From booming market growth and changing import trends to the dominance of flower products with high THC, the sector is carving out a vital role in the future of healthcare and wellness. However, the path forward is not without challenges: regulatory complexities, telemedicine integration, and equitable medical access require thoughtful navigation. This article dives deep into these dynamic trends and explores the promising future developments poised to transform Australia’s cannabis market, a sector rich with opportunity and innovation that is set to reshape both industry and society

Table of Contents

Australia has emerged as one of the world’s fastest-growing medical cannabis markets. Backed by sustained patient demand, a maturing regulatory framework, and a dominant position in flower-based treatments, the country is quickly solidifying its role as a global leader in therapeutic cannabis. While growth remains strong, the sector now faces important inflection points—from tightening oversight of prescribing practices to rising dependence on imports and growing pressure on domestic producers. As 2025 unfolds, Australia’s cannabis industry stands at a crossroads, navigating between rapid expansion and the need for greater clinical, regulatory, and supply-side maturity.

Decoding market dynamics and shifting import trends

Australia, a global leader in cannabinoid medicine access, offers critical insights for stakeholders across both the public and private sectors in other global cannabinoid markets. Despite its relatively late entry into the market, following the legalisation of medical cannabis in 2016, Australia has experienced consistent year-on-year growth.

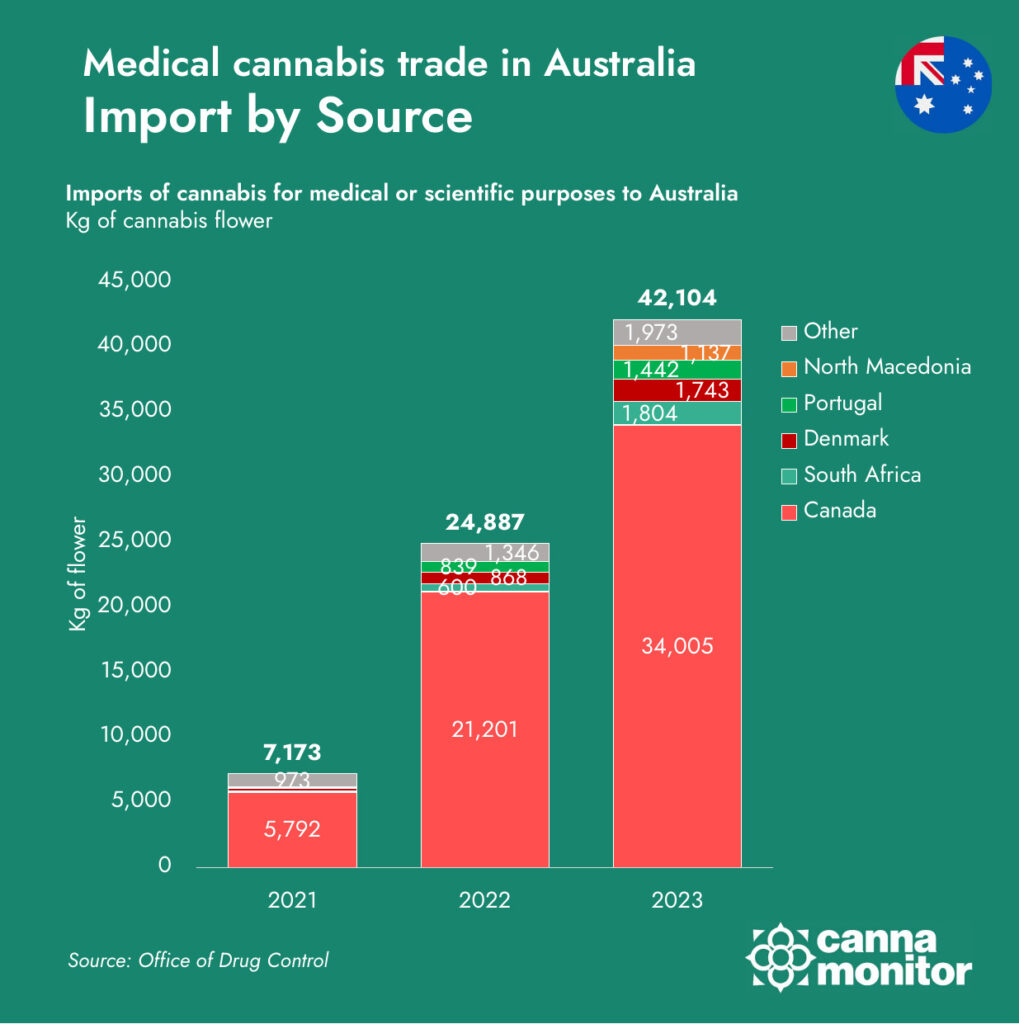

Imports to Australia by Country

By 2024, it had become one of the world’s largest federally legal cannabis markets, rivalling established players such as Germany and Canada, with over 6.5 million medicinal cannabis products supplied to patients. This surge was primarily driven by high-THC flower, which alone surpassed 70 tonnes.

Despite tighter regulations and fewer prescribers, medical cannabis sales in Australia have surged eightfold since 2022, driven largely by patient demand for dried flower. This remarkable growth highlights the sector’s ability to adapt amid regulatory and compliance challenges, showing signs of low churn and strong patient retention.

All of the above serves as solid evidence for the commercial viability, demand adaptation and high-performance market responsiveness from Australia.

