The UK medical cannabis market has experienced remarkable growth, with over 120,000 privately prescribed items in 2022 alone. This article delves into the factors driving this growth, including the thriving private clinic sector, improved affordability, and diverse product offerings. It also provides a comparative analysis with European models and discusses future trends and opportunities. With projections indicating even higher growth in 2023, the UK is positioned to become a leading market for medical cannabis. This comprehensive analysis highlights the strengths of the UK’s liberal, privatised approach and the potential benefits for patients and stakeholders.

Table of Contents

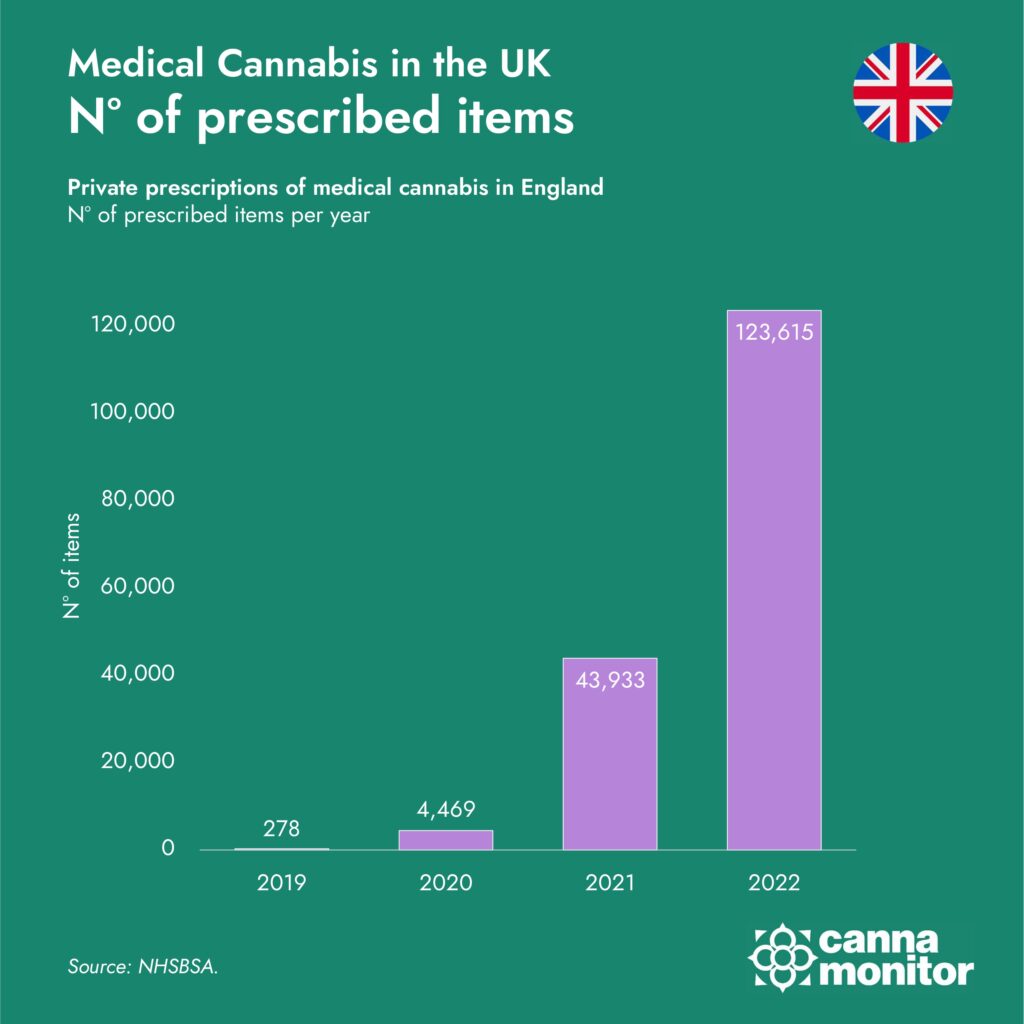

The medical cannabis market in the UK has witnessed a significant surge, with over 120,000 medical cannabis items privately prescribed in England during 2022. This represents an exponential growth trend, with the number of prescribed items nearly tripling from the previous year, reflecting the burgeoning acceptance and demand for medical cannabis within the healthcare sector.

