Germany has rapidly become the world’s leading medical cannabis market since legalisation in April 2024. Imports more than doubled from 32.5 tonnes in 2023 to 71.6 tonnes in 2024. The second quarter of 2025 alone saw imports of 43 tonnes, with over 132 tonnes imported in the last 4 quarters. Current projections suggest Germany could surpass imports of 160 tonnes this year, with a potential to exceed 200 tonnes in coming years despite the risk of a clampdown by the new government. However, as Germany surges ahead, emerging cracks in Portugal’s supply chain raise questions about resilient growth and whether the established Canada-Portugal-Germany triangle can withstand the pressure.

Table of Contents

The Global Import Leader: Germany's Rise From 2 to Over 160 Tonnes

Germany’s medical cannabis market was relatively underdeveloped by the time it established a medical cannabis market by 2017, with fewer than 2 tonnes imported. By 2019, imports had quadrupled to just over 8 tonnes, and by 2021 volumes had reached more than 20 tonnes.

Despite an initial reliance on the Netherlands, the supply of medical cannabis to Germany was quickly dominated by Canadian producers and by a small number of European nations like Portugal and Denmark.

The market’s true acceleration began after the transformative expansion following the enactment of the CanG in April 2024, that established Germany as the clear centre of gravity in the global cannabis economy: upwards of 72 tonnes were imported by 2024, and in 2025 it is expected that over 160 tonnes will be imported by the European cannabis powerhouse.