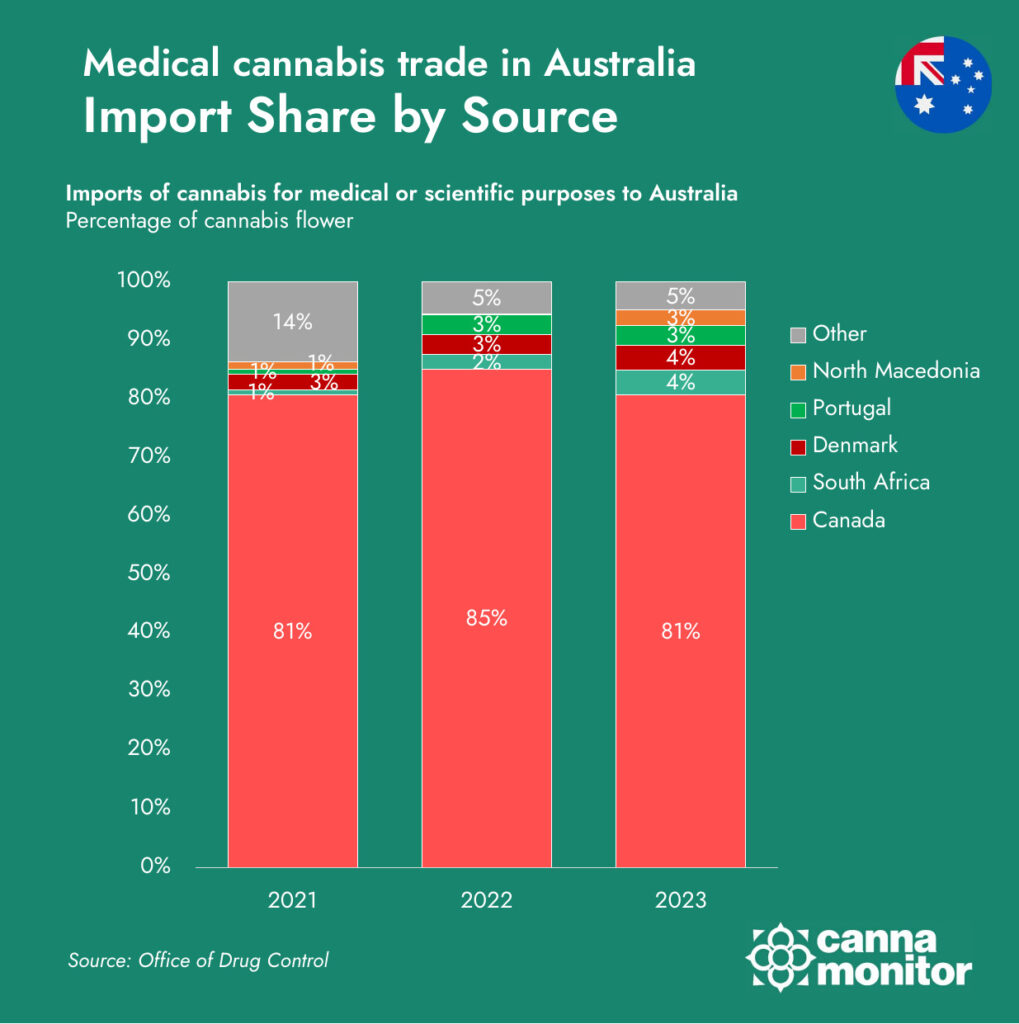

As of 2023, Australia’s medical cannabis market experienced a significant surge in imports, totaling 42,104 kilograms, a 69% increase from the previous year. Canada remains the dominant supplier, accounting for approximately 34,000 kilograms, or about 80% of the total imports. Other notable contributors include South Africa (1,804 kg), Denmark (1,743 kg), Portugal (1,442 kg), and North Macedonia (1,137 kg).

These figures highlight Australia’s declining domestic cannabis production and its increasing reliance on international imports to satisfy the rising demand for medical cannabis products.

