As the Czech Republic continues to navigate the evolving landscape of cannabis regulation, the country is balancing between partial decriminalization, medical access expansion, and economic potential. While full legalization remains out of reach for now, ongoing reforms and market growth position Czechia as a key player in Europe’s cannabis industry.

Table of Contents

The Czech Republic has long been at the forefront of cannabis reform in Central Europe. With a well-established medical cannabis program, a growing CBD sector, and increasing momentum toward legalisation, the country is positioning itself as a key player in the European cannabis landscape. As 2025 approaches, several trends are shaping the future of the Czech cannabis market, from regulatory changes to market expansion and shifting consumer behavior.

Full Legalisation Efforts Stalled, Leaving Only Criminal Reform

Efforts to fully legalise cannabis in the Czech Republic have been repeatedly frustrated, with reforms limited primarily to criminal law adjustments. The Czech government recently approved a major criminal law reform that partially decriminalises cannabis possession and cultivation. Under the new rules, individuals will be allowed to grow up to three plants and possess up to 50 grams of cannabis outdoors (25 grams indoors) without facing criminal penalties. While this aligns Czechia with broader European decriminalisation trends, critics argue that the limited possession limits create impractical restrictions for home cultivators.

At the same time, economic studies highlight the potential benefits of full legalization. A Prague University analysis suggests that a legal market could yield an annual net benefit of CZK 5.5 billion (€218 million) through taxation and economic activity. Despite these findings, legislative progress has stalled, leaving incremental reforms as the primary pathway toward an open market.

Cannabis consumption remains widespread in the Czech Republic, with self-medication rates high. Surveys indicate that 16–25% of the population aged 15+ has used cannabis for self-medication at some point, and 9–14% have done so in the past 12 months. This translates to approximately 800,000 to 1.3 million people using cannabis for medical purposes each year, further underscoring the demand for accessible and affordable legal options. The illicit market remains active, with surplus cannabis often exported to Austria, Poland, and Slovakia.

