The Israeli medical cannabis market, characterised in recent years by rapid patient growth and bold regulatory reforms, now faces significant challenges due to a situation of oversupply, allegedly caused by cheap imports from Canada.

Following an investigation that revealed substantial dumping rates, the Israeli Commissioner on Trade Leavies has recommended to impose tariffs on Canadian cannabis aimed at protecting local producers.

This article explores the Israeli medical cannabis market: its evolution in the last 5 years, the details of the investigation, the allegations of price dumping, supply-demand dynamics in the Israeli market, and the future of the global cannabis trade in Israel’s context.

Note: This article was published on July 31, 2024 and has been updated in November 21, 2024 to reflect the final report of the investigation.

Table of Contents

Regulatory Reforms Fuel Patient Growth in Israel's Cannabis Market

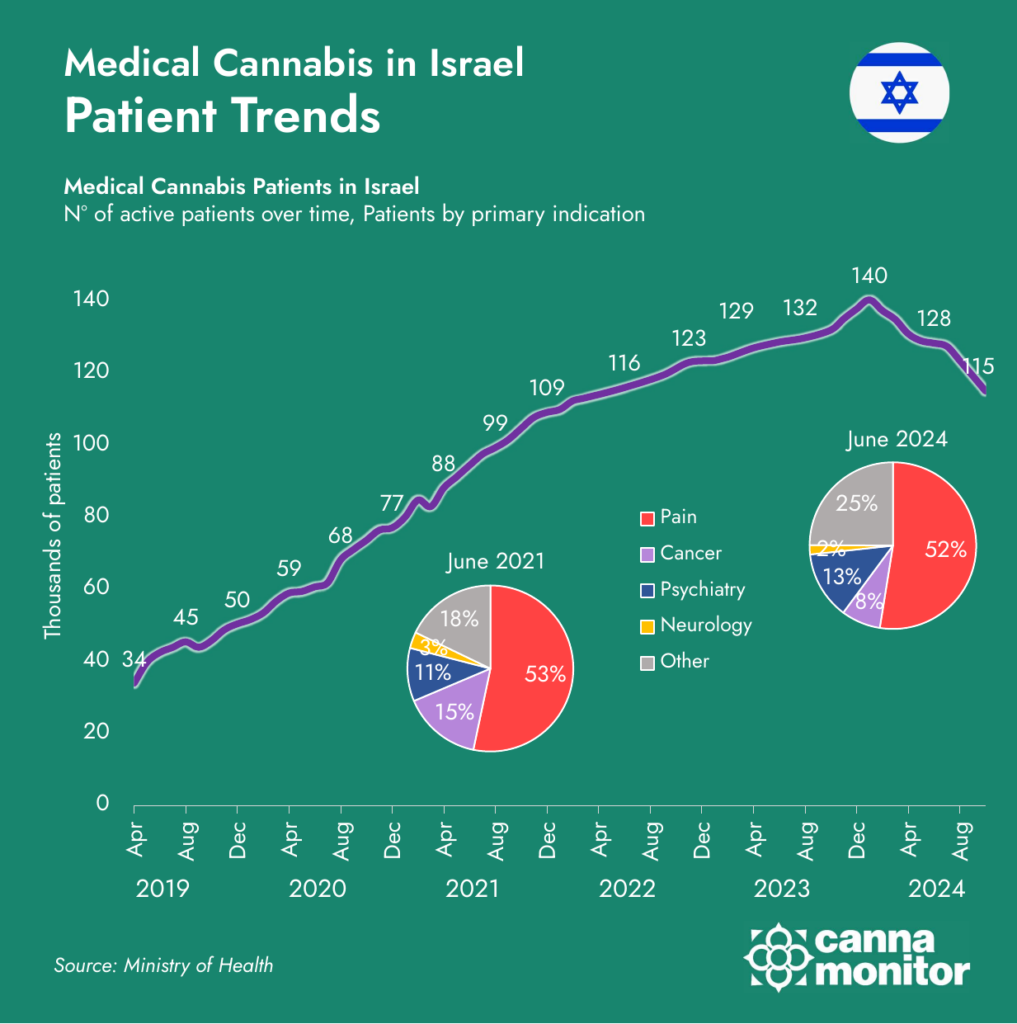

The Israeli medical cannabis market has experienced significant growth in the last few years, driven by liberal regulatory reforms and increasing patient acceptance. Israel was one of the first countries in the world to develop a domestic medical cannabis market, albeit relatively small and constrained until 2019. From January 2019 to January 2024, however, patient numbers soared from approximately 32,000 to over 140,000.

This impressive market development was prompted by reforms enacted in 2019 which liberalised the market, allowing patients to access products at the pharmacy instead of directly from the producers as the system was set up before, as well as simplifying the process for obtaining medical cannabis for a wide range of qualifying conditions without needing to exhaust other treatment alternatives first. This resulted in a surge in patient enrolment, making medical cannabis more accessible through the healthcare system.

Patient trends of Medical Cannabis in Israel

The reforms also allowed free floating prices and enabled international trade, seeking to boost the domestic sector by exporting cannabis to international demand markets of the likes of Germany. However, long coveted hopes of seeing Israel as a global cannabis export powerhouse did not materialise, as only two exporters (Panaxia and BOL Pharma) traded a limited amount of products to Australia, Germany and France.