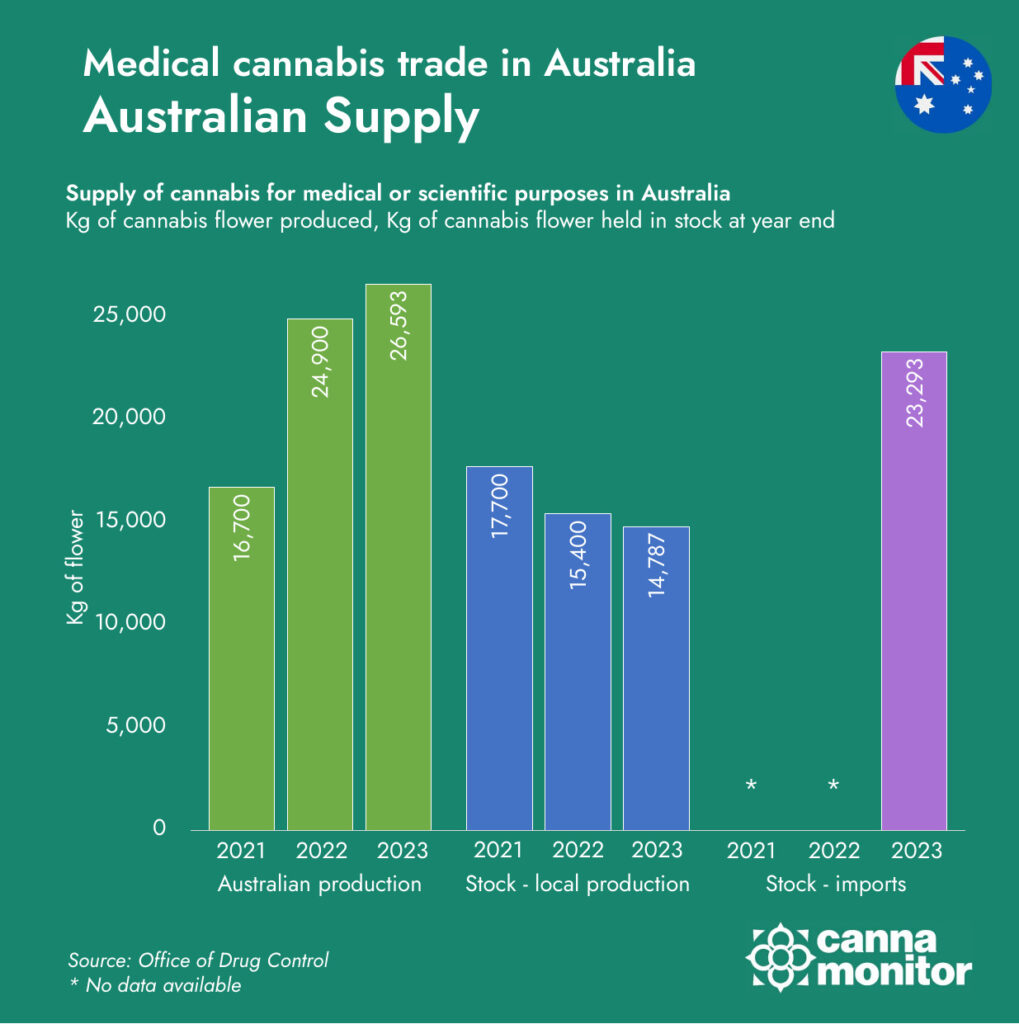

Australia’s medical cannabis industry has come a long way since legalisation in 2016. With over 150 licensed producers and more than 1,000 products available on the market, the sector is entering a phase of operational maturity and market saturation. Yet beneath the surface of growth lies a complex structural imbalance: domestic supply is being outpaced by demand, forcing the country to lean heavily on imports, while local producers struggle to maintain competitiveness at home even as they look to expand abroad.

In 2023, Australian licensed producers generated approximately 26.6 tonnes of medical cannabis—an impressive figure in isolation, but significantly overshadowed by the 42.1 tonnes of imported product that entered the country in the same period. Canada alone accounted for over 80% of these imports, cementing its dominance in Australia’s supply chain. Other notable suppliers included South Africa, Denmark, and Portugal, each leveraging different competitive advantages: from South Africa’s low-cost production environment to Denmark’s pharmaceutical-grade consistency and Portugal’s strategic use of EU-GMP certification and contract manufacturing.

This growing import dependency has sparked concern among domestic producers, many of whom operate under stricter regulatory and cost regimes. While Australian LPs must comply rigorously with GMP standards, adhere to the Therapeutic Goods Order 93 (TGO93), and often face expensive overheads related to energy, labor, and compliance, importers can benefit from regulatory loopholes. The Therapeutic Goods Administration (TGA) does not routinely inspect or verify foreign facilities or batches upon import, instead placing the responsibility on importers to self-declare conformity. This creates an uneven playing field, where overseas producers—already operating in more cost-effective environments—can undercut local prices while still accessing Australia’s growing patient market.