April 2025: Prescriber Expansion Set to Transform the Market

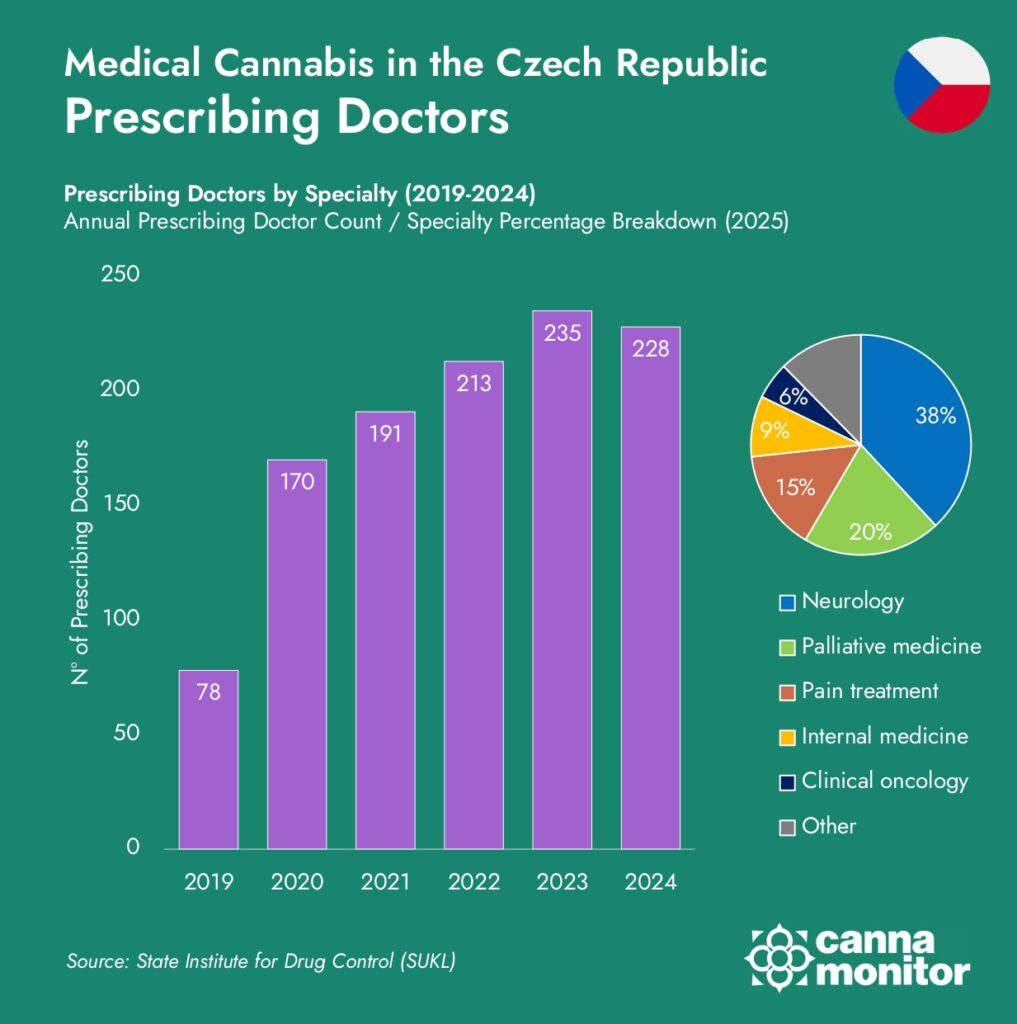

Since its introduction in 2013, the Czech medical cannabis program has grown significantly. The latest reform, set to take effect in April 2025, will allow general practitioners to prescribe cannabis for chronic pain patients—a privilege previously limited to just 200 specialists. This change could potentially increase the number of prescribing doctors from 228 to over 6,000, significantly expanding patient access.