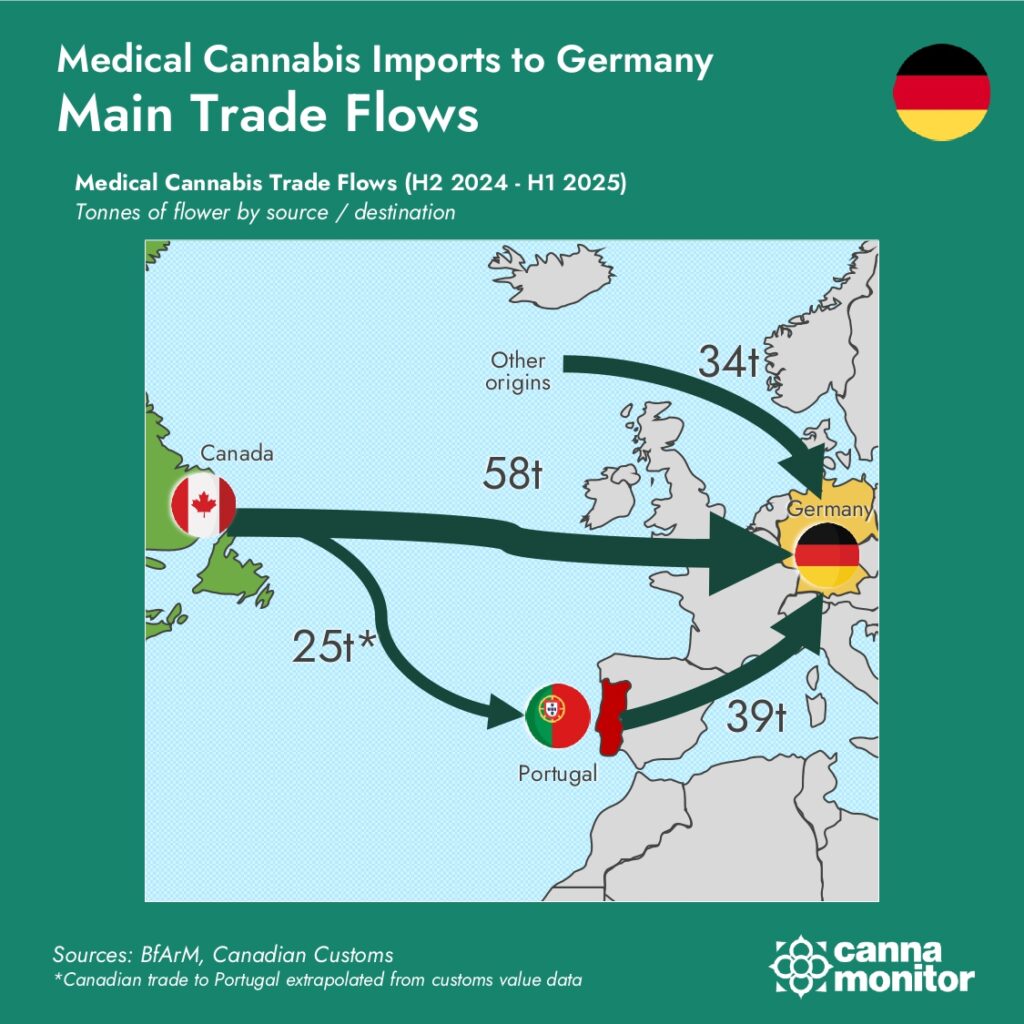

In the year leading up to Q2 2025 Canada remained the single largest source country for medical cannabis imports, with 58 tonnes of direct exports between the second half of 2024 and the first half of 2025. Portugal accounted for 39 tonnes in the same period, serving both as a direct supplier and as a crucial processing hub for flower grown in Canada and other global geographies.

Canadian Customs data suggest that at least 25 tonnes of Canadian product entered Germany through Portuguese facilities in the last twelve months. Its figures report $250 million worth of products were shipped to Portugal in the period, making it the third-largest destination of Canadian exports after Germany and Australia. Given that GACP flower destined for EU-GMP processing is typically priced lower than finished goods, recorded customs values may understate the true volume of throughput—potentially bringing Canada’s indirect imports via Portugal closer to 30–35 tonnes. This reflects increased through-put by key EU-GMP service providers such as Cannprisma, Blossom, Canapac, and MediCane.

Main trade flows of medical cannabis to Germany

Other origins of imports to Germany in H2 2024 and H1 2025 contributed a combined 34 tonnes, including Denmark, the Czech Republic, Australia, Spain, and several smaller suppliers. Some of these geographies ey remain secondary to the transatlantic axis.

