Australia’s medical cannabis market continues to grow at an impressive pace, yet it faces a series of regulatory, clinical, and supply-side inflection points that are shaping the sector’s trajectory. Despite a growing scale and further maturation of the market, challenges remain in terms of patient safety, prescriber oversight, and domestic supply competitiveness. This feature article provides a detailed review of regulatory and market developments, supply and trade data, and the broader implications for industry stakeholders.

Table of Contents

The coming 12-18 months represent a pivotal period that will determine whether Australia can successfully harmonise its regulatory oversight, ensure safe product use, and achieve a sustainable balance between domestic production and strategic exports. With appropriate management of these challenges, Australia is well-positioned to consolidate its status as a global leader in therapeutic cannabis, potentially offering a blueprint for sustainable, patient-centred industry growth.

Regulatory Reform and Market Growth in Australian Medicinal Cannabis

Australia’s medicinal cannabis market shows significant financial potential. With a growing supplier base, Australia is well-positioned for substantial market growth. International opportunities, particularly in Europe and Asia, are enabling Australian companies to establish themselves globally.

Australia’s potential as a global exporter is growing, supported by quality-controlled production standards. With increasing international demand, Australia is positioned to become a major supplier, particularly to Europe as restrictions ease.

The country’s export regulations and product standards ensure Australian products meet international requirements. As a result, export volume is expected to increase, establishing Australia as a significant player in the global cannabis market.

The medicinal cannabis supply chain encompasses cultivation, extraction, and distribution. To meet demand, Australia must expand production capacity and build robust distribution networks. Challenges include managing logistical bottlenecks, maintaining quality control, and meeting regulatory requirements.

Advocacy groups like AMCA and MCA significantly influence policy and advocate for patient access. They bridge gaps between regulatory bodies and the medical community, educating practitioners on best practices. Their efforts support public policy reform and advance clinical acceptance.

Public perception of medicinal cannabis has evolved considerably. Initial stigma has given way to greater understanding as scientific evidence supporting its benefits accumulates.

Media plays a relevant role in shaping public opinion, with coverage of adverse events impacting regulatory scrutiny. However, as patient success stories and clinical evidence emerge, public acceptance of cannabis as a mainstream therapeutic option increases.

Education for healthcare professionals is essential. Evolving practices require integrating cannabis into general practice rather than limiting it to specialized clinics. Initiatives like AMCA-MCA roadshows help doctors understand regulations and clinical practices. This education is vital for mainstream healthcare integration. Continuous education addresses concerns about safety and efficacy, fostering wider acceptance.

Product pricing remains challenging. While prices have decreased with increased supply, cannabis remains expensive for many patients. Limited insurance coverage compounds this issue.

Market competition is intensifying with new domestic and international suppliers. As the market matures, pricing dynamics will evolve, and generic cannabis products may improve accessibility.

Since 2016, Australia’s regulatory system has developed under the TGA. While it provides a centralized framework, implementation remains fragmented across states and territories.

Each jurisdiction maintains distinct rules for patient eligibility, prescribing, and dispensing. This regulatory patchwork creates inconsistent access despite the TGA’s streamlined pathways through SAS-B and Authorized Prescriber systems.

Queensland accounts for over 50% of prescriptions due to telehealth adoption and supportive regulations. In contrast, Tasmania and Northern Territory maintain restrictive policies. This indicates geography, not medical need, often determines access.

Administrative complexity deters many doctors from prescribing. Many cite uncertainty about state requirements as barriers. A unified framework would create consistency in prescribing and oversight, streamline approvals, and reduce regulatory burdens.

Aligning state regulations with the TGA’s federal framework would help ensure equitable patient access regardless of location, greater efficiency in prescriber authorization and supply, improved data for pharmacovigilance and research and reduced reliance on unregulated sources. This regulatory harmonization would create a more consistent and accessible medical cannabis system across Australia.