Medical cannabis export volumes from Israel in the last few years were as follows:

- 2020: 177kg

- 2021: 664kg

- 2022: 662kg

- 2023: 525kg

Instead, Israel import sector quickly grew as the country became the largest medical cannabis importer in the world in 2020, overcoming Germany. Despite the abundance of domestic supply, international producers were attracted to the Israeli market thanks to its conducive standards regime, with the domestic IMC-GAP certification accepting the validity of not only the more stringent EU-GMP, but also allowing global suppliers to ship products with easier to obtain, third-party certifying body standards such as CUMCS-GAP (awarded by Control Union) and ICANN-GAP (awarded by IQC). The evolution of import figures was as follows:

- 2020: 14,778kg

- 2021: 22,037kg

- 2022: 24,309kg

- 2023: 15,950kg

This made the entry into Israel more feasible for international suppliers compared to other global jurisdictions that require EU-GMP or its equivalent to place products on the market, often requiring the manufacturer to conduct an audit by an official inspector from a European Union country, as well as being stricter in terms of manufacturing standards and microbial limits.

During most of 2023 the influx of new patients stabilised, but in the aftermath of the October 7 attack there was an influx of patients dealing with PTSD symptoms due to the hostilities, which also saw some relaxation of rules to deal with the influx of displaced people from areas near the conflict zone. Patient numbers surged to the maximum historical record of 140,412 patients in January 2024. However, reforms introduced in April 2024, which included a switch from a patient license to a prescription model for certain conditions, saw patient figures receding, and as of June 2024 sit at around 128,000 active patients.

Investigating Allegations of Price Dumping against Canadian Producers

The investigation by Israeli officials was triggered by complaints from local producers about the influx of low-priced Canadian cannabis, which they claimed was being sold below production costs and flooded the local market. Israeli producers complained in particular about consignment sales, allowing importers to receive products in bulk and pay only for those that they managed to sell.

According to the local companies that requested the launch of the investigation, the impact of Canadian competition on local players included a collapse in wholesale and retail prices, local distributors scaling down deals with Israeli producers (preferring international supply deals instead), as well as manufacturers shifting business models to favour importation.

In the decision to launch the investigation, Danny Tal, the Israeli Commissioner on Trade Levies, part of the Ministry of Economy, cited data to justify the need to further research the allegations of price dumping:

- According to the Commissioner, Canadian wholesale transactions to Israel were conducted at prices between $1 to $3 per gram (at an average of $2.1/g in 2023).

- This figure is significantly lower than a quoted Canadian spot price index of $3.75/g maintained by US brokerage firm Cannabis Benchmarks.

- However, this Canadian price index does not represent bulk transactions, but rather what Canadian retailers pay for packaged goods to the provincial distributors.

While the Commissioner suggested that this pricing gap means that Canadian producers were engaging in price dumping, it revealed a flaw that persevered in the rest of the investigation: comparing packaged goods into retail in Canada to bulk goods into distribution in Israel to assess price disparities.

This led to finding greater price differences than those actually existing. After all, Canadian producers are attracted to international trade because of the superior margins they can secure compared to their local market, which has been flooded by excess capacity for years. If anything, Canadian companies have flooded their own market first and foremost, and exportation represents an opportunity to secure better prices in less developed markets.

The preliminary findings of the investigation published in July 2024 confirmed the suspicions of the Commissioner, finding dumping rates of Canadian exports to Israel ranging from 63% to 369%, depending on the company. The investigation delved into the financial accounts of Canadian companies to highlight significant disparities between production costs and selling prices of Canadian products in their domestic market compared to Israel.

- The Commissioner found a factory gate price in Canada of CAD$7.86/g ($5.8), while comparable products were sold in Israel for CAD$2.1/g ($1.5) or less. Please note that the actual revenue received by LPs, after accounting for taxes and distribution margins, is significantly lower.

- Some Israeli producers were forced to sell flower at prices as low as $1.4/g, well below production costs, leading to significant unsold inventories. Other growers were unable to sell their production as flower, and had to dispatch it as biomass for extraction instead, for $0.8/g or less.

- Retail prices in Israel fell below NIS 40 ($11/g), with aggressive promotions such as “buy 1—get 1 free” driving a general trend of price compression in the market.