Local supply in Australia

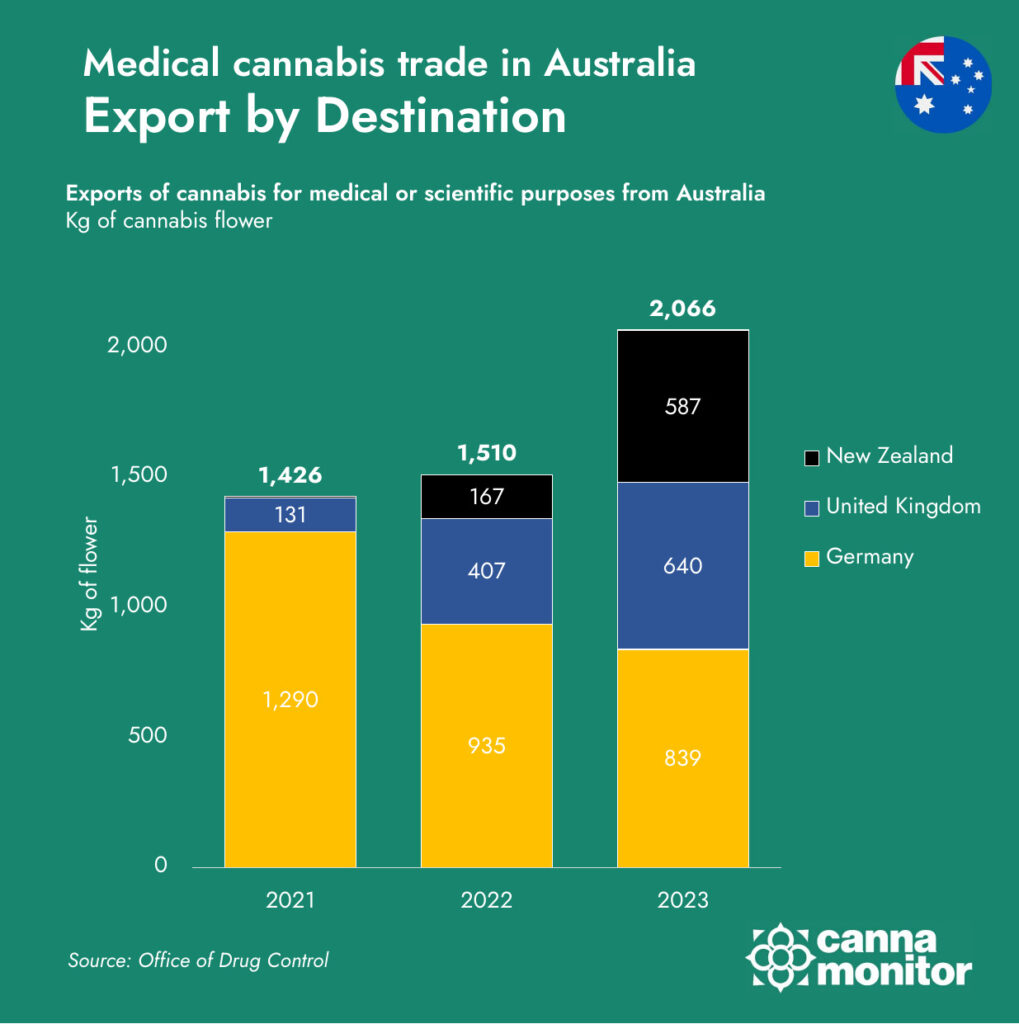

Exports by Destination

At the same time, Australia’s producers are becoming increasingly outward-looking. While Germany has historically been the top destination for Australian cannabis exports, accounting for nearly 90% of shipments in 2021, this concentration has diminished rapidly. By 2023, Germany represented just 41% of total exports, with New Zealand and the United Kingdom gaining momentum. This shift reflects a strategic diversification effort by Australian LPs, who are actively pursuing access to smaller, but quality-driven markets where they can compete on regulatory reputation and product consistency rather than price alone.

The New Zealand market, in particular, has become a focal point of trans-Tasman cannabis trade, benefiting from proximity, similar regulatory frameworks, and shared cultural and commercial ties. In 2023, exports to New Zealand grew by over 250%, making it Australia’s second-largest export market. The UK, with its underdeveloped but expanding medical cannabis framework, also presents significant upside, especially for premium formats such as oils and capsules that meet stricter pharmaceutical expectations.

Meanwhile, new markets such as Thailand and Uruguay—which began importing Australian cannabis in 2023—represent the next frontier. These countries may offer smaller volumes in the short term, but their inclusion reflects Australia’s proactive global trade positioning, with an eye on regulatory openness and long-term scalability. Such diversification efforts are also a strategic hedge against potential policy changes in larger markets like Germany, where future reform may reshape domestic production incentives and limit foreign supply access.

This dual dynamic—intense price and compliance pressure domestically, coupled with growing export ambition internationally—defines the current phase of Australia’s cannabis sector. On one hand, local producers are advocating for stronger enforcement of compliance standards on imports, urging the TGA to inspect batches more rigorously and to support domestic cultivation as a matter of public interest and pharmaceutical sovereignty. On the other, they are investing in GMP-certified infrastructure, expanding cultivation and processing capacity, and forming international partnerships to secure footholds in global markets.

If Australia aims to become not just a major cannabis consumer market but a global production and export hub, its domestic production ecosystem will need continued policy support. This could come in the form of incentives for export-focused manufacturing, greater transparency and accountability in import oversight, and harmonisation of certification standards to protect the integrity of the domestic supply chain. Without such support, there is a real risk that Australia’s cannabis trade surplus remains permanently skewed, with growing reliance on imports undermining the viability of local producers—despite their crucial role in innovation, jobs, and pharmaceutical resilience.

Flower power: Product trends and THC/CBD ratios

The market is undergoing a transitional phase marked by several key developments: A growing preference for flower-based treatments over oils, a rise in B2C (business-to-consumer) demand and a heightened regulatory scrutiny, particularly concerning prescribing practices.