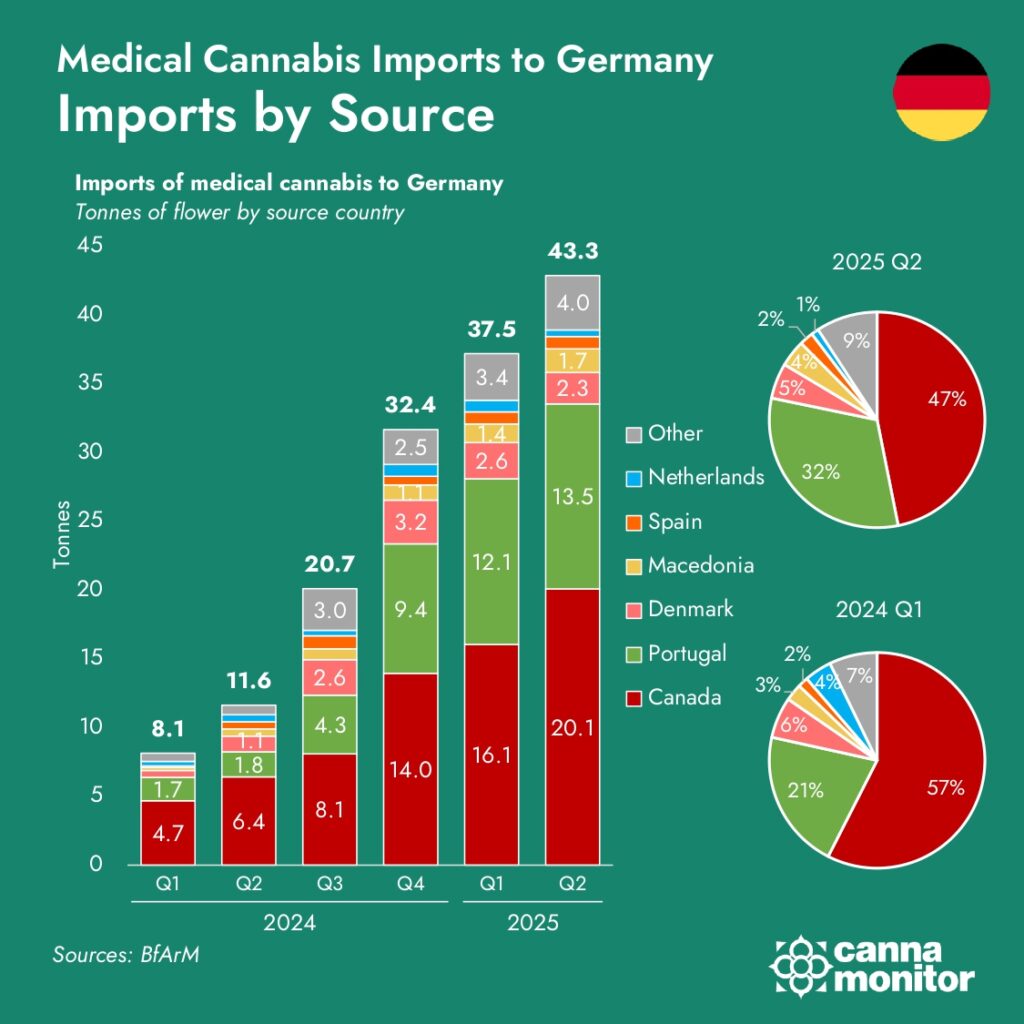

Between the first quarter of 2024 and the second quarter of 2025, Germany’s medical cannabis imports increased more than fivefold, rising from 8 to 43 tonnes each quarter. Canada maintained its position as the dominant supplier, expanding from 4.7 to 20 tonnes, while Portugal increased its share from 1.7 to 13.5 tonnes. Denmark contributed steadily with smaller volumes, and by mid-2025, new sources including Spain, the Netherlands, and other suppliers emerged, reflecting a diversifying supply base.

Market share shifted significantly between the first quarter of 2024 and the second quarter of 2025, with Canada declining from 58% to 47% of imports despite significant volume growth, Portugal rising from 21% to 32%, Denmark stabilising near 6%, as Spain, Netherlands, and others collectively grew to almost 15% by mid-2025.

This demonstrates a diversification of imports from over 15 global geographies, however, the origins of products reaching the market remains heavily concentrated. In the first half of 2025 alone, Germany imported over 80 tonnes of medical cannabis, nearly four times more than during the same period in 2024, with Canadian and Portuguese products representing almost 80%:

- Canada maintained its leadership through strategic evolution. After shipping over 30 tonnes in 2024, including a record 14 t in the fourth quarter, the surge accelerated in 2025 with 36 t delivered by mid-year. This includes 16 t in the first quarter and 20 t in the second quarter alone. Canadian firms increasingly bypass Portuguese processors to ship directly into Germany, supported by acquisitions that have established local distribution networks.

- Portugal delivered about 17 tonnes in 2024, including 9.4 t in the fourth quarter, amid tighter regulatory oversight that created delays and uncertainty. Despite these challenges, Portugal maintained its strong position in 2025, supplying 25.5 t in the first half (with 12 t in the first quarter and 13.4 t in the second quarter), demonstrating resilience as both a direct supplier and a processing hub.

Imports to Germany by Source Country

- Denmark exported over 7 tonnes in 2024, recovering after a difficult 2023, with a notable rebound of 3.1 t in the fourth quarter alone. In 2025, the country continued rebuilding capacity, exporting 2.6 t in the first quarter but dropping slightly to 2.2 t in the second quarter. Producers such as Schroll Medical and Little Green Pharma make Denmark a strategically important European supplier.

- North Macedonia supplied over 2.6 tonnes in 2024, including 1.1 t in the fourth quarter. In 2025, volumes appear stable, with 1.4 t in the first quarter rising to 1.7 t in the second quarter. The country remains primarily a low-cost cultivation hub, though EU-GMP alignment remains a challenge for wider adoption.

- Spain shipped just over 2 tonnes in 2024, including 0.9 t in the third quarter and 0.6 t in the fourth quarter, with exports growing steadily in 2025. The country supplied 0.8 t in the first quarter and 0.9 t in the second quarter, reflecting consistent growth. Companies such as Linneo Health and Medalchemy (Curaleaf) position Spain in the top 5 suppliers to Germany.

- The Netherlands maintained its consistent but limited contribution of around 2 tonnes in 2024 (peaking at 0.8 t in the fourth quarter), a figure broadly sustained into 2025 with 0.9 t in the first quarter and 0.5 t in the second quarter.

- Australia delivered over 1 tonne in 2024, including 0.6 t in the fourth quarter. This focus has continued in 2025, with 0.8 t in the first quarter and 0.6 t in the second quarter, positioning Australia more on product quality than on volume.