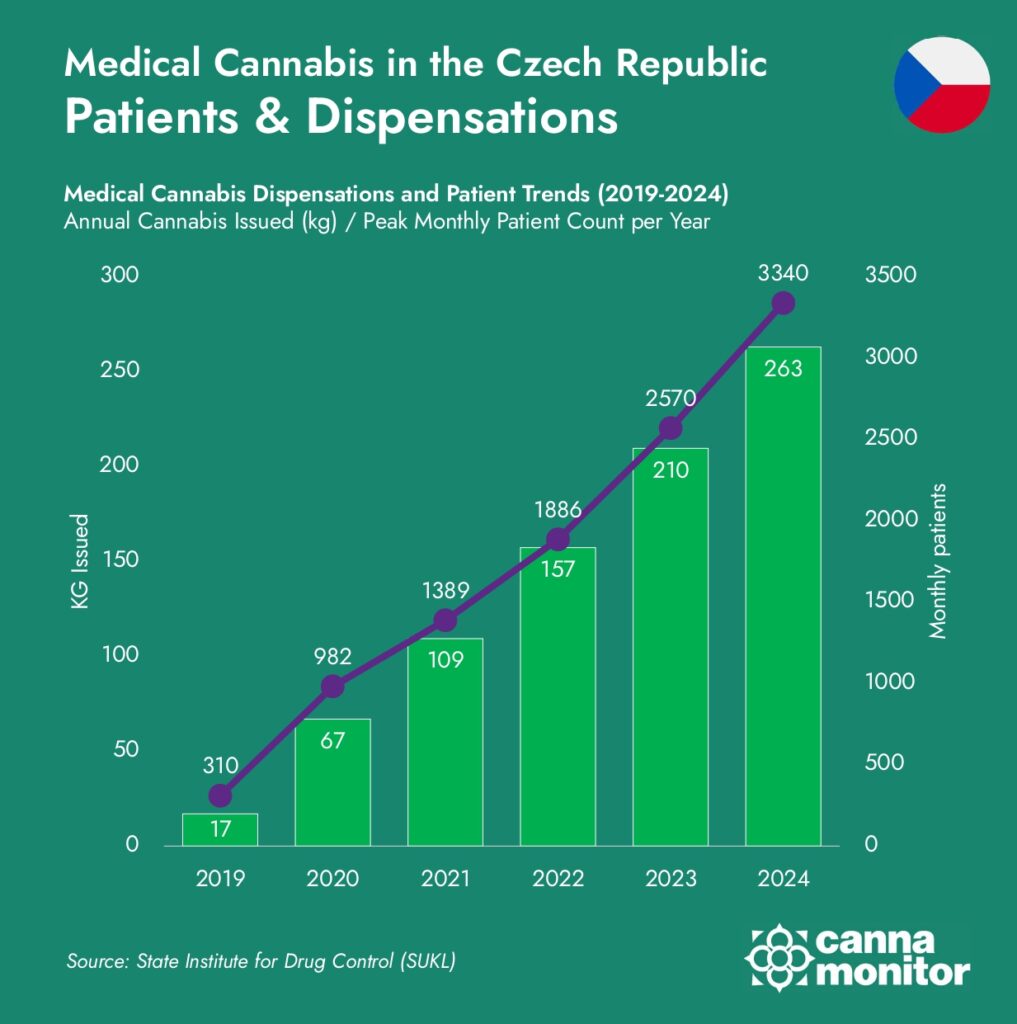

Patients & Dispensations in Czechia

Prescribing Doctors of Medical Cannabis in the Czech Republic

Medical cannabis dispensations have also surged, with the amount issued growing from just 17 kg in 2019 to an estimated 310 kg in 2024. Likewise, the number of monthly patients has increased from barely 310 in 2019 to over 3,300 in 2024. With an estimated 500,000 Czechs already self-medicating with cannabis, the formal medical market is expected to experience a rapid boost. The launch of the first online cannabis clinic in the country further underscores the increasing demand for medical cannabis solutions.

Following the 2022 liberalization of cannabis production, many former CBD growers have pivoted to producing high-THC, EU-GMP-certified medical cannabis, including Lagom Pharmatech, SensiQure, and Zenplanto, supplying both local pharmacies -through Czech Medical Herbs or pharmaceutical distributors such as Pharmos- as well the German market in partnership with local distributors like Drapalin (Lagom) and Nimbus Health (SensiQure). Similarly, Annabis has begun supplying four new medical cannabis products to Czech pharmacies, produced by local grower Elkoplast, with plans for future imports and exports by 2025.

International giants such as Canopy Growth, Aurora and Neuraxpharm initially entered the Czech market with high expectations but have faced challenges due to limited product demand and stringent reimbursement policies. As a result, local distributors like Czech Medical Herbs, Motagon, and Annabis continue to strengthen supply chains, ensuring a stable supply for both domestic patients and exports. US Cannabis Giant Curaleaf announced entry to the Czech market through Astrasana

Czechia’s Rise as Europe’s Premier CBD and Hemp Hub

The Czech Republic is emerging as a central hub for CBD and hemp-derived intoxicating cannabinoids, attracting businesses from countries like Italy and Spain, where regulatory uncertainty has increased. The introduction of the Psychomodulatory Substances Act, which governs the sale of cannabis with up to 1% THC, has provided stability to the industry.

By mid-2025, regulated sales of low-THC cannabis and kratom will be permitted under strict retail conditions, ensuring consumer safety while fostering business growth. International companies, including Flora Growth’s JustCBD, are expanding in the region, reinforcing Czechia’s role as a key CBD supplier. Flora Growth recently renewed its CBD sales orders in the Czech Republic and Slovakia, with annual revenues from this partnership estimated at $500,000.

Meanwhile, the Czech Republic has seen significant business activity in cannabis-related sectors. EcoStem—a collaboration between Czech Hempoint and Ukrainian Hemp—is seeking investment for the country’s first hemp-processing facility, capable of handling over 30,000 tonnes of biomass annually.

Beyond 2025: Can Czechia Lead Central Europe’s Cannabis Revolution?

With medical access expanding, the CBD sector thriving, and decriminalization efforts advancing, the Czech cannabis market is at a turning point. Despite political obstacles to full legalization, the steady growth of the regulated industry, combined with high consumer demand, positions Czechia as a leading player in the European cannabis market. The coming years will be crucial in determining how the country capitalizes on its strategic advantages and regulatory progress.