The Rise of Imports: How Canada Dominated Israel’s Supply Chain

Imports to Israel by Source Country

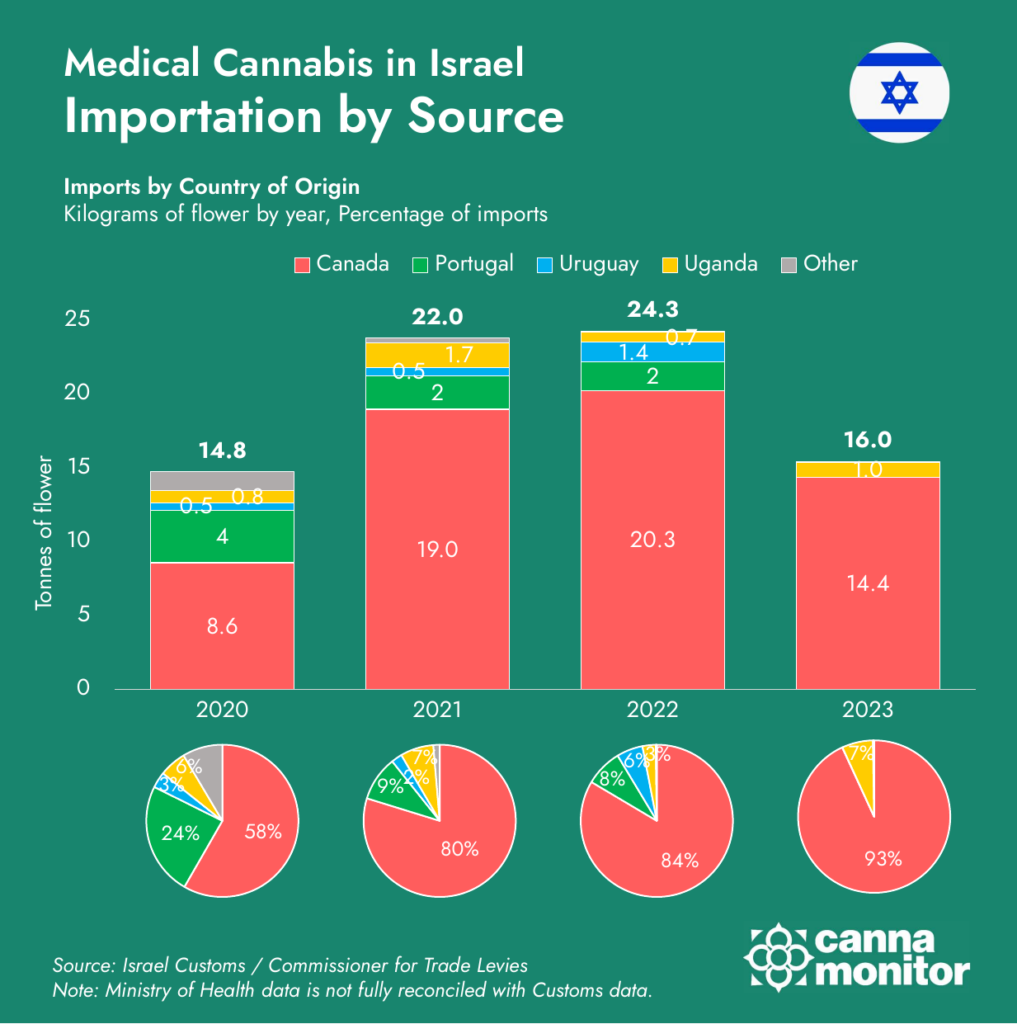

Since the market opened to international trade at the end of 2019, the importation of medical cannabis into Israel has undergone a noticeable shift. Over time, Canadian producers increasingly came to dominate the market, with the share of imports from Canada jumping from 58% in 2020 to 93% in 2023.

In 2020 the supply landscape was relatively diversified, with the 8,614 kg imported from Canada complemented with 3,551 kg from Portugal, 499kg from Uruguay, and 848kg from Uganda. However, the dominance of Canadian imports grew stronger in the following years both in absolute and relative terms, with over 20 tonnes of Canadian cannabis imported in 2022, and only 4 tonnes from other origins.

This trend came not only at the expense of local producers complaining about price dumping, but also of other international producers, particularly in Portugal and Uruguay, whose imports in absolute terms dwindled. Only Uganda maintained a steady market share of around 7%, thanks to the vertical integration of Israeli producer Together Pharma which operates a facility in the African nation, ensuring a stable demand for Ugandan cannabis.

In 2023, Israel experienced its first decline in medical cannabis imports, with a drop to 15,950 kg compared to 24,309kg in 2022. While this may suggest a contraction in demand for imported products, market operators believe the reduction was mainly due to excess inventory from previous years, and the fire sales of domestic products about to expire which were being sold at under production costs.

Despite the launch of the investigation in the beginning of 2024 and the very likely prospect of facing tariffs since the interim results of the investigation were published in July, data from the first nine months of 2024 shows a continued influx of cannabis, with 14,647 kg already imported in 2024 up to September. Despite the tariffs, if no more changes are made, the Israeli market might very well continue relying on imports for a large part of its demand moving forward.