Tracking the Flows: Australia’s Medicinal Cannabis Supply

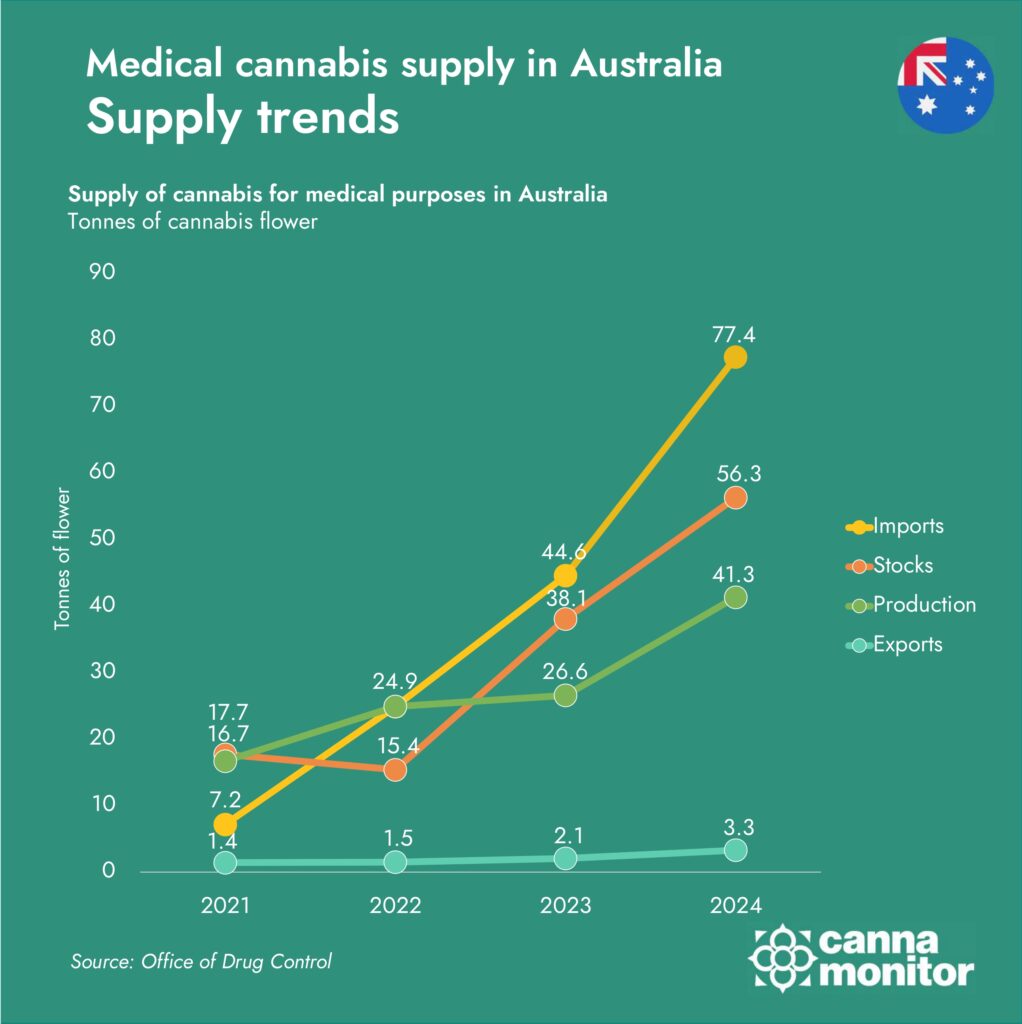

Between 2021 and 2024, Australia’s cannabis flower and extract markets underwent a remarkable phase of expansion.

Flower volumes rose from 7.2 to 77.4 tonnes, reflecting annual growth rates of +247%, +79%, and +74%, equivalent to an impressive compound annual growth rate (CAGR) of approximately 122% over three years. Meanwhile, extract imports increased from 1.4 to 3.3 tonnes, and extract exports surged from 0.2 to 2.0 tonnes, a CAGR of roughly 115%.

The data reveal a pronounced scale-up in flower supply beginning in 2022, likely driven by regulatory adjustments, licensing liberalisation, or expanded market access, followed by sustained though moderating growth thereafter.

The extract trade matured steadily: exports, though starting from a small base, expanded more rapidly than imports, signalling the development of domestic processing capability and an emerging export orientation.

While the flower market remains the primary driver, the narrowing import-export differential in extracts points to increasing local value addition and a shift towards re-export of refined products.

Structurally, this trajectory reflects an industry in rapid ascent, demanding substantial investment in cultivation capacity, logistics, quality assurance, and regulatory compliance. The 2022 inflection almost certainly denotes a moment of policy or operational realignment, after which the industry began to consolidate around higher standards and expanded commercial opportunity.