- The Czech Republic was the most notable new entrant in 2024, exporting 1.0 t during the year, with the highest quarter being 0.5 t in the third quarter. In 2025, however, no recorded exports were reported in the first or second quarters, though its geographic proximity to Germany and scaling EU-GMP industry still give it a strong competitive position for future expansion.

For several emerging suppliers outside Europe, notably Uruguay, South Africa, and Colombia, direct shipments to Germany have largely disappeared in 2025. Instead, their products increasingly reach the German market indirectly, routed through EU-GMP certified intermediaries. Against this backdrop, their role remains more symbolic than material, reflecting both regulatory hurdles and the gradual integration of Latin American and African producers into European supply chains.

- Uruguay crossed the 1 tonne threshold in 2024, exporting 1.1 t in the third quarter and 0.6 t in the fourth quarter. In 2025, its role has diminished, with 0.1 t in the first quarter and no reported exports in the second quarter.

- South Africa contributed just over 1 tonne in 2024, with its largest quarter being 0.6 t in the fourth quarter. In 2025, no shipments were recorded in either the first or second quarters, reflecting a modest and inconsistent presence as exporters work to strengthen compliance.

- Colombia has played only a minor role in Germany’s medical cannabis imports but has maintained a steady presence. After exporting 0.05 t in the first quarter of 2024, shipments rose to 0.2 t in the second quarter, before stabilising at 0.2 t in the third quarter and 0.2 t in the fourth quarter. In 2025, volumes remained modest, with 0.35 t in the first quarter and a further decline to 0.2 t in the second quarter.

The data shows that while supply diversification is well underway, the transatlantic axis still anchors the market. Canada has surged ahead in volume, Portugal has maintained its position despite regulatory headwinds, and Denmark is rebuilding as a steady European base. Meanwhile, new entrants like the Czech Republic and growing EU producers such as Spain are gradually reshaping the supply map, adding resilience to this rapidly expanding market.

Shifting Supply Dynamics: The New Rules of Cannabis Competition

Since the February 2025 elections brought a CDU-SPD coalition to power, Germany’s medical cannabis market has operated under a growing cloud of regulatory uncertainty. Federal Health Minister Nina Warken (CDU) has led an aggressive campaign to reform the Medical Cannabis Act (MedCanG), proposing restrictions that would significantly reshape how patients access cannabis. Her proposals include a mail-order ban, mandatory in-person consultations, and elevated penalties for non-compliant prescriptions—measures explicitly targeting the booming telemedicine sector that has underpinned much of the industry’s recent growth. Legal pressure has mounted accordingly, with several court rulings—most notably from Munich’s Regional Court—declaring some telemedical prescribing models unlawful.

Yet this tightening regulatory landscape has not stopped the market’s expansion. Imports surged to over 43 tonnes in Q2 2025, and the country remains on track to exceed 160 tonnes this year. Patient numbers have soared from 250,000 in April 2024 to nearly 900,000 by May 2025, with projections reaching as high as 1.7 million by 2026. Behind the scenes, Canada has begun bypassing Portuguese EU-GMP facilities to ship directly to German distributors, while local companies—like Berlin-based Remexian—have scaled aggressively, launching dozens of SKUs and building monthly distribution volumes above two tonnes. The resulting supply chain adaptation has reinforced the market’s resilience, even as Lisbon’s processors face tighter oversight and port delays disrupt throughput.

Political resistance is mounting. The SPD has categorically rejected the CDU’s draft legislation, warning that it risks undermining patient access in underserved regions and pushing hundreds of thousands back to the black market. As SPD lawmaker Carmen Wegge put it: “We will not support the draft law in its current version under any circumstances.” A recent survey of 9,583 German medical cannabis patients showed that over 90% fear being cut off from legal channels, and more than half would return to illicit sourcing if telemedicine is curtailed. Meanwhile, the industry is pushing back through petitions and lobbying, with Grünhorn targeting 50,000 signatures and BvCW estimating that 50 providers could be affected. High Tide’s acquisition of Remexian illustrates how regulatory volatility is already reshaping deal flow, with discounted assets creating windows for strategic expansion.

Nonetheless, product innovation and market segmentation continue at pace. German firms are launching medical cannabis creams, live rosin extracts, handheld inhalers, and oral formulations, while major distributors like Cantourage posted record revenues of €27.9M in Q2 2025. Meanwhile, nearly 300 Cannabis Social Clubs have been approved since April 2024, despite bureaucratic barriers and inconsistencies in local implementation.