UK Cannabis Data Insights and Market Growth

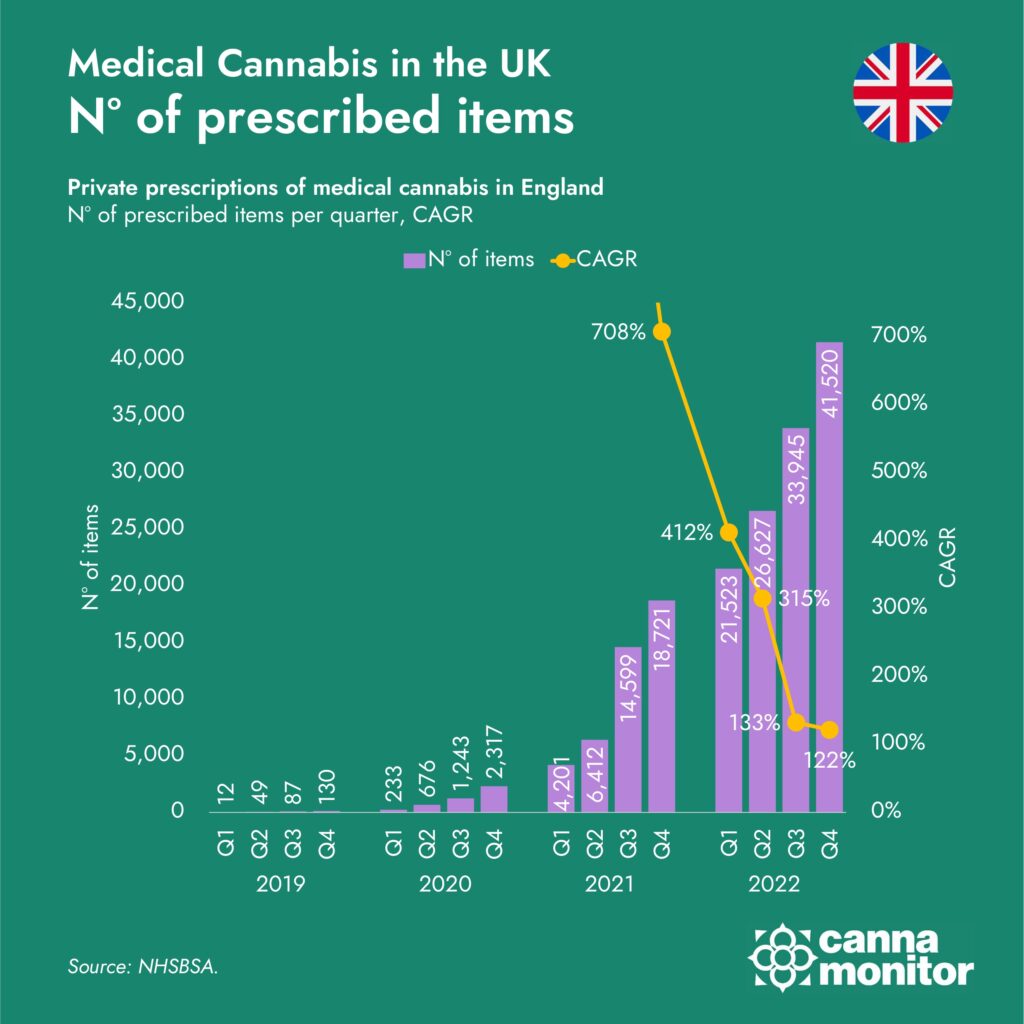

According to data released by NHS Business Services Authority (NHSBSA), the number of privately prescribed medical cannabis items has seen remarkable growth over recent years. In 2019, the number of prescribed items was a mere 278. This number increased to 4,469 in 2020, followed by a substantial rise to 43,933 in 2021, and finally, an impressive 123,615 items in 2022. This growth trajectory underscores a compound annual growth rate (CAGR) of 708% between Q1 2019 and Q4 2022.

Interim data from Q1 2023, coupled with industry stakeholders’ estimates of the patient population exceeding 30,000 by the end of 2022, suggests that the number of prescribed items for 2023 could approach or surpass 200,000. This projection is indicative of the sustained growth and expanding reach of the medical cannabis market in the UK.