Market Oversupply Challenges Israeli Medical Cannabis Sector

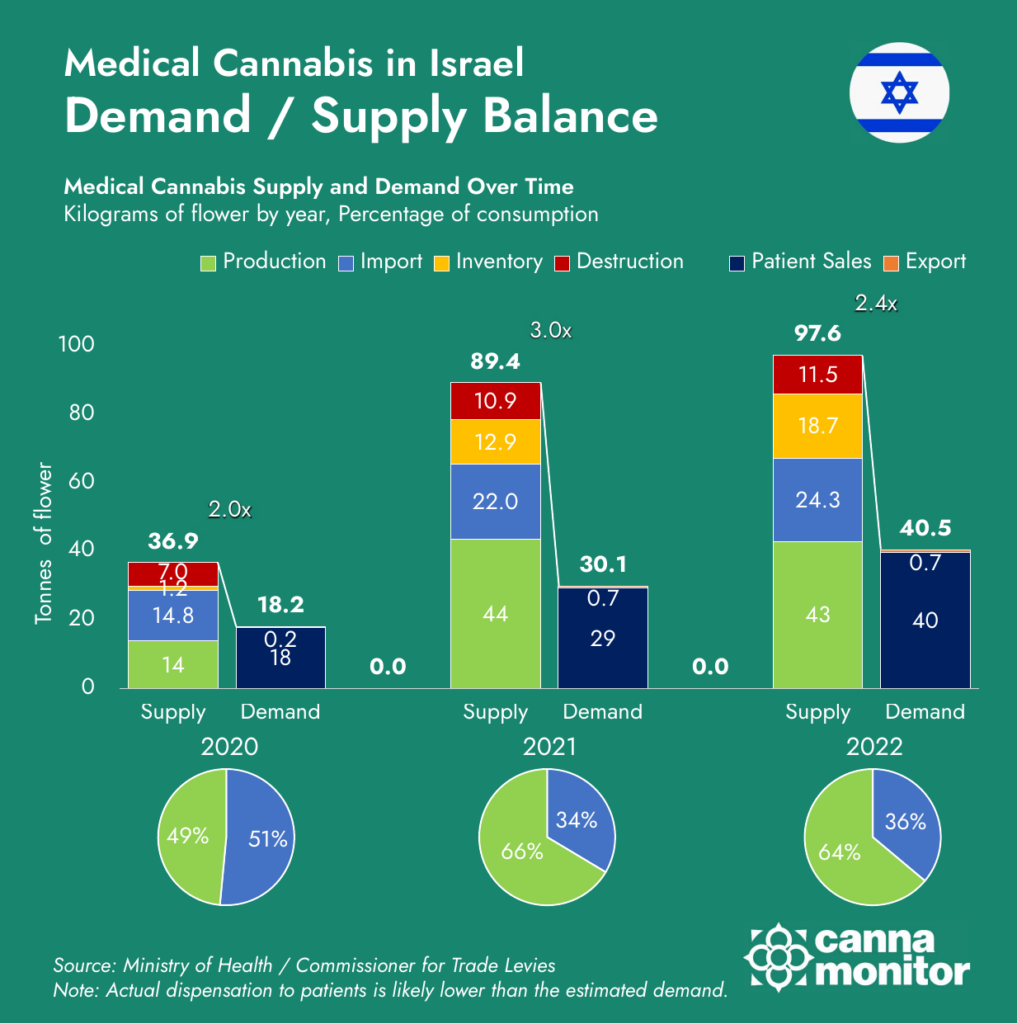

Despite a dramatic expansion in patient demand in the Israeli cannabis market over the last five years, a combination of domestic oversupply and a surge in imports, primarily from Canada, has led to a severe supply-demand imbalance that the Commissioner outlines in its report. This oversaturation has resulted in overcapacity issues and financial distress among local producers, with imports significantly driving down prices and intensifying competition. Increased imports are cited as one of the causes for prices to plummet—in the case of Canada, the investigation mentions that import prices fell by 44% in 2021, 46% in 2022, and another 22% in 2023, contributing to a general dynamic of price compression.

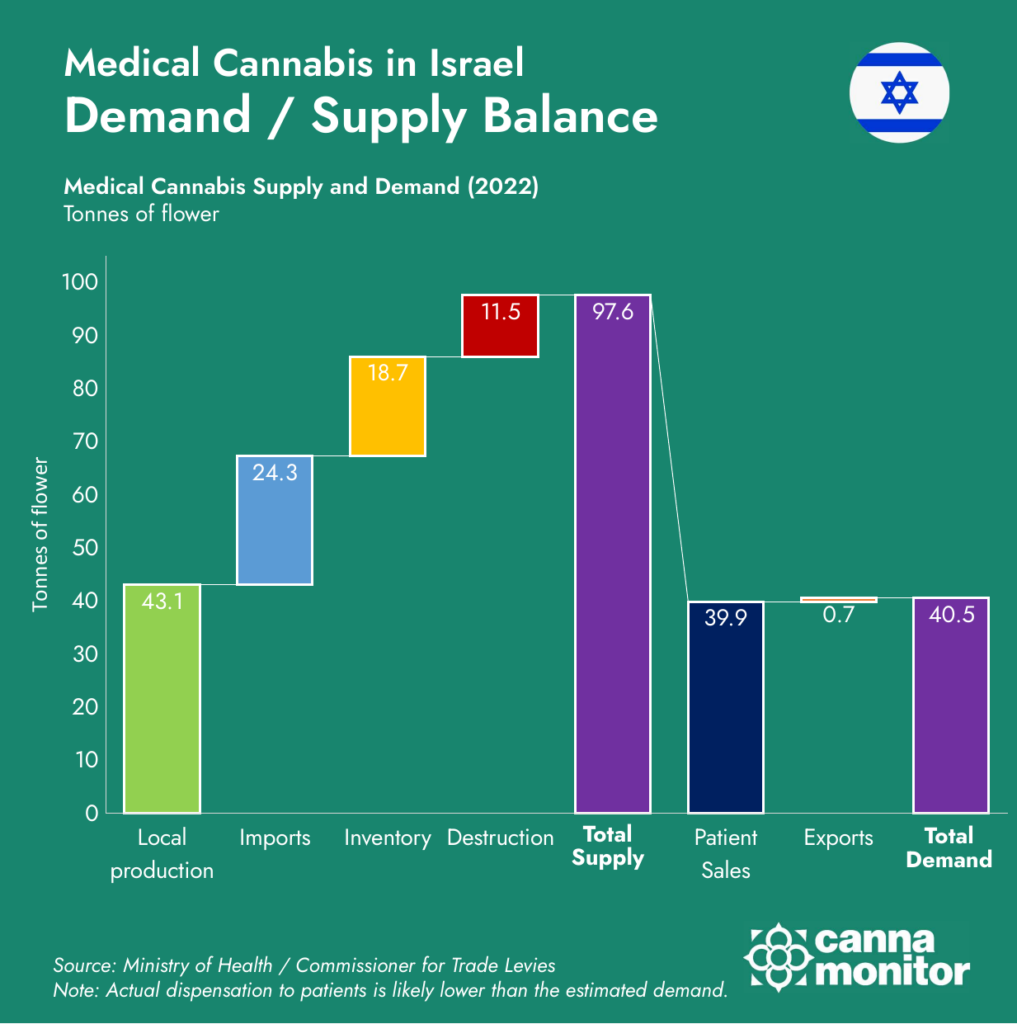

The total cannabis supply in 2022 reached 98 tonnes (including inventories and destroyed stock), as barely 40 tonnes were dispensed to patients, of a maximum licensed consumption of 53 tonnes, leading to a surplus of 2.4 times more supply than demand, which further depressed prices and placed additional financial strain on local producers. Companies struggled to address overbuilding, with many operating below capacity, halting expansion plans, and failing to secure additional capital. Inventories ballooned from 1.2 tonnes in 2020 to 18.7 tonnes in 2022, and the destruction of unsold cannabis increased by 65% to 11.5 tonnes.