Looking ahead, the CDU-led government faces both institutional and political limits. With only 328 of 630 seats in parliament and the SPD firmly opposed, drastic CanG rollbacks appear politically unfeasible. Economic incentives also play a moderating role: the legal market already serves an estimated 13% of cannabis users and generates substantial tax revenue, reducing appetite for retrenchment. The ongoing CanG evaluation—with reports due in October 2025 and final conclusions expected by April 2028—also serves as a procedural brake on immediate action, extending the horizon for any meaningful legislative shift.

Germany’s medical cannabis sector stands at a pivotal inflection point. While tightening access and compliance are reshaping the playing field, the market’s structural drivers—demand growth, supply chain innovation, and product diversification—remain intact. As a result, the country’s cannabis evolution will likely proceed not through abrupt reversals but through contested, negotiated adaptation—anchored by patient need, political checks, and the commercial logic of a maturing ecosystem too large and complex to unwind.

Policy Battles, Soaring Demand: the German Market Keeps Growing

Germany has established itself as the driving force of the global medical cannabis industry. With record-breaking imports, a rapidly expanding patient population nearing one million, and growing direct links to international suppliers, it now stands as the undisputed centre of global supply chains. While early market cycles were defined by oversupply, commoditisation, and price compression, what we see today is the emergence of a more complex ecosystem shaped by segmentation, volatility, and strategic repositioning.

Three structural forces now reshape cannabis pricing across international markets. First, boom-bust investment cycles continue to destabilise capacity, driving intermittent supply shocks. Second, innovation in genetics and product formulation is fragmenting the flower category and expanding the value chain beyond raw biomass. And third, brand differentiation and delivery format diversity — from live rosin and oral sprays to creams and vaporisers — are enabling margin expansion even under competitive pricing pressure.

Canada, which saw wholesale prices collapse between 2020 and 2022, is now recovering as quality flower supply tightens and consumer preferences consolidate around premium brands. Israel, once flooded with cheap imports, now sees some cultivars retailing at over USD 14 per gram. Australia maintains a strong premium SKU segment despite growing budget lines. In each case, product quality and strategic focus have proven more defensible than low-cost volume playbooks.

Germany remains earlier in this cycle but is rapidly catching up. The rise of budget brands has accelerated since 2023, but portfolio segmentation is now evident across most distributors, with SKUs targeting both cost-conscious and high-need medical users. Price variation across product types, cannabinoid profiles, and form factors signals a departure from purely commodity-like behaviour.

Within this strategic context, the Remexian–High Tide acquisition exemplifies the interplay between consolidation, pricing dynamics, and supply chain realignment. Remexian, once a minor distributor, expanded aggressively in 2024 by scaling its SKU count to over 200, leveraging low-cost Portuguese flower, and capturing significant share in the budget segment — reportedly around 15% of the market and 2.5 tonnes per month in sales. Its pricing strategy succeeded where others failed: not only defending volume, but growing average selling prices quarter-over-quarter despite downward pressure on the category.

This model depended heavily on streamlined supply from Portuguese GMP producers such as Agrivabe. But recent investigations into producers like CANNPRISMA and Herdade das Barrocas — and logistical delays in Portuguese ports — have disrupted what was once a hyper-efficient export platform. Simultaneously, legal complaints filed by Vayamed GmbH, alleging cultivar mislabelling and lack of transparency around irradiation, triggered distribution boycotts from players like Cansativa. Though High Tide defends the deal, the situation exposes the compliance fragility of fast-scaling models in a pharmaceutical-grade environment.

Meanwhile, Canadian producers — previously reliant on Portugal as an EU-GMP conversion hub — are now bypassing Iberian bottlenecks, exporting directly into Germany through local partners. This not only cuts lead times and regulatory risk, but also repositions Canada as a premium origin, not merely a bulk supply surplus.

Other European hubs are also entering the fray. Spain, Czechia, and Denmark are expanding production footprints, offering alternatives to the congested Portugal–Germany corridor. Distributors are rethinking sourcing strategies to balance compliance, cost, and continuity.

Germany’s market is no longer just growing — it is stratifying. Companies are moving beyond volume strategies toward brand-building, innovation, and channel-specific differentiation. This trend is reinforced by political tensions, including proposed restrictions on mail-order and telemedicine. Yet with strong structural demand and growing tax revenues, a full rