Australia’s medical cannabis market has undergone a remarkable transformation over the past few years, cementing its position as one of the largest federally legal cannabis markets in the world.

Fuelled by regulatory reforms, an increasing number of patients, and a surge in international trade, the industry is growing at an unprecedented rate.

This article delves into the evolution of Australia’s medical cannabis market, with a particular focus on the rapid expansion of international trade, market dynamics, and the future outlook for this burgeoning industry.

Table of Contents

Surging Imports Fuel Australia’s Growing Cannabis Demand

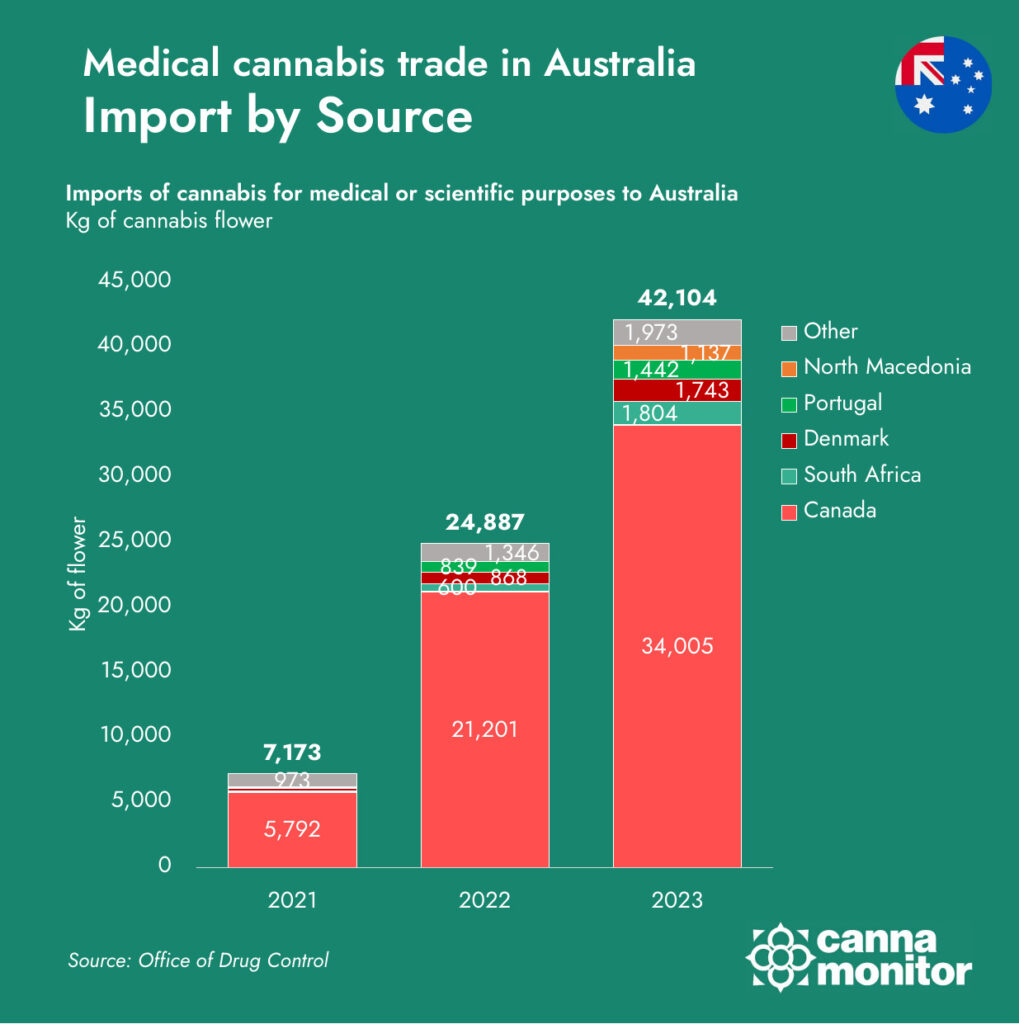

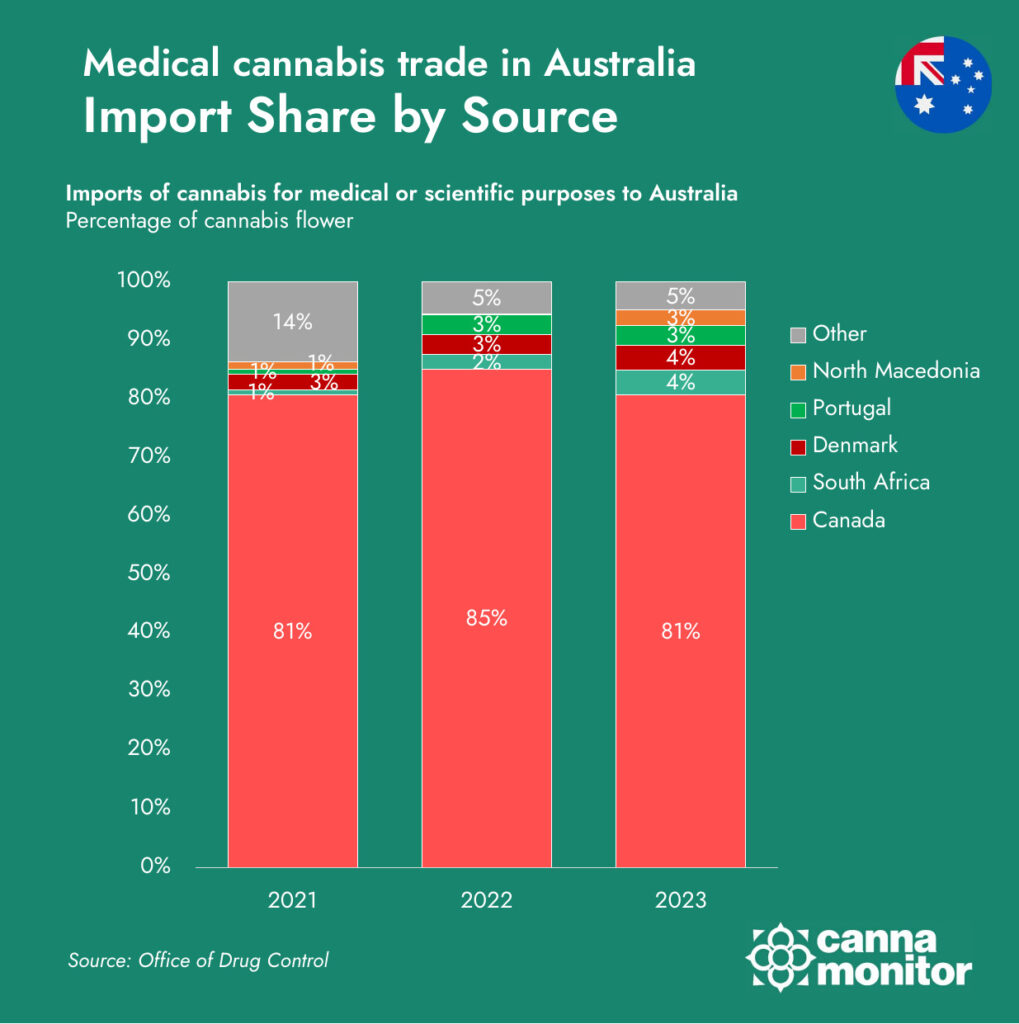

In 2023, Australia’s medical cannabis market reached new heights with the importation of over 42 tonnes of cannabis, marking a 69% increase compared to the previous year. This surge in imports is a clear indication of the country’s growing demand for cannabis products, driven by an expanding patient base and evolving product preferences, as well as Australia’s reliance on international suppliers to meet the escalating needs of its medical cannabis market.

Canada continues to lead the pack as Australia’s top cannabis supplier, with exports increasing by 60% in 2023 to an impressive 34 tonnes. Canada’s dominance is fueled by its mature cannabis industry, which boasts advanced cultivation, processing, and distribution capabilities, allowing it do deliver a consistent supply of high-quality medical cannabis and solidify its position as a cornerstone of Australia’s import market.

South Africa‘s cannabis exports to Australia skyrocketed by 201% in 2023, reaching 1.8 tonnes. This dramatic increase highlights South Africa’s emergence as a competitive producer, leveraging the more favourable cost structure of dozens of licensed producers in the country, with great diversity in production methods and varietal selection. Australia has emerged as the main partner of the African nation.