As extract exports gather pace, Australia appears to be ascending the value chain, transitioning from a raw-material importer to a producer of processed, higher-margin goods.

Imports and Exports in Australia

Production and Stockpiles in Australia

Medical cannabis supply trends

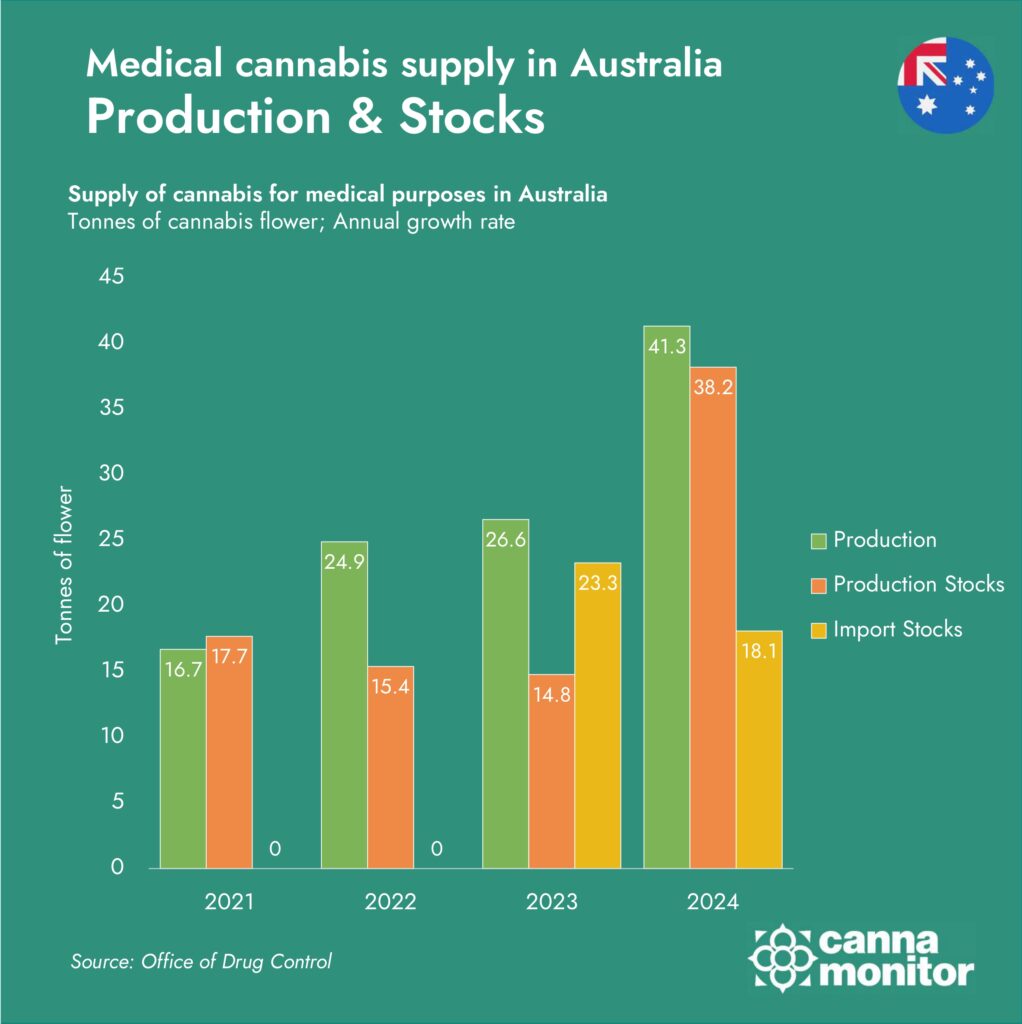

Australia’s medicinal cannabis production and supply chain experienced substantial, if uneven, growth. Local production rose from 16.7 tonnes in 2021 to 41.3 tonnes in 2024. The annual increments averaged around 13 tonnes per year, with significant surges in 2022 (+9.9 t) and 2023 (+14.7 t), followed by continued growth into 2024. Stocks consistently exceeded or matched recorded supply, rising from 17.7 tonnes in 2021 to 56.3 tonnes in 2024, confirming that domestic cultivation remains the dominant source of material.

