Germany, a pivotal player in the European Union, finds itself at the forefront of cannabis regulatory reform. Recent developments signal a transformative shift in the country’s approach to cannabis importation and legalization.

In this thorough analysis, we delve into the nuanced dynamics of Germany’s cannabis import trends, deciphering their implications for forthcoming legal reforms and their potential impact on various stakeholders within the cannabis industry.

Table of Contents

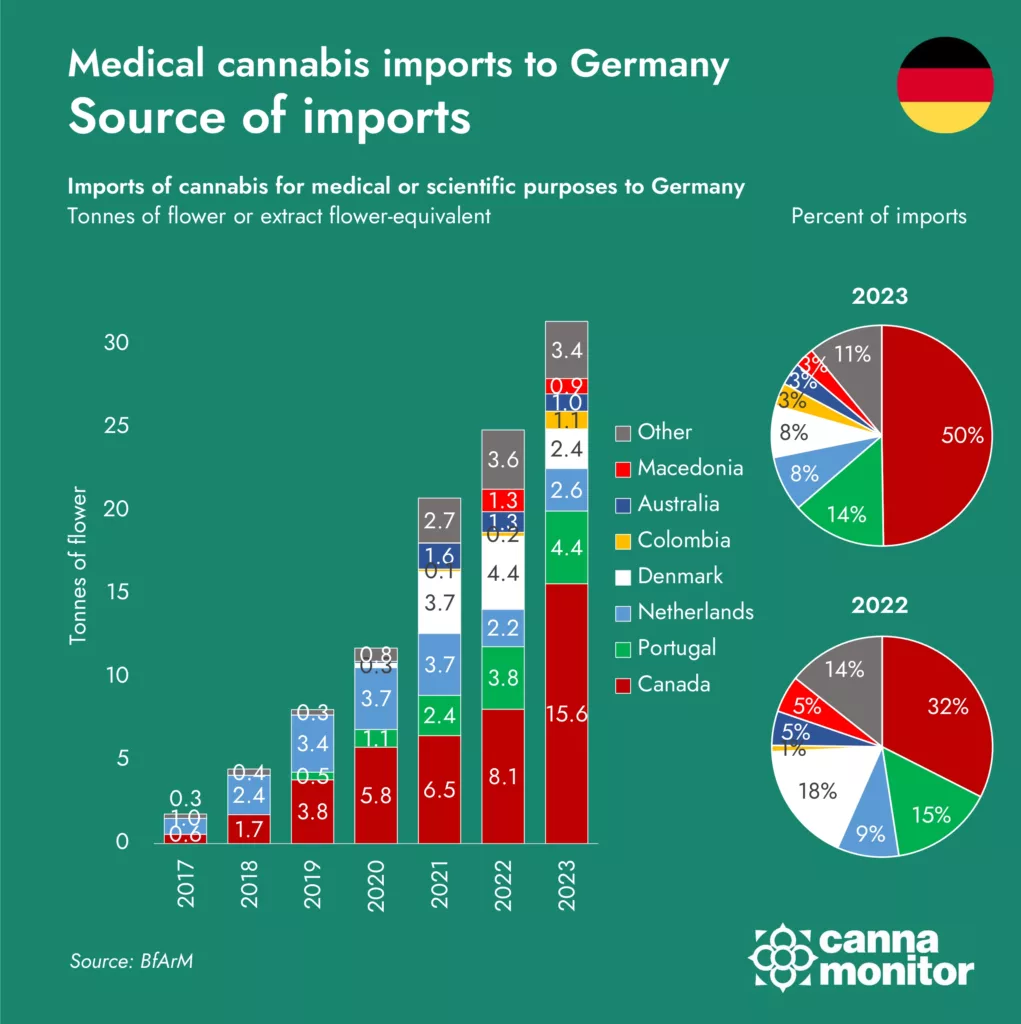

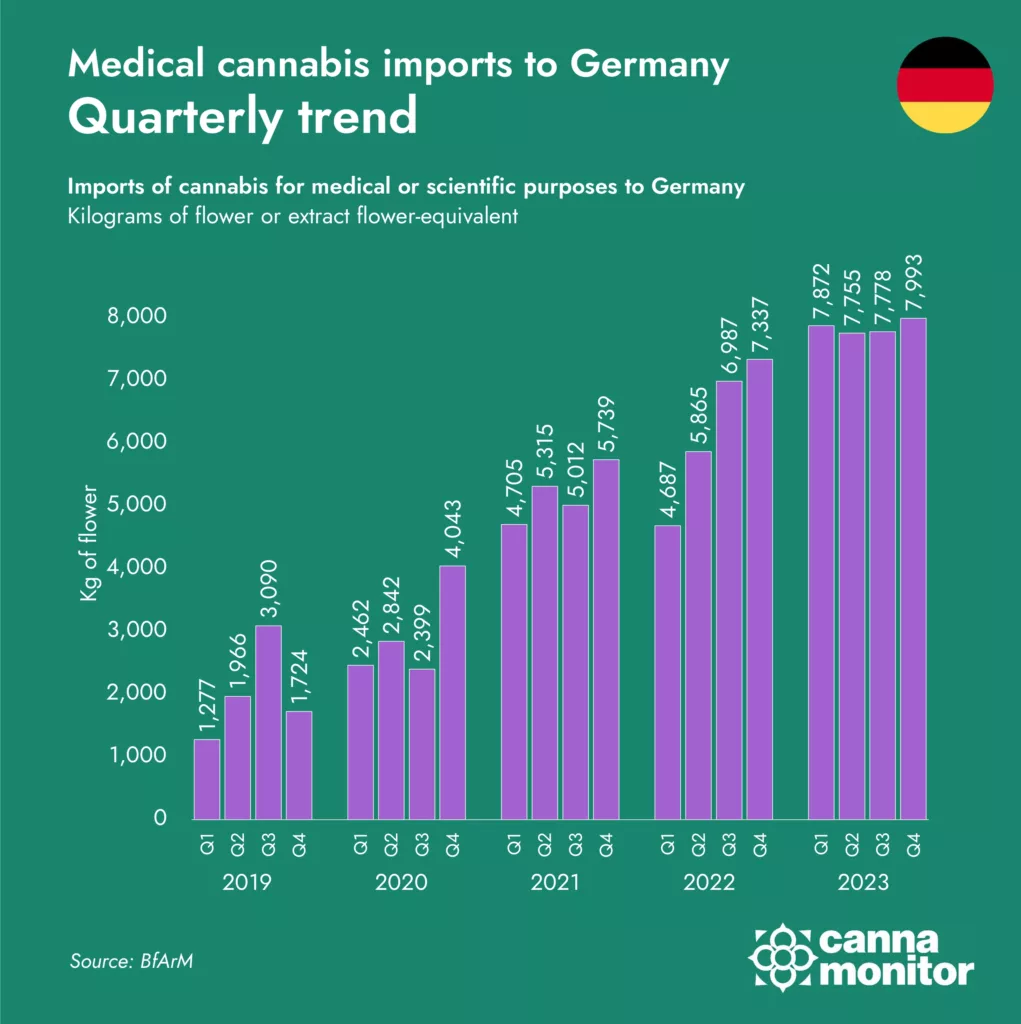

In 2023, Germany’s cannabis importation surpassed the 30-tonne mark, indicating a significant 26% year-on-year growth. This surge in imports coincides with imminent regulatory amendments set to redefine the legal landscape surrounding cannabis within the country. Notably, while import rates remained relatively stable, hovering around 8 tonnes per quarter, the proportion of imported supply reaching German pharmacies for dispensation warrants careful consideration, standing at approximately 60%.

The uptick in cannabis importation reflects a growing demand for cannabis products within Germany and a proactive response to impending regulatory changes. As the country prepares for limited adult-use legalization, stakeholders across the cannabis industry are positioning themselves strategically to capitalise on emerging opportunities.

Annual trend of cannabis imports to Germany

Countries exporting to the German medical market

Canada emerges as the dominant supplier, capturing an increasingly significant share of Germany’s cannabis imports, representing half of all imported products. Thanks to being one of the first countries to legalise cannabis at the federal level, Canada has emerged as the top global supplier of medical cannabis, achievin high levels of quality and consistency at an early stage, making it a preferred source for many countries seeking to establish or expand their cannabis markets.

Portugal and the Netherlands maintain prominent positions as well, leveraging their established infrastructure and regulatory frameworks to supply cannabis products to the German market. Portugal, in particular, has emerged as the top producing country in Europe capitalising on its favourable climate and progressive approach to cannabis regulation, with a clear licensing system and institutional support.

Despite losing ground in the last quarters due to the exit of Aurora from cultivating in the Nordic country, Denmark remains one of the top suppliers to the German market.

Furthermore, the entry of Colombian produce into the German market signals a diversification of supply sources, indicative of a broader global engagement within the cannabis trade. Colombia’s rich history of cannabis cultivation and its growing reputation for high-quality cannabis products position it as an attractive option for countries seeking to diversify their supply chains.