Nº of medical cannabis items prescribed in England

Factors Driving Medical Cannabis Market Expansion

Several factors contribute to the rapid expansion of the medical cannabis market in the UK:

Private Clinic Sector: The thriving private clinic sector has played a crucial role in facilitating patient onboarding and access to medical cannabis. These clinics provide streamlined services that make it easier for patients to obtain prescriptions. The efficiency and accessibility of private clinics reduce the barriers to entry for new patients, contributing to the overall growth of the market.

Affordability Improvements: The cost of medical cannabis has become more affordable, encouraging more patients to consider it as a viable treatment option. Competitive pricing has made it accessible to a broader patient base. The reduction in costs can be attributed to increased competition among suppliers and economies of scale as the market expands. Affordability is a key driver in patient adoption, particularly for long-term treatments.

Diverse Supply Chain: The UK market now boasts a greater diversity of medical cannabis products, including flower, oils, vapes, and capsules of higher quality. This variety allows for tailored treatment options, catering to different patient needs and preferences. A diverse product range ensures that patients can find the most effective form of medication for their specific conditions, enhancing treatment outcomes and patient satisfaction.

Local Production: The first products grown within the UK are expected to become available in pharmacies this year. Although the UK predominantly relies on imports, with 24 tonnes imported from January to September 2023, the introduction of locally produced products is anticipated to enhance supply chain stability and product availability. Local production also reduces dependency on international suppliers, which can mitigate risks associated with supply chain disruptions.

Comparison with European Models

The growth and development of the UK’s medical cannabis market present a stark contrast to state-led models seen in other parts of Europe, such as Italy. The UK’s more liberal and privatised approach has led to fewer product shortages and a broader range of product alternatives at more competitive prices. This model has significantly improved patient access and market penetration without substantial public support, demonstrating the strengths of a market-driven approach.

In Italy, the state-led model has been characterised by frequent product shortages and limited product diversity. These issues stem from bureaucratic inefficiencies and restrictive regulatory frameworks that hinder the growth of the market. In contrast, the UK’s privatised model allows for greater flexibility and responsiveness to market demands, fostering a more dynamic and resilient industry.