Stocks grew alongside production, with stocks rising from 15.4 t in 2021 to 48.0 t in 2024, resulting in a high stock-to-production ratio of around 87% by the end of the period. This ratio suggests a deliberate inventory strategy or a lag between production and market release. The 2022 expansion likely reflects regulatory and licensing changes, while the 2023 slowdown may indicate temporary demand constraints, processing bottlenecks, or certification delays.

The significant build-up in inventory highlights potential risks related to oversupply, quality control, and biomass degradation over time. Additionally, large stockpiles could complicate operational logistics, tying up capital and increasing compliance challenges.

Imports surged more than tenfold, from 7.2 tonnes in 2021 to 77.4 tonnes in 2024, representing the most substantial increase. Domestic production grew steadily from 16.7 tonnes in 2021 to 41.3 tonnes in 2024, while exports showed modest growth from 1.4 tonnes in 2021 to 3.3 tonnes in 2024. Stock levels remained comparatively low throughout this period, increasing only from 1.4 tonnes in 2021 to 3.3 tonnes in 2024.

The expansion of local cannabis cultivation demonstrates Australia’s growing capacity in the sector. Despite this progress, domestic production still significantly trails imports, highlighting Australia’s ongoing dependence on international supply chains for meeting medical cannabis demand.

The growth in domestic production represents an important step toward greater self-sufficiency, though Australia remains years away from meeting its internal needs through local cultivation alone.

Export volumes, while showing consistent growth, increased at a much slower rate than both imports and production. This modest export activity indicates that Australia’s market remains primarily consumption-oriented rather than export-focused.

This trade imbalance confirms Australia’s current position as more of a net consumer of cannabis than a global supplier, despite its expanding production capabilities.

Australia’s medical cannabis flower imports went from 7.2 tonnes in 2021 to 77.4 tonnes in 2024, reflecting a 10.7-fold increase. Canada dominates the supply during this period, expanding from 5.8 tonnes in 2021 to a 62.1 tonnes in 2024, making up a substantial portion of the total imports.

While countries like Portugal, New Zealand, Thailand, Denmark, Czechia, and South Africa contribute to the diversification of supply, their share remains relatively small compared to Canada.

- Canada: Dominating Australia’s medicinal cannabis imports, supplied 5,792 kg in 2021, increasing to 62,111 kg by 2024. This consistent growth underscores Canada’s pivotal role in meeting Australia’s demand for medicinal cannabis. A stress test scenario suggests that a 25% reduction in Canadian supply could lead to a loss of approximately 15.5 tonnes, necessitating a fourfold increase from other suppliers to compensate. Office of Drug Control (ODC)

- South Africa: Experiencing significant growth, South Africa’s exports rose from 60 kg in 2021 to 4,992 kg in 2024. This surge highlights South Africa’s expanding presence in the global medicinal cannabis market.

- Denmark: Denmark’s exports grew from 195 kg in 2021 to 2,110 kg in 2024, reflecting a steady increase in its contribution to Australia’s medicinal cannabis supply.

- Portugal: Portugal’s exports showed variability, starting at 58 kg in 2021, peaking at 1,472 kg in 2023, and then declining to 1,006 kg in 2024. This fluctuation indicates Portugal’s fluctuating role in the market.

- New Zealand: New Zealand’s exports increased from 51 kg in 2021 to 1,087 kg in 2024, demonstrating its growing involvement in supplying medicinal cannabis to Australia.

- Thailand: Thailand’s exports began at 0 kg in 2021, reaching 1,093 kg in 2024, marking a significant entry into the Australian market.

- Czechia: Czechia’s exports were minimal, with 10 kg in 2021 and a notable increase to 2,400 kg in 2024, indicating its emerging role in the market.

- Other Countries: With smaller contributions, countries like Colombia, with 0’16 tonnes in 2021 and 0’9 tonnes in 2024, Israel with 0’42 tonnes in 2021 and 0’45 tonnes in 2024, Lesotho with 0’12 tonnes in 2021 and 0’42 tonnes in 2024 and North Macedonia with 0’01 tonnes in 2021 and 0’5 tonnes in 2024 reflect diverse sources of Australia’s medicinal cannabis imports.

The rapid growth in imports has significant supply-chain and market implications. The increase in volume will require substantial scaling of infrastructure, such as customs processing, cold-chain logistics, storage, testing, and domestic distribution networks.