Denmark expanded its cannabis exports to Australia by 101% to reach 1.7 tonnes. Known for its stringent quality standards, reliable and consistent pharma-grade production facilities, Denmark has established itself as a reliable supplier of medical cannabis. Despite a reduction in productive capabilities in the last year, due to the closure of Aurora’s facility, Danish LPs have successfuly targeted international markets like Germany and Australia.

Portugal has emerged as the second largest global supplier only after Canada, and it increased its cannabis exports to Australia by 72% in 2023 to 1.4 tonnes. Investment in dozens of production facilities have positioned Portugal as a key player in the European supply chain, coupling cultivation and manufacturing capabilities with third-party processors that grant EU-GMP certification to imported products for further reexportation.

North Macedonia made significant strides in 2023, with exports to Australia jumping from just 33kg to 1.1 tonnes. This surge underscores Macedonia’s rapid development in the cannabis sector. Surprisingly for the European nation outside the EU, Australia has emerged as a key destination for its production, overcoming Germany.

New Zealand exported 306kg of cannabis to Australia in 2023, marking a significant step in the strengthening of trans-Tasman trade relations in the cannabis sector, which is for the moment favourable to Australian producers.

Other significant suppliers to the Australian market include Colombia, which exported 467kg of cannabis to Australia in 2023, marking a stable entry into the market, and Israel with 440kg, reflecting the country’s long-standing expertise in medical cannabis research and cultivation. Other suppliers with smaller volumes include Germany, the UK, Jamaica, Lesotho and the Netherlands. Interestingly, in 2023, Uruguay and Thailand made their first entries into Australia’s medical cannabis market, contributing small volumes.