Nº of medical cannabis items prescribed in England

Product and Patient Analysis

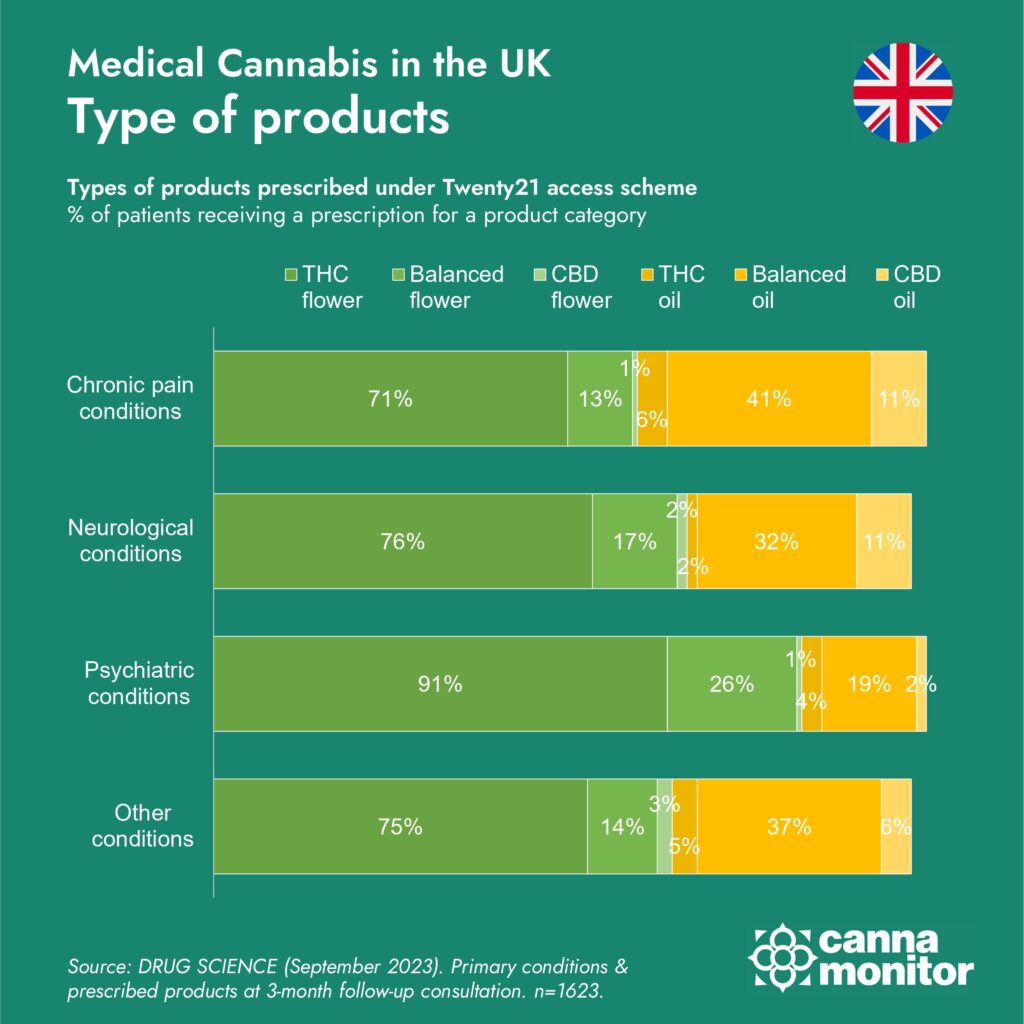

Detailed analysis of the types of products prescribed under the Twenty21 access scheme reveals interesting trends. Data from Drug Science (September 2023) indicates that a significant majority of patients receive prescriptions for THC flower (71%), followed by balanced flower (13%), and CBD flower (1%). These preferences highlight the demand for different cannabis compositions tailored to specific medical conditions.

The types of products prescribed are indicative of the conditions being treated. For instance, THC flower is commonly prescribed for chronic pain, which constitutes 41% of the primary conditions treated with medical cannabis. Other conditions treated include neurological conditions (32%), psychiatric conditions (19%), and other conditions (37%). The effectiveness of medical cannabis in managing chronic pain and neurological conditions is particularly notable, driving its adoption among patients suffering from these ailments.

Moreover, the variety in prescribed products suggests that patients and healthcare providers are seeking the most effective treatment modalities. Balanced flower, which contains both THC and CBD, is preferred for its therapeutic benefits without significant psychoactive effects. CBD products, on the other hand, are popular among patients who prefer non-psychoactive treatments.

Nº of medical cannabis items prescribed in England

Future Outlook

The future of the medical cannabis market in the UK looks promising. With the ongoing growth in patient numbers and prescriptions, the market is expected to continue expanding. The delay in the publication of full-year data for 2023, due to the complex process of reviewing prescriptions, indicates that the final figures will likely reflect substantial market activity and further growth.

As the market matures, several trends are likely to shape its future:

Regulatory Evolution: Continued regulatory support and potential reforms could further facilitate market growth. Streamlined processes for approving and reviewing prescriptions would reduce delays and enhance patient access.

Technological Advancements: Innovations in medical cannabis cultivation and product development could lead to higher quality and more effective treatments. Advances in biotechnology and agricultural practices are expected to improve yield and consistency in cannabis products.

Increased Research and Education: Greater investment in clinical research and patient education will likely drive better understanding and acceptance of medical cannabis. Comprehensive research on the efficacy and safety of different cannabis products will support evidence-based treatments and guide clinical practices.

Market Consolidation: As the market grows, consolidation among suppliers and clinics is anticipated. Mergers and acquisitions could lead to more robust and competitive market players, enhancing service delivery and product availability.

The exponential growth of the medical cannabis market in the UK, driven by a combination of private sector involvement, improved affordability, diverse product offerings, and impending local production, marks a significant development in the healthcare sector. The contrast with other European models underscores the potential benefits of a liberal, market-driven approach to medical cannabis supply. As the market continues to evolve, stakeholders and patients alike stand to benefit from enhanced access, variety, and quality of medical cannabis products.

For medical cannabis operators looking to capitalise on this burgeoning market, strategic commercial planning and market entry strategies are crucial. Our consultancy specialises in guiding operators through these processes to maximise their market impact and growth potential. Contact us to explore opportunities and develop your commercial strategy in this dynamic and rapidly expanding market.

As the UK medical cannabis market continues to grow, now is the time to position your business strategically. Leveraging our expertise can provide you with the insights and strategies needed to thrive in this competitive environment. Connect with us to learn more about how we can support your commercial goals and help you navigate the complexities of this evolving market.