Medical cannabis stocks in Australia

Imports by country in Australia

Imports share by country in Australia

Exports by country in Australia

Exports by country in Australia

Between 2021 and 2024, Australia’s medical cannabis flower exports increased from 1.4 tonnes to 3.3 tonnes.

- New Zealand remained the single largest destination throughout the period, increasing moderately from 0.2 t to 1.6 t, reflecting geographical proximity, similar regulatory frameworks, and established trade relationships.

- Germany, by contrast, exhibits rapid expansion, rising from 3 t in 2021 to 1.4 t in 2024, and is the primary driver of export acceleration in 2023–2024.

- The United Kingdom maintains a small and variable role, growing to 0.4 t in 2023 before falling slightly to 0.3 t in 2024, indicating modest and unstable demand.

The composition shift underscores a diversifying export destination mix: Germany’s growing share reduces New Zealand’s proportional dominance despite New Zealand’s absolute growth. This pattern is likely driven by market access improvements, regulatory alignment, and commercial agreements in Germany, alongside continued preference for nearby New Zealand markets due to familiarity and logistical ease. The year-on-year changes suggest a combination of spot shipments and discrete contracts, rather than fully smoothed, recurring demand. Specific product attributes or formulations may also influence Germany’s uptake, highlighting the importance of domestic value-add in meeting destination-specific clinical or commercial requirements.

From a strategic standpoint, the trends indicate improving export diversification, which reduces destination concentration risk and enhances revenue stability for Australian producers. Accelerated European exports, particularly to Germany, increase the imperative for robust GMP certification, reliable logistics, and compliance with EU regulatory frameworks. Success in Germany positions Australia to expand further into continental European markets, provided quality and regulatory standards are maintained.

Between 2022 and 2024, Australia’s medical-cannabis production and inventory landscape exhibits rapid scale-up and parallel growth in domestic and imported supply. Production more than doubles from 16.7 tonnes in 2022 to 41.3 tonnes in 2024, reflecting substantial capacity expansion. Correspondingly, production stocks track output closely, rising from 17.7 t to 38.2 t, indicating that a significant portion of output is being retained as inventory. Imported stocks also increase from 7.7 t to 18.1 t, underscoring continuing reliance on imported flower even as domestic production grows. Across this period, absolute changes are notable: production rises by 24.6 t, production stocks by 20.5 t, and imported stocks by 10.4 t.

Several structural implications emerge from these trends. The high ratio of production stocks to output suggests either a deliberate inventory strategy to secure supply, release lags due to testing or processing, or slower downstream conversion into finished products. The simultaneous growth in domestic and imported stocks indicates parallel supply streams, whereby Australia expands both local cultivation and import pipelines to meet immediate demand, support processing for export, or balance seasonal and contractual requirements. Finally, the persistence of large and rising stocks despite rapid production increases signals potential throughput constraints downstream, such as bottlenecks in GMP testing, extraction, formulation, or market absorption.

As prescribers gain confidence in cannabis therapies and patients seek pharmaceutical alternatives, the Australian market has responded with increased accessibility and product diversity. The data reveals cannabis’s progressive integration into mainstream medicine.

Flower products have seen extraordinary growth, increasing from 0.27 million items (H1 2021) to 2.93 million (H2 2024), establishing themselves as the market foundation. This reflects growing patient trust and preference for flower’s tangible form, quick onset, and adjustable dosing for conditions like chronic pain and anxiety.

Meanwhile, oral liquids have followed a distinctive path; initially dominant (peaking at 0.45 million items in H2 2021) before declining as flower gained popularity, now stabilizing with a dedicated user base seeking precise, non-inhaled administration. The emergence of vapes and oral solids marks significant product innovation, offering discreet, fast-acting alternatives and pharmaceutical-style formulations, respectively.

The elimination of the “Other” category after H1 2022 signals market maturation through product consolidation. Collectively, these trends illustrate a responsive, increasingly patient-centered market where Australia’s medical cannabis ecosystem has evolved beyond basic access to focus on refinement and personalization, representing a fundamental shift in how medicine is delivered.