Imports of Cannabis by Source

Share of Imports by Source

Expanding Horizons: Australia’s Growing Cannabis Exports

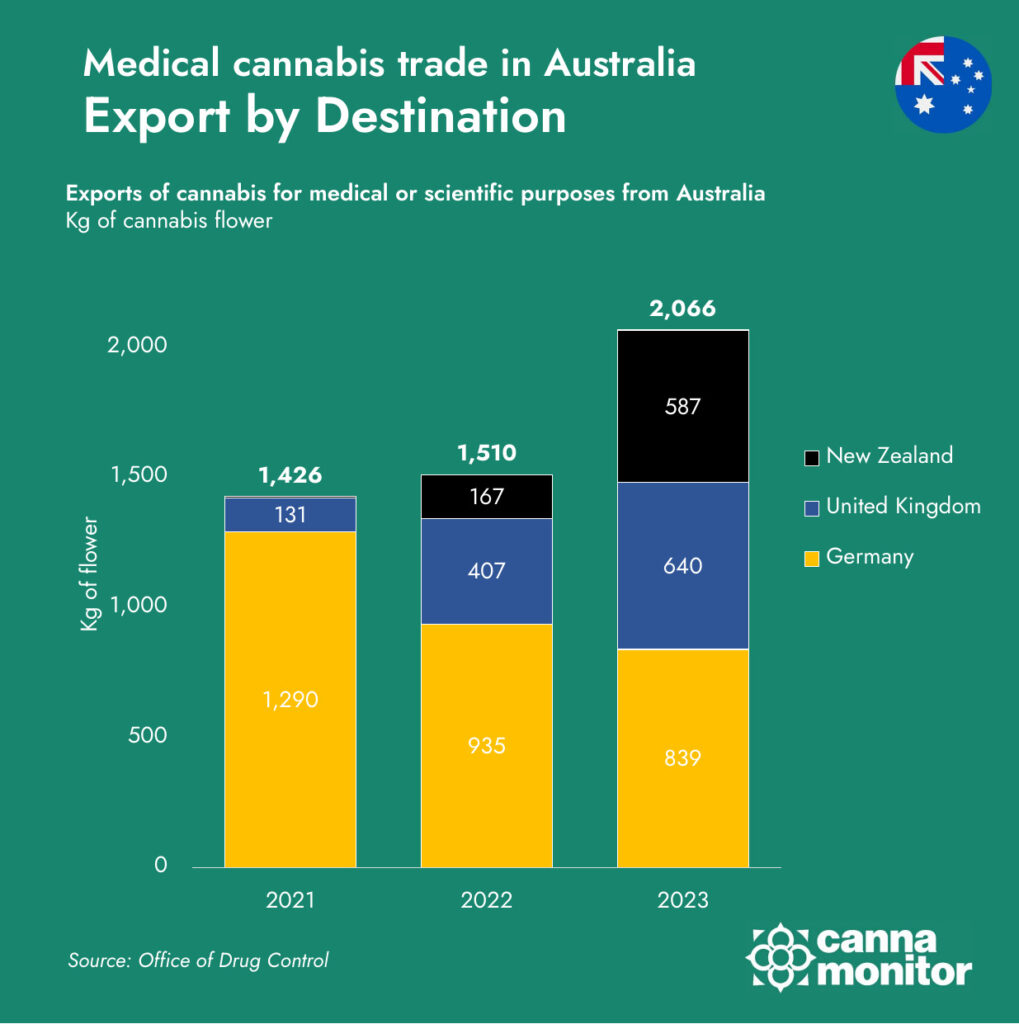

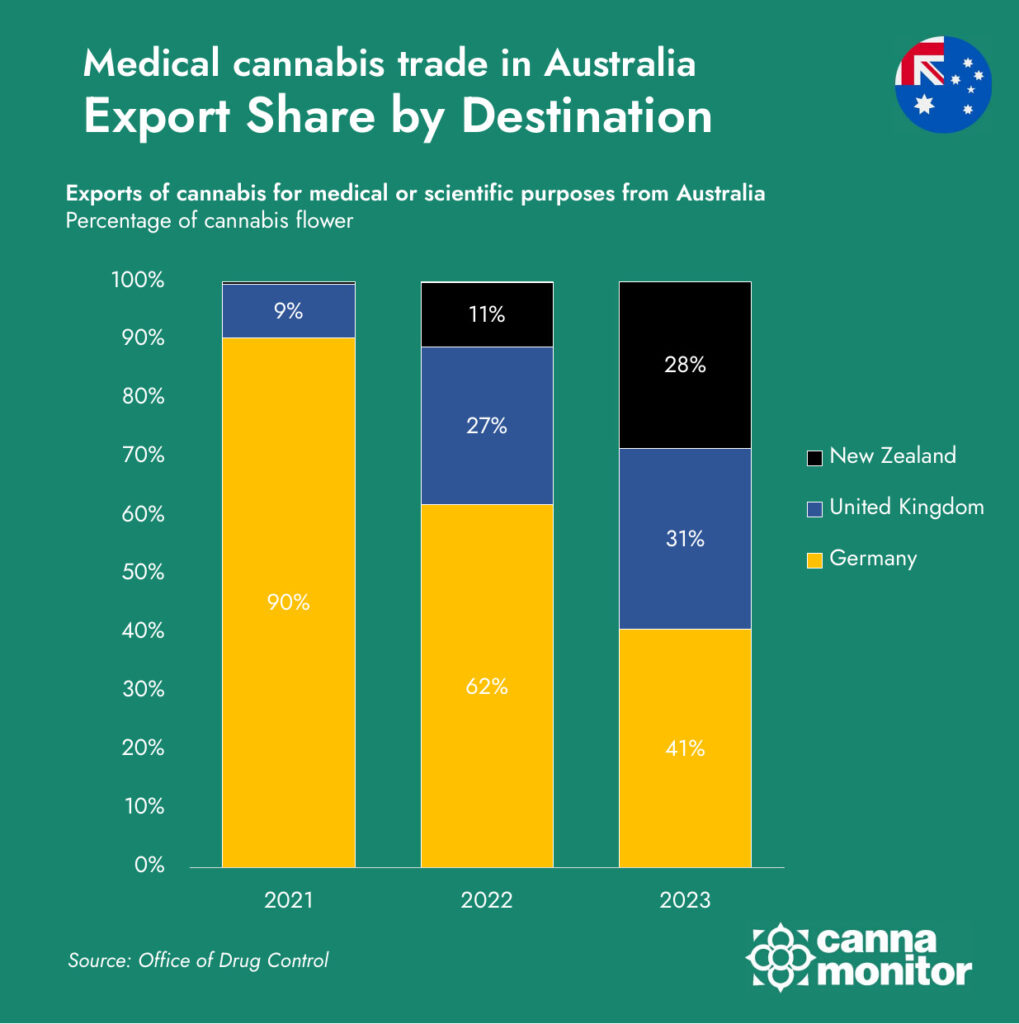

While Australia’s medical cannabis market is often highlighted for its significant import volumes, in 2023, Australia’s cannabis exports experienced remarkable growth, with a 37% increase in shipments compared to the previous year, Australia is solidifying its position as a key supplier of medical cannabis to various international markets.

One of the most notable developments in 2023 was the surge in exports to New Zealand. Australian cannabis producers shipped 587kg to their trans-Tasman neighbor, marking an extraordinary 251% increase from the previous year. This rapid growth underscores the strengthening trade ties between the two countries and highlights New Zealand’s growing demand for high-quality medical cannabis products.

Germany continues to be Australia’s largest export partner, despite a slight decline in volume. In 2023, Australia exported 839kg of medical cannabis to Germany, maintaining its status as a critical player in the European market. This steady demand from Germany reflects the robust nature of its medical cannabis program and the country’s reliance on high-quality imports to meet the needs of its patient base.

The United Kingdom also emerged as a significant destination for Australian cannabis exports, with shipments increasing by 57% to reach 640kg in 2023. The UK’s medical cannabis market, while still in its early stages compared to other countries, is growing rapidly, and Australia’s exports are playing a crucial role in meeting this rising demand.

Looking ahead, Australia’s ability to maintain and grow its export market will depend on several factors, including the continued expansion of domestic production capabilities, the development of strong trade relationships with key international partners, and the capacity of domestic LPs to increase competitiveness in price and quality. If these elements align, Australia could see its export volumes increase even further, making it a major player in the global medical cannabis supply chain.