Flower-based prescriptions rose from 0.27 million to 2.93 million—an increase of nearly 1,000%—making up over 78% of all products in H2 2024.These confirm a strong clinical and consumer shift toward inhalable flower formats, signaling maturity in both physician prescribing habits and patient treatment patterns.

Volume sales by format

Volume sales by THC ratio

One of the most striking characteristics of Australia’s medical cannabis market is the clear and accelerating shift toward high-THC formulations. This trend has reshaped the product landscape over the past two years, with inhalable flower products—typically containing >20% THC and <1% CBD—emerging as the dominant format. While oral oils with elevated THC ratios were once the backbone of the early prescription market, they are now ceding ground to flower-based products, which offer faster onset, greater patient control, and—in many cases—improved symptom relief for conditions such as chronic pain, anxiety, and insomnia.

By 2024, products with THC concentrations above 20% represented the majority of items supplied, underscoring a growing prescriber and patient preference for concentrated, fast-acting formulations. This evolution is not merely a reflection of market hype or consumer demand; it reveals a more fundamental shift in the clinical positioning of cannabis within Australian medicine. Increasingly, THC-dominant products are being prescribed as first-line treatments rather than as a last resort—particularly for chronic and treatment-resistant conditions where conventional pharmaceuticals have failed.

This change in clinical practice is driven by multiple factors. First, growing clinical familiarity and positive patient-reported outcomes have contributed to a normalisation of THC-rich cannabis in medical settings. Second, the regulatory evolution from the SAS-B scheme to the Authorised Prescriber (AP) pathway has empowered physicians—particularly general practitioners—to prescribe with greater autonomy and confidence. Third, industry-led education and product innovation have enhanced prescriber understanding of dosage forms, pharmacokinetics, and titration strategies, reducing hesitancy around initiating THC-based therapies.

In parallel, demand for CBD-dominant and balanced-ratio (e.g. 1:1 THC:CBD) products has steadily declined. Once favored for their perceived safety and non-psychoactive profile, these formulations are now often reserved for specific patient groups (e.g. paediatrics, elderly populations, or individuals with psychiatric comorbidities) rather than for broad-spectrum use. This trend reflects not only patient preference but also a shift in prescriber confidence: more clinicians now view THC as the primary active component responsible for therapeutic efficacy, particularly in pain management, muscle spasticity, and sleep disorders.

Between the first half of 2022 and the second half of 2024, the proportion of THC-only products rose sharply—from 58% to 86% of all supplied items. This transformation signals more than just market growth—it indicates clinical consolidation around THC as the dominant therapeutic agent. Meanwhile, balanced THC:CBD products dropped from 12% to 6%, and CBD-only products fell from 14% to just 4%, confirming the marginalisation of formulations once seen as the safest entry point into cannabinoid therapy.

Although this shift may raise concerns about over-reliance on high-potency products, especially in contexts with insufficient psychiatric screening, it also reveals an important insight: Australia’s medical cannabis system has evolved from cautious experimentation to targeted, condition-specific intervention. Patients and prescribers are no longer merely exploring cannabis—they are strategically deploying it, with high-THC flower as the central therapeutic format.

Looking ahead, the continued dominance of THC-rich products will likely drive further innovation in delivery formats, including solventless extracts, vaporizable concentrates, and rapid-onset edibles. It may also prompt renewed regulatory scrutiny, particularly as concerns emerge about overprescription, dependency risks, and a growing divergence between recreational and medical use models. Managing this evolution will require ongoing prescriber education, clear clinical guidelines, and careful patient stratification to ensure THC’s potential is maximised—without undermining safety or trust in the system.

Regulatory challenges: Telemedicine and medical access

Since 2016, over 1.4 million prescriptions have been issued via the Special Access Scheme, with monthly approvals surpassing 100,000 by late 2024—clear evidence of the mainstreaming of cannabinoid-based therapies.