Australia’s medical cannabis market is shifting decisively toward high-THC formulations. From 58% in H1 2022 to 86% by H2 2024, THC-only products have redefined the therapeutic landscape. This trend reflects a fundamental shift in clinical priorities. As prescribers develop greater confidence in THC’s efficacy for pain, sleep, and mood disorders, the market is aligning with a more symptom-driven, outcome-focused approach.

Item sales by format

Item sales by THC ratio

The gradual decline in THC-dominant and balanced products suggests a refinement of therapeutic intent. Hybrid ratios initially served as cautious entry points, balancing psychoactivity with modulation. However, as prescribers and patients gain experience, the need for compromise diminishes and precision becomes paramount. The data suggests medical cannabis is no longer experimental but strategic in application.

CBD-dominant and pure CBD products, once positioned as “safer” alternatives, are steadily declining. Their drop from 6% and 3% to just 3% and 2% respectively indicates a redefinition of their role. CBD’s subtle effects may be better suited to wellness regimens than clinical interventions, while patients seeking stronger symptom relief increasingly turn to THC-based options.

This evolution in cannabinoid ratios represents more than a market trend; it reflects how cannabis is being reimagined as medicine. The dominance of THC, the declining middle ground of balanced products, and the diminishing role of CBD all indicate a healthcare system learning to treat cannabis not as a novelty but as a precise clinical tool requiring confidence and clear therapeutic targeting.

Prescribing doctors by access scheme

Sales by access scheme

Since 2016, over 1.4 million prescriptions have been issued via the Special Access Scheme, with monthly approvals surpassing 100,000 by late 2024—clear evidence of the mainstreaming of cannabinoid-based therapies.

From 2018 to early 2025, the number of medical cannabis prescribers in Australia rose significantly, with a clear dominance of the SAS-B (Special Access Scheme – Category B) pathway. SAS-B prescribers grew from just under 500 in 2018 to over 2,600 in 2024, showing steady growth in mainstream medical adoption. Meanwhile, Authorised Prescribers (AP) saw a sharp increase from 47 in 2018 to 1,251 by 2024, reflecting regulatory changes and growing trust in cannabis treatments. Although 2022 marked a peak year with 4,138 total prescribers, the market has since stabilized, with 2025 Q1 showing strong ongoing engagement, already registering over 1,700 prescribers in the first quarter alone.

While retail sales continue to show promise, leading firms are facing margin pressure, driven by high operational costs and increasing price competition. The industry is being reshaped, in part, by regulatory interventions targeting non-compliant prescribing models, including generalist providers, telehealth-only services, and clinics offering financial incentives that may encourage overprescription.

Even though stricter regulatory oversight in the medical cannabis sector has caused a decline in the number of prescribing doctors, as authorities addressed non-compliant practices among certain providers such as non-specialist generalist services, telehealth clinics/online-only prescribing services, and medical clinics offering financial incentives leading to overprescription, recent developments suggest further tightening of controls.

Australia's Pivotal Moment: Balancing Growth and Compliance

Australia’s medical cannabis sector has undergone remarkable transformation between 2021 and 2024, with flower volumes surging from minimal levels to an impressive over 120 tonnes. This explosive growth reflects both increasing patient adoption and expanding production capacity throughout the supply chain.

The market’s evolution is characterized by rapid expansion across all segments – production facilities have scaled up operations, import volumes have increased substantially, export markets have diversified, and substantial inventory stockpiles have been established to ensure continuity of supply. Despite growing domestic production capabilities, Australia maintains significant import dependence, with Canada continuing as the dominant supplier, accounting for over 80% of imports during this period. Export has remained constrained to Germany, New Zealand and the United Kingdom.

Despite this growth trajectory, several significant challenges remain. Regulatory complexity continues to hamper market development, with TGA safety reviews, prescriber oversight requirements, and inconsistent state-level policies creating a fragmented regulatory landscape that requires harmonisation. A persistent supply-side imbalance exists where domestic production capabilities, though growing, still lag behind overall demand. This creates a continuing dependence on imports while simultaneously creating market pressures that potentially undercut local producers who may struggle to compete with international economies of scale.

The substantial increase in inventories observed (production stocks of 35-48 tonnes and import stocks of 14-18 tonnes) point to significant bottlenecks within the supply chain in driving market access for all product segments. Additionally, safety concerns surrounding high-THC products necessitate more robust monitoring systems and evidence-based standards to ensure patient wellbeing.