Unfair competition exacerbated these issues, with consignment sales allegedly flooding the market and allowing importers to pay only for products sold. Many manufacturers shifted their focus to importing cannabis, while distributors reduced their engagements with domestic producers in favour of cheap imports from Canada. This dynamic further deepened the economic downturn, as sales declines and squeezed margins pushed companies into severe financial distress. Extended payment terms of 90–180 days created cash flow challenges, with postponed payments leading to job losses. Moreover, the downturn deterred investment and financing in the sector, with banks unwilling to provide credit and investors avoiding the struggling market altogether.

Demand / Supply balance of medical cannabis in Israel

Israeli Producers Struggle Amid Unfair Competition and Price Pressures

Demand / Supply Balance of the Israeli Market

The investigation into Canadian cannabis imports exposed a profound impact on Israeli operators, fundamentally transforming the domestic market landscape between 2021 and 2023. Local producers faced continuous margin erosion as import prices undercut domestic products by 10-20%, compelling them to either lower their prices to unsustainable levels or forfeit market share. This intense competition led to significant operational reductions, including scaled-back production capacity, halted expansion plans, and widespread workforce reductions. The financial strain was further deepened by extended payment terms of 90-180 days, which created severe cash flow challenges and limited the ability of companies to sustain investments in research and development.

A key outcome was the strategic divergence among domestic producers. Some companies attempted to maintain their exclusive focus on domestic production models, enduring significant financial losses, while others adapted by diversifying their business strategies to include a pivot toward hybrid models involving imports, or a focus on niche market segments to carve out a sustainable competitive edge. However, these adaptation efforts were insufficient to halt the sector’s overall decline. The market share of domestic producers fell 40%, and numerous well-established companies faced insolvency.

Canadian imports achieved a dominant market position through their consistent price advantage, supported by efficient supply chains and volume discounts that strengthened their competitive edge. As market dynamics shifted, import-oriented operations gained traction, leading to market consolidation that marginalised domestic producers. While import competition drove efficiency in the market, the investigation highlighted that it also imposed unsustainable pressure on local producers, ultimately undermining Israel’s domestic cannabis production capacity and threatening the long-term sustainability of the industry.

Vertically Integrated Companies Pivoted their Business Models

Certain Israeli companies more diversified along the supply chain demonstrated more resilience through business model adaptation, though still facing significant challenges. These companies either diversified into imports or focused on premium market segments to thrive in a tough market by deploying:

- Complex internal pricing strategies

- Development of niche market strategies

- Focus on premium product differentiation

- Integration of imports with local operations

- Adaptating to maintain viable domestic production

Vertically integrated players that collaborated with the investigation reported the following:

- Bazelet: Managed dual roles as producer and importer, though struggled with low prices and surplus inventory. It provided data showing a 40% price drop between 2021 and 2023, illustrating instances where imported cannabis, although more cost-effective, reduced their competitive edge as a domestic producer. Despite a good trend of increasing volumes in 2023, the company data showed an erosion of operating profits and profitability.

- Seach Medical Group: Successfully pivoted to differentiated niche products, though forced to phase out lower-quality domestic products. The company sustains that origins are not comparable, as it imports premium products while in Israel it buys or grows lower quality products. However, the company denies any price suppression due to imports, claiming that its purchase price of Israeli products did actually increased from 2020 to 2023.

- Cronos: The largest importer to the country with over 70% market share, the company initially claimed it was not affected by the investigation due to importing other products than whole flower, such as prerolls. However the investigation found that it was a key importer, particularly lower quality, lower price, and the company stopped working with local producers.

- Together Pharma: Its subsidiary Globus Pharma experienced 10-15% price undercutting by imports, impacting R&D investment capability despite attempts at market repositioning.

Local Cultivators Came Under Pressure

The investigation revealed that companies focused solely on domestic production faced the most severe challenges, bearing the full impact of price comppression, resulting in significant operational and financial stress:

- Workforce reductions

- Average price declines of 15-20%

- Delayed or cancelled expansion projects

- Significant reduction in capacity utilisation

- Difficult to maintain quality while cutting costs

- My Green Fields: The largest cultivator in Israel documented sales volume stagnation during 2021-2023, with mounting inventories. Its original business plan forecasted a selling price of NIS 12-13 per gram which was much higher than the prices it was forced to sell at, leading to severe margin compression. Long payment terms of up to 180 days force producers to bear finance costs for 7-10 months.

- Evergreen Pharma: Experienced sharp decline in market share and profit margins, with data showing progressive erosion of pricing power as import competition intensified, leading to financial difficulties and unsold inventory. They had to sell under production costs and destroy a part of their harvest, leading to reduction of capacity.

- Can For Life: Forced to abandon expansion plans and reduce capacity utilisation, with specific evidence of investment projects being postponed due to market uncertainty, affecting its financial stability and market position. In 2020 and 2021 they had enough orders to fill their facility: when imports started, buyers stopped the agreements.

- CannEden Crops: Its data showed a direct correlation between import price levels and operational scale-backs. According to the company, they were even forced to destroy produce due to low demand for local products. Company claims that importers buy the goods on consignment and implement promotions such as buy 1, get 1 for free.

- Greenkom: Reported wholesale price drops of up to 12% during peak import periods. It was particularly affected by established Canadian brands’ pricing strategies. According to the company, excessive inventory levels in Canada create an incentive to offload production internationally at low prices.