Exports by Destination

Share of Exports by Destination

Market Dynamics: Products, Prices, and Access

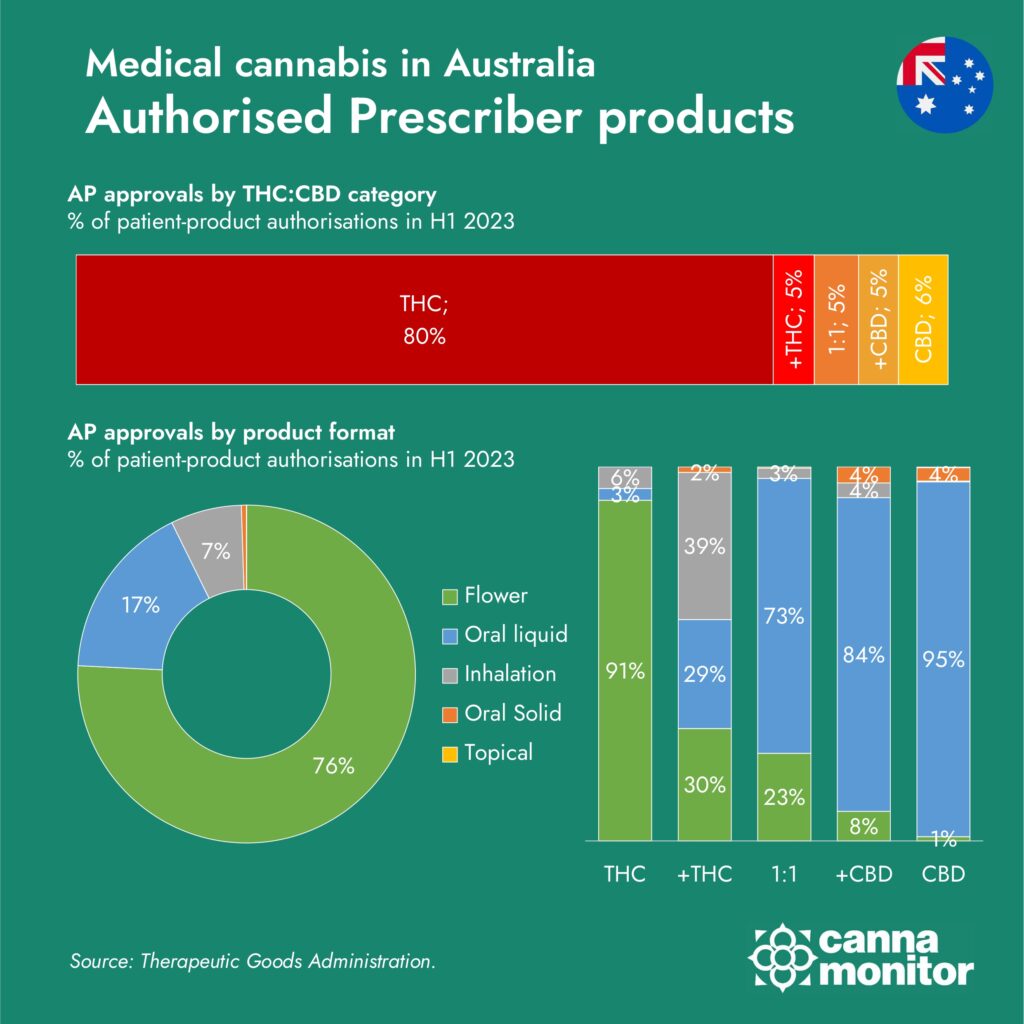

The Australian medical cannabis market is not just growing in volume but also in diversity of products available to the country’s patients. The product landscape is evolving rapidly, with high-THC flower gaining a dominant market share over oils and other forms. This shift is partly driven by increased use of cannabis for mental health conditions, such as anxiety, insomnia, and depression, where high-THC products are often preferred.

