Exclusive Insights on the UK Market

Rising Demand for High-THC Flower Products

The UK’s medical cannabis market is increasingly defined by a “THC race,” where high potency often equates to value. This trend mirrors North American markets, where THC levels routinely exceed 30% and controversies over lab “shopping” have raised concerns about labelling accuracy. Although the UK operates under stricter Good Manufacturing Practice (GMP) standards, the pursuit of high THC could bring similar quality assurance challenges as the market matures.

In addition to patient demand, this emphasis on THC is driven by advances in genetics, cultivation, and processing, allowing producers to optimise cannabinoid levels. Economic incentives also play a role, with premium pricing linked to higher THC content, creating a competitive environment where brands vie for a share of the expanding high-THC segment.

Curaleaf Leads as New Challengers Emerge in the Market

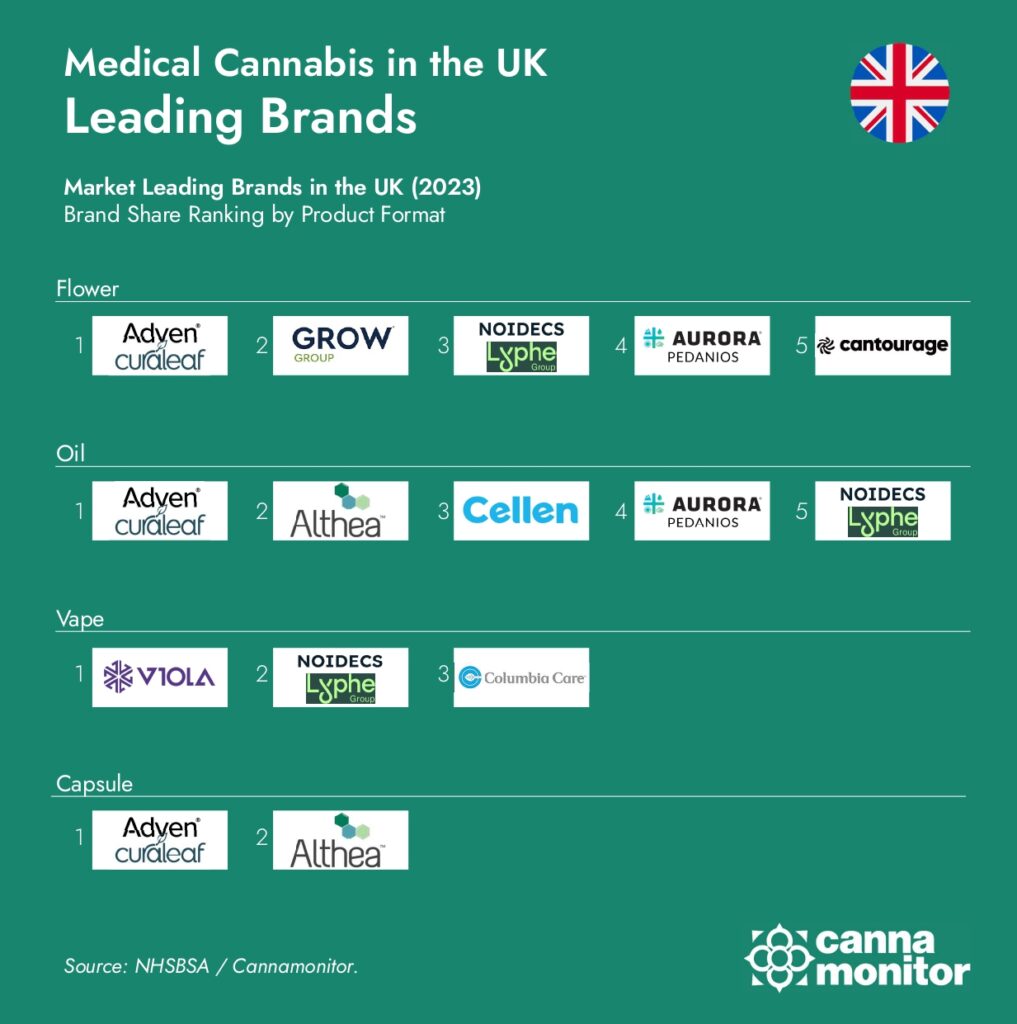

In 2023, Curaleaf solidified its dominance in the UK’s medical cannabis market, achieving the leading market share across major product formats, including flower, oil, and capsules. This growth positions Curaleaf well ahead of its competitors, capturing significant portions of consumer demand in these categories.

Several challenger brands have emerged, including Grow, Lyphe, Althea, Cellen, Aurora, and Cantourage, each striving to gain traction against Curaleaf’s stronghold. Despite their efforts, these brands face stiff competition, as evidenced by the modest growth seen from Grow, Aurora, and Cantourage. Althea and Cellen managed to maintain stable positions, indicating a more resilient footing in a competitive landscape. However, some brands have experienced challenges; both Lyphe and Khiron saw notable declines in their market share, underscoring the volatility and shifting dynamics within the market.

Additionally, there are promising entrants such as Mamedica, Therismos, and Little Green Pharma that, while not fully reflected in the 2023 data, represent potential future growth. Their emergence signals a diversifying market, with new players possibly altering the competitive landscape in the coming years. This influx of contenders reflects the ongoing evolution in the UK’s medical cannabis sector, as companies vie to capture and expand their share in an increasingly competitive environment.

Conclusion: What Lies Ahead for the Market?

The UK’s medical cannabis market is at a pivotal moment, with the potential for significant growth but also considerable challenges. While high-THC flower remains dominant, there are signs of an impending shift towards product differentiation beyond potency. As the market matures, consumer education is expected to drive interest in factors like terpene profiles, unique strains, and aroma, suggesting an eventual evolution towards a more diversified product landscape.

For global cannabis companies, the UK presents a compelling opportunity. With its high growth rate and demand for potent, GMP-compliant products, the UK market is drawing attention from suppliers worldwide. However, the path forward may require balancing this demand for high potency with an emphasis on quality, safety, and product variety. As the market continues to develop, companies capable of delivering innovative, well-differentiated products are likely to gain a competitive edge.