- Cannarava: The company’s data shows that despite being cashflow positive in 2021, its losses in 2022-2023 created a negative return on investments, alongside a deepening of the deficit in the company’s equity. Deferred payments from buyers were also a significant problem. The decrease in revenues is an “existential threat”:

Importers Benefited from Lower-Priced Canadian Products

These companies, focused exclusively on import operations, generally showed stronger performance, benefiting from lower-priced Canadian products. Key Success Factors of Importers included:

- Efficient supply chain management

- Strong relationships with Canadian suppliers

- Capturing market share from domestic producers

- Successful exploitation of price arbitrage opportunities

- IMC: It operates through AMC Pharma and Focus Medicinal Plants. The company claims that it imports quality medical cannabis grown indoors in Canada, which is not available locally. Factors explaining the local downturn include regulatory environment and excess capacity. After reporting losses in recent years, the company decided to exit the cannabis business and is now seeking a buyer for its assets.

- Intercure: Its Canndoc subsidiary developed strong logistical partnerships with Canadian exporters, achieving cost advantages through supply chain optimisation, while ceasing to work with domestic producers such as Green Fields.

- Dr. Samuelov: Effectively utilized streamlined import procedures and volume-based discounts to maintain competitive advantage.

- Regubis Israel: Diversified offering through imports while cost-cutting domestic operations.

Other Companies in Distress or Exiting the Market

In the past two years, numerous companies in the Israeli cannabis sector have exited the market due to severe financial distress and broader economic challenges. Notable examples include:

- Tikun Olam: the crisis of the pioneer lead to the closure of two breeding and cultivation farms.

- BOL Pharma: Filed for insolvency and requested the court to appoint of a trustee.

- Panaxia: Is negotiating the sale of its cannabis operations to settle outstanding debts.

- Cannasure: Saw its market value plummet by 98%, with activity nearly halted.

- Univo: Filed an insolvency petition, citing debts amounting to approximately NIS 50 million.

- Pharmaken: Ceased operations and entered insolvency proceedings.

- Intelicanna: Pivoted away from the cannabis industry by merging with a real estate company.

- Canomed: Formerly a public company, it sold to a real state firm in December 2022.

Canadian Producers Accused of Price Dumping in the Israeli Market

The investigation into Canadian cannabis companies exporting to Israel revealed significant discrepancies in pricing practices, with several companies found to be engaging in dumping. The investigation highlighted systemic pricing issues across Canadian exporters, underscoring their role in destabilizing the Israeli market. While some companies cooperated fully, the findings confirmed widespread dumping practices, further exacerbating competition and financial strain for Israeli producers, recommending the impositon of the following tariffs on Canadian products:

- Decibel: 2%

- Village Farms: 33%

- Organigram: 39%

- Tilray: 77%

- Other companies: 175%

Below is a detailed account of the findings of the investigation, highlighting differences between the interim and final results for each company:

- Decibel Cannabis: Initially, the Commissioner found that the company exported cannabis at prices below production cost, with dumping rates of up to 63%. In the final report, Decibel argued that its products sold to Israel were premium and sold at higher prices than both domestic Israeli products and its Canadian product mix. However, the Commissioner found that the company’s export prices still reflected a loss rate of 10-40%. Adjustments were made to account for differences in production, packaging, transportation and compliance costs, but the acceptable price was ultimately based on the company’s costs, with a reasonable profit margin of 8% applied. While Decibel successfully demonstrated some factors reducing the initial margin, the Commissioner upheld that its export prices still deviated from standard business practices, leading to a small but persisting dumping rate of 2%.

- Village Farms: Pure Sunfarms, a subsidiary of Village Farms, initially faced a dumping rate of 74%, attributed to inconsistencies in its export prices to Israel compared to local production costs. This margin was influenced by the inclusion of bulk wholesale transactions in its domestic pricing data, many of which were loss-making and intended for oils or other downstream products. However, Pure Sunfarms demonstrated during the investigation that its export goods were premium, retail-packaged products unsuitable for comparison with the Canadian bulk transactions. The Commissioner acknowledged that greenhouse cultivation, while reducing production costs, yields lower quality and consistency than indoor-grown cannabis. Through extensive cooperation, the company clarified product classifications, allowing the Commissioner to rely on actual retail sales figures from the Canadian market. Despite these adjustments and the company’s proactive engagement and detailed data segmentation, the Commissioner concluded that Pure Sunfarms’ export prices still required regulatory alignment to comply with fair trade standards, leading to a reduction in the dumping rate to 33%.

- Organigram: : In the interim findings, Organigram had a staggering dumping rate of 112%, driven by claims that its export prices fell well below production costs. The company argued that its export products to Israel should not be compared to value products sold in the Canadian market. However, the Commissioner determined that the exported products were comparable to both the premium and value products in the Canadian market. This conclusion was reached despite the company’s clarification that the export products were always premium, as the Commissioner considered this claim was only made when it became clear that it could affect the price comparison. The company’s other arguments—regarding differences in marketing channels and consumer loyalty between Canada and Israel—were not fully accepted. Given Organigram’s significant loss in 2023, with CAD$ 233 million in revenue but a CAD$ 252 million loss, the Commissioner found that its pricing did not reflect a normal course of business, indicating unsustainable pricing. As a result, the Commissioner based the dumping rate on the company’s cost structure, incorporating adjustments for packaging, shipping, and a reasonable profit margin, setting the dumping rate at 39%.

- Tilray: Tilray Brands, encompassing Tilray and HEXO, initially provided incomplete sales data, focusing solely on bulk sales to downstream industries in Canada, while withholding retail consumer sales data, despite indicating that it did not export to Israel during the investigation period. While the company insisted on the comparability of its bulk products, the Commissioner disagreed, citing the need for retail sales data to establish an accurate acceptable price for the exported goods. However, the Commissioner considered this submission as cooperation with the investigation, awarding more lenience to Tilray Brands by calculating its accepted price based on export prices to Israel, with additional costs derived from the weighted average expenses as confirmed during the verification visits with the Canadian companies, to determine a dumping rate of 77%.