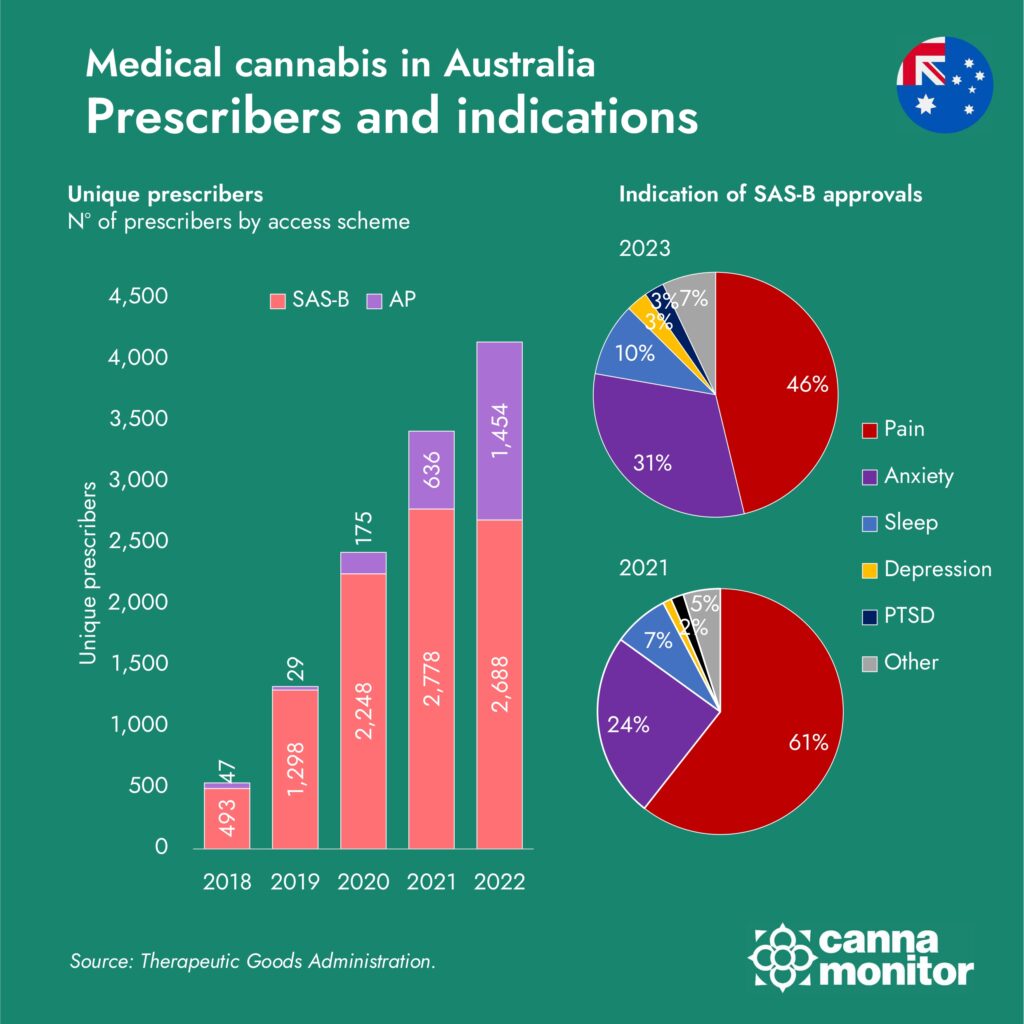

The Therapeutic Goods Administration’s (TGA) reforms in November 2021 played a pivotal role in shaping the current market dynamics. These reforms facilitated easier access to unapproved cannabis-based medicines, reducing the reliance on the paperwork-heavy Special Access Scheme B, requiring specific authorisation for each patient, in favor of the Authorised Prescribers‘ scheme, which grants doctor the ability to prescribe medical cannabis more freely. As a result, patient access to cannabis products has improved significantly, further driving demand.

In 2024, growth in new product formats has been attracting attention: particularly in regards to vapes, as well as pastilles (edibles). The conducive regulatory framework of Australia, allowing imports from a variety of countries with different certifications, has allowed foreign producers to supply novel dosage forms to the Australian market, while some local manufacturers have opted to develop production capabilities for these advanced product formulations in Australia.

Given that the government mandates compliance with product quality standards, but unlike other international medical cannabis markets does not restrict the types of products that can be supplied to patients, Australia is seeing a lot of innovation in solventless extracts, including different varieties of hash and concentrates, as well as alternatives to distillate-based vapes, such as rosin.

The

SAS-B Product Approvals (H1 2023)

AP Product approvals (H1 2023)

The Impact of Regulatory Changes and Market Growth

Regulatory changes continue to play a critical role in the evolution of Australia’s medical cannabis market. A significant development in 2023 was the introduction of a mandate requiring Good Manufacturing Practice (GMP) certification for imported products. This regulatory shift led to a rush of imports before the new rules took effect, with Portugal alone exporting over 1 tonne of cannabis in the months leading up to the change.

However, hopes by domestic producers that tightened rules for importers would limit the influx of foreign-grown products did not materialise. In fact, the TGA admitted that no inspections to ensure compliance of imported products to Australian TGO93 standards were conducted, making importers solely responsible to ensure that products are up to standard. This led some local LPs to request tightened controls on imports, and to prioritise Aussie-grown products.

As Australia solidifies its position as a global leader in the medical cannabis industry, the market’s rapid growth has attracted the attention of international stakeholders. Although Germany and Israel remain strong contenders in terms of market value and flower volumes, Australia’s growth trajectory is unmatched. This growth, however, raises questions about the sustainability of relying heavily on imports and the potential impact on domestic producers.