Use of medical cannabis for PTSD in Israel, UK, Australia and Germany

Main cannabis exporting countries to Germany

German market operators get ready for legalisation

The impending regulatory changes, including the anticipated delisting of cannabis as a narcotic and the facilitation of personal cultivation and consumption, hold profound implications for the future of cannabis within Germany. While medical sales are poised to benefit from a more conducive regulatory environment, the emergence of non-profit cannabis clubs and the persistence of the grey market present formidable challenges and opportunities.

The legalisation of adult-use cannabis in Germany has the potential to reshape the country’s cannabis industry and unlock new avenues for growth and innovation. However, the success of legalisation will depend on policymakers’ ability to strike a balance between promoting public health and safety and fostering a competitive and equitable cannabis market.

A nuanced understanding of the evolving regulatory framework and its interplay with market dynamics is essential for stakeholders navigating Germany’s burgeoning cannabis industry. As evidenced by the flurry of supply deals inked during the initial quarter of 2024, the cannabis market in Germany exhibits a high degree of dynamism, characterised by strategic alliances and evolving consumer preferences.

The forecasted market dynamics suggest that the demand for cannabis products in Germany will continue to grow, driven by both medical and adult-use markets. This presents significant opportunities for domestic and international cannabis companies to expand their presence in one of Europe’s largest and most affluent markets.

Quarterly trend of cannabis exports to Germany

The medical market might surge thanks to adult legalisation

In conclusion, Germany’s cannabis import trends offer a compelling glimpse into the evolving landscape of cannabis regulation and commerce within the European Union’s largest economy. As the country navigates the path towards legalisation, stakeholders must remain vigilant, leveraging insights gleaned from import data and regulatory developments to inform strategic decision-making and capitalise on emerging opportunities.

For further analysis and strategic insights into international cannabis markets, we invite you to engage with us and explore tailored solutions to address your specific business needs.

With a wealth of data and strategic foresight, navigating Germany’s cannabis market becomes an opportunity to seize rather than a challenge to overcome. Stay ahead of the curve with our comprehensive analysis and strategic guidance tailored to your business objectives. Contact us today to unlock the full potential of Germany’s evolving cannabis landscape.