From 2018 to early 2025, the number of medical cannabis prescribers in Australia rose significantly, with a clear dominance of the SAS-B (Special Access Scheme – Category B) pathway. SAS-B prescribers grew from just under 500 in 2018 to over 2,600 in 2024, showing steady growth in mainstream medical adoption. Meanwhile, Authorised Prescribers (AP) saw a sharp increase from 47 in 2018 to 1,251 by 2024, reflecting regulatory changes and growing trust in cannabis treatments. Although 2022 marked a peak year with 4,138 total prescribers, the market has since stabilized, with 2025 Q1 showing strong ongoing engagement, already registering over 1,700 prescribers in the first quarter alone.

While retail sales continue to show promise, leading firms are facing margin pressure, driven by high operational costs and increasing price competition. The industry is being reshaped, in part, by regulatory interventions targeting non-compliant prescribing models, including generalist providers, telehealth-only services, and clinics offering financial incentives that may encourage overprescription.

Even though stricter regulatory oversight in the medical cannabis sector has caused a decline in the number of prescribing doctors, as authorities addressed non-compliant practices among certain providers such as non-specialist generalist services, telehealth clinics/online-only prescribing services, and medical clinics offering financial incentives leading to overprescription, recent developments suggest further tightening of controls.

Prescribing Doctors in Australia

Sales by Access Scheme

On May 22, 2025, the Australian Medical Association (AMA) released a statement supporting Therapeutic Goods Administration (TGA) reforms that would enable data sharing with the Australian Health Practitioner Regulation Agency (Ahpra) to better monitor and prevent overprescription and misuse of Special Access Scheme (SAS) and Authorised Prescriber Scheme (APS) pathways, particularly regarding medicinal cannabis.

The AMA specifically targets telehealth providers as major sources of system abuse, citing alarming cases such as a single doctor prescribing to over 31,000 patients within six months.

Additionally, the AMA calls for a ban on ultra-high-THC (98%+) cannabis products and advocates for mandatory registration of frequently prescribed medicinal cannabis products on the Australian Register of Therapeutic Goods (ARTG), aiming to close existing regulatory loopholes. These measures imply increased scrutiny of cannabis clinics, especially online providers, and may pressure manufacturers to register products formally or face exclusion from SAS/APS schemes, signaling a regulatory shift toward tighter control over Australia’s expanding medical cannabis market.

Between the first half of 2022 and the second half of 2024, medical cannabis item sales in Australia saw rapid and sustained growth, with the AP (Authorised Prescriber) scheme accounting for the vast majority of items supplied.

Total sales surged from just 0.45 million items in H1 2022 to a record 3.72 million items in H2 2024, with AP items rising from 0.31 to 3.33 million in the same period, indicating a clear shift towards broader and more regularised prescribing under the AP framework.

The CAGR (Compound Annual Growth Rate) reached its peak at 409% in H1 2023 before tapering to 68% by H2 2024, suggesting the market is entering a maturation phase after a period of exponential growth. SAS-B sales remained steady but modest, contributing only a small portion relative to AP, underscoring the latter’s growing centrality in Australia’s medical cannabis ecosystem.

Shaping Tomorrow’s Landscape: What's Next?

Australia’s medicinal cannabis sector is expanding rapidly, but clinical research has lagged behind real-world use, creating data gaps that risk improper dosing and unmet therapeutic outcomes.

Promising academic trials such as those by Deakin and Monash universities studying cannabis for anxiety and ADHD in children highlight both potential and ethical complexities. However, the system faces significant challenges: overprescription of high-THC products may be linked to rising psychosis cases, especially in Queensland; fragmented care and poor access to psychiatric histories leave patients vulnerable; counterfeit products threaten consumer safety; and regulatory inconsistencies across agencies create confusion and weaken oversight. Comprehensive prescriber education, better risk screening, and coordinated regulation are as well urgently needed.

A significant challenge has emerged with the proliferation of cannabis-focused clinics that operate outside the framework of integrated care. Many such services are characterised by high patient turnover, minimal clinical assessments, and commercial incentives linked directly to product sales. This undermines the medical credibility of cannabis-based treatments.