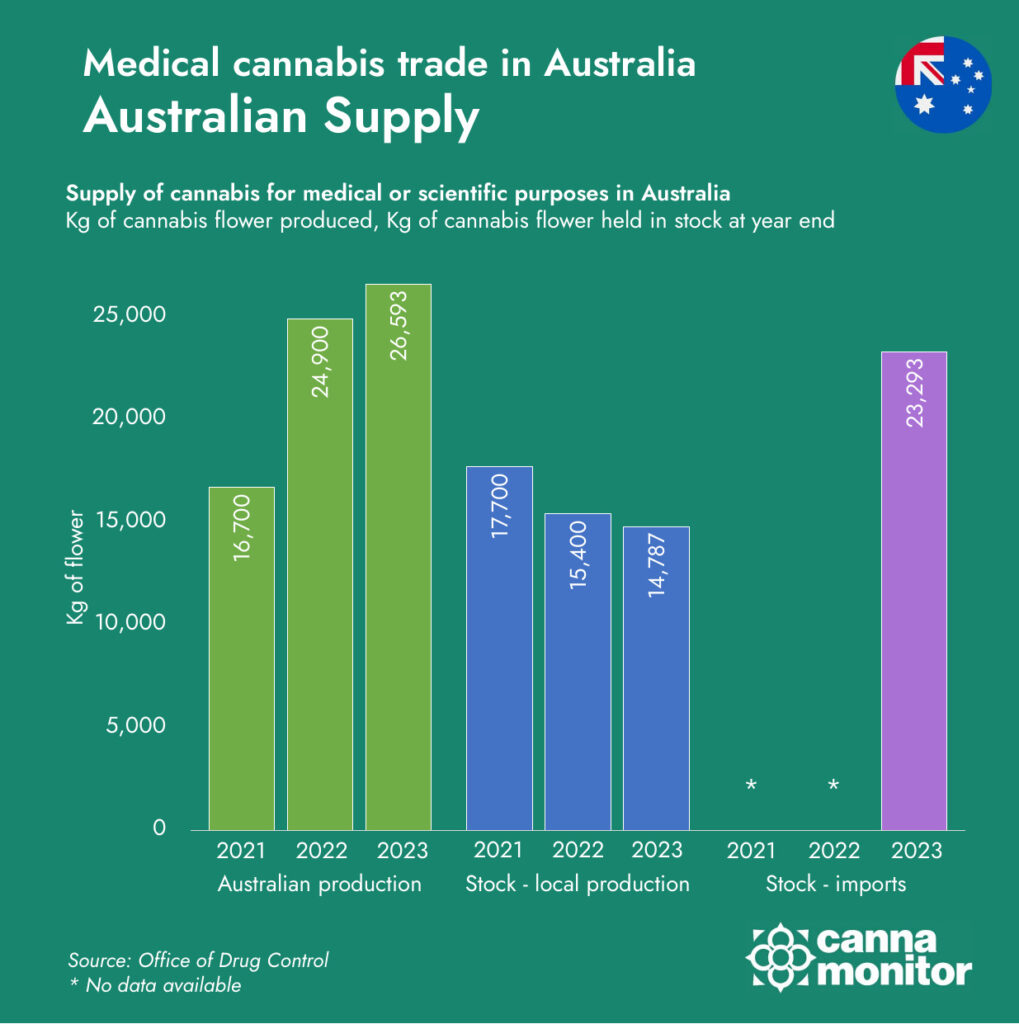

Cannabis Supply in Australia

What Lies Ahead for Australia's Cannabis Market?

The future of Australia’s medical cannabis market is filled with possibilities, driven by both domestic and international factors. On the one hand, continued growth in patient numbers and product diversity could further boost demand, necessitating even higher levels of imports. On the other hand, increasing pressure from domestic producers to limit foreign competition could lead to the implementation of protective measures, such as higher import standards or even tariffs.

One possible scenario is the emergence of a more balanced market where domestic production catches up with demand, reducing the reliance on imports. This would require significant investment in cultivation and manufacturing facilities, as well as further regulatory support to streamline the approval process for new products.

Alternatively, if import growth continues at its current pace, Australia could become a major global hub for medical cannabis, with a well-established supply chain that caters not only to domestic needs but also to international markets. This would position Australia as a key player in the global cannabis industry, attracting further investment and fostering innovation in product development.

Patient-product Approvals

Unique prescribers and indications

Growth, Challenges, and Global Leadership

Australia’s medical cannabis market is at a critical juncture, characterized by record-breaking import levels, evolving product dynamics, and a rapidly expanding patient base. As the market continues to grow, the interplay between domestic production and international trade will shape its future trajectory. Whether Australia continues to rely on imports or shifts towards greater self-sufficiency, one thing is clear: the country is poised to remain a global leader in the medical cannabis industry, offering valuable lessons for operators and policymakers worldwide.

As we look ahead, the potential scenarios for Australia’s cannabis market are both exciting and uncertain. Will the market continue to grow at its current pace? Will domestic producers rise to the challenge and reduce the need for imports? The answers to these questions will determine the future of the industry and its role on the global stage.