In the case of Canadian producers that did not cooperate with the investigation, such as SNDL, Canopy, and Auxly, the Commissioner relied heavily on external data sources, including the Canadian Cannabis Survey 2023 and a Deloitte study. These sources revealed an average price of CAD$8.14 per gram for dried flower, which the Commissioner adjusted to an assumed factory gate price of CAD$7.86 per gram, despite acknowledging the Canadian Cannabis Exchange spot price of bulk transactions, averaging CAD$0.96/g in 2023, the investigador insisted in comparing packaged goods with the bulk imports to Israel.

In the interim investigation, the dumping rate for these producers was estimated at 369%. Challenges to this high rate focused on the premium nature of imports, with benchmarks based on factors like packaging size, THC content, and production methods such as indoor cultivation. Verification visits by the Commissioner confirmed that smaller package sizes (1–3.5 grams) typically represented higher-quality cannabis, while broader market dynamics, including consignment sales, were acknowledged as strategies to clear excess stock—often of lower-quality goods or those grown in less favorable conditions.

Claims from the Cannabis Council of Canada, such as objections to the inclusion of excise taxes or arguments against the link between packaging size and product quality, were refuted by the Commissioner citing insufficient evidence. To establish fair export pricing for producers that didn’t submit information, the Commissioner instead relied on customs data of cheap imports from Cronos, the largest importer of Canadian cannabis, rather than the average prices submitted by the producers. This adjustment reinforced the distinction between premium products and stock-clearance strategies. The final acceptable price was set at NIS 19.29 per gram, resulting in a revised dumping rate of 175% for all other Canadian producers.

Shortcomings of the Investigation

While the investigation provided critical insights into the pricing practices of Canadian producers, it also had limitations. The focus on price dumping did not fully address the broader supply-demand imbalances in the market. Additionally, the investigation’s reliance on pricing data from a few years may not reflect current market conditions, leading to potential discrepancies in the findings.

the investigation suffered from multiple biases:

· Insisting on comparing bulk wholesale prices into Israel with packaged sales to Canadian retail. The assumption is that LP margins account for 75% of the retail price — however, LPs receive no more than 1/3 of what consumers pay.

· Canadian producers actually trade at a premium in the Israeli market: as indicated by the CCX spot price, 2023 bulk transactions in Canada averaged CAD 0.96/g, compared to CAD 2.1/g for Canadian products into Israel.

· Oversupply in the country has broader causes: in 2022, Canada imported 20 tonnes (30% of supply), while local LPs produced 43 tonnes. Inventories surged to 19 tonnes, with 12 tonnes of product destroyed.

· Israeli patients appear to prefer premium imported products, as evidenced by the higher prices of Canadian products compared to local ones.

Despite all indications pointing to a flawed investigation, no evidence of creative accounting by the investigators is likely to alter a decision that has already been made. Adapting to the new reality is now paramount.

Strategic Adaptations and the Future of Israel's Cannabis Market

The Israeli medical cannabis market stands at a pivotal moment, shaped by transformative regulatory, competitive, and economic forces. The imposition of tariffs on Canadian imports marks a decisive shift towards protectionism, seeking to stabilize a market that has struggled under the weight of oversupply, price dumping allegations, and intense international competition. While these measures may provide short-term relief to local producers, the broader implications for the market’s long-term evolution remain uncertain.

Israeli LPs: Innovation is Key to Increase Market Share

With the imposition of tariffs on Canadian cannabis imports, Israeli producers now have an opportunity to recalibrate their strategies and navigate the new market landscape. These tariffs aim to level the playing field, allowing domestic companies to regain some competitive ground. However, long-term sustainability will require strategic adaptations to counter persistent challenges such as oversupply, market consolidation, and reduced margins.

One viable approach is for Israeli companies to focus on premium product differentiation. By leveraging unique qualities of locally grown cannabis, such as specific strains or organic cultivation methods, producers can target high-value market segments less sensitive to international price competition. Companies like Seach Medical Group have already shown success by pivoting to differentiated, niche products, carving out a stable albeit smaller market share.

Another strategic pivot involves vertical integration and hybrid business models that incorporate imports alongside domestic production. Firms like Bazelet have managed to weather the competitive pressures by balancing both roles, despite challenges in maintaining profitability. This model allows companies to optimize operations while meeting diverse market demands.

Operational efficiency will also be critical. Producers must focus on improving cultivation techniques to lower production costs, streamline supply chains, and enhance inventory management to prevent surplus and destruction. For example, vertically integrated players could adopt more sophisticated pricing strategies to mitigate risks associated with fluctuating demand.

To stabilize cash flow, companies need to negotiate more favorable payment terms with buyers and explore alternative financing options. Accessing funds through partnerships or governmental support programs can provide much-needed liquidity for sustaining operations and driving innovation in research and development.

Finally, there is a need to address export opportunities. By leveraging Israel’s reputation for high-quality cannabis and stringent medical standards, domestic producers can explore international markets with less competitive saturation. Building robust export pipelines will allow companies to offset local market pressures and tap into global demand.

The post-tariff landscape presents both challenges and opportunities. While tariffs alone may not reverse the damage caused by years of price suppression, Israeli cannabis companies have a chance to rethink their strategies, focus on value creation, and position themselves as resilient players in a transformed market.

Canadian LPs: Strategically Navigating Tariffs

The imposition of tariffs on Canadian cannabis imports has created a complex environment where producers producers face new trade barriers and must adapt strategically. Some companies like Decibel face minimal tariffs, enabling them to likely remain competitive with minimal changes to their strategy, while others encounter prohibitive rates that effectively bar them from trading directly with the Israeli market, but might find workarounds. Emerging options by Canadian producers include:

- Absorbing Tariffs and Keep Operating as Usual. Producers like Decibel Cannabis, which received a minimal tariff of 2%, can likely absorb this new cost within their margins and remain competitive. This minor tariff may even provide a competitive advantage, as Decibel can underprice Canadian competitors, including Village Farms and Organigram, whose tariffs are substantially higher at 33% and 39%, respectively. Decibel’s premium products, already priced higher than the market average, are better positioned to weather these trade barriers while maintaining profitability.

- Shifting Focus to Other Markets: Producers facing higher tariffs, such as Tilray (77%) and non-cooperating companies hit with the maximum rate of 175%, must reevaluate their international strategies. For companies like SNDL and Canopy, the Israeli market is no longer viable without drastically inflating prices to over NIS 20 per gram (USD $5/g), far exceeding competitive levels. These producers are likely to redirect their efforts toward other high-demand markets, including Australia, Germany, and Brazil, where regulatory landscapes and demand conditions may offer better profitability.

- Nearshoring Through Processing Partners: Nearshoring provides a pathway for Canadian producers seeking to maintain a foothold in Israel. By partnering with processing facilities in Portugal or other countries with favorable trade relationships, producers can bypass direct tariffs while potentially minimizing additional shipping and compliance costs. This strategy increases operational complexity, and third-party processing carries a cost that might inflate prices beyond what’s sustainable (however, much less than the tariff). Nonetheless, shipping through third-party repackagers could enable companies like Village Farms and Organigram to remain competitive despite their higher tariff rates.

The investigation underscores the disparities among Canadian producers. For example, Decibel’s strategic focus on premium products allowed it to demonstrate smaller deviations from fair trade practices, leading to a competitive tariff rate. Conversely, producers like Tilray and those that did not cooperate faced harsher penalties due to insufficient transparency and practices deemed inconsistent with fair trade norms.

Producers that collaborated extensively with the investigation, such as Village Farms and Organigram, retain a potential edge by addressing compliance gaps and refining pricing structures. However, the steep tariffs levied on companies that failed to engage with the process highlight the consequences of non-cooperation and reliance on unsustainable pricing practices.

Canadian producers that remain active in the Israeli market must also consider product innovation and branding to differentiate themselves. With tariffs narrowing the price gap, promoting product quality, unique strains, or advanced formulations will be essential to capturing market share at the higher prices imposed by the investigation. In this recalibrated market, strategic agility and the ability to pivot quickly will determine which Canadian producers can sustain a meaningful presence in Israel and other competitive markets.

International LPs: Opportunities in a Rebalanced Market

The Israeli market’s pivot towards protectionism has created significant opportunities for international producers, particularly from countries like Portugal, Uruguay, or Uganda. These producers can capitalise on gaps left by Canadian companies facing tariffs and position themselves strategically in a rapidly evolving landscape.

With Canadian producers constrained by tariffs, particularly in higher-tier products, international companies have a unique chance to dominate the premium market segments. These producers can emphasize quality over volume by offering premium indoor-grown cannabis, high-THC strains, or innovative formulations that align with Israel’s demanding consumer base. For example, Portuguese companies already operating under strict EU-GMP standards could leverage this compliance to appeal to medical cannabis patients and regulators alike.

International manufacturers and GMP service providers, like those in Portugal or Malta could be well-positioned to serve as third-party processing hubs for Canadian companies looking to circumvent tariffs. By acting as nearshore partners, these producers can process Canadian cannabis into compliant bulk or finished products before export to Israel. This strategy benefits both sides: Canadian producers gain a tariff-advantaged route, and international companies establish themselves as critical nodes in a diversified global supply chain.

Countries with lower production costs, such as Uruguay and Uganda, can target the value-driven market segments by offering competitively priced products. Leveraging favorable climates, low labor costs, and large-scale outdoor cultivation, these producers can provide consistent supply at prices that undercut both local Israeli and remaining Canadian products. However, success in this segment requires investment in efficient logistics, streamlined regulatory compliance, and consistent quality assurance to meet Israeli standards.

Partnerships with local Israeli distributors or investments in regional storage facilities could streamline operations and enhance reliability. A robust marketing strategy that highlights origin stories, sustainability practices, and unique product attributes could enhance differentiation in the Israeli market, building brand equity and consumer loyalty.

As the Israeli market recalibrates, international producers have a unique window of opportunity to carve themselves a piece of the market. By targeting underserved segments, providing innovative solutions, and enhancing operational efficiency, they can thrive in a market that is simultaneously consolidating and diversifying.

Evolving Dynamics: Challenges and Opportunities Ahead

The Israeli medical cannabis market is experiencing a pivotal transformation, driven by complex dynamics of protectionism, market oversupply, and international competition. The implementation of tariffs against Canadian imports represents more than a defensive measure—it’s a strategic recalibration of the domestic cannabis ecosystem.

Key Strategic Imperatives:

- Local producers must prioritize innovation and premium product differentiation

- Operational efficiency and cost management are critical for survival

- Vertical integration and hybrid business models offer resilience

Global Implications:

- Israel’s protectionist approach could trigger similar responses in other cannabis markets

- International producers now face opportunities to reposition themselves strategically

- Compliance, quality, and adaptability will distinguish successful global players

The market’s future depends on balancing local production capabilities with international collaboration. Success requires a holistic approach that addresses structural challenges while remaining agile enough to capitalize on emerging opportunities in the rapidly evolving global cannabis landscape.

The trajectory of Israel’s medical cannabis sector will be defined not by protective barriers, but by the industry’s capacity to innovate, optimize, and strategically engage with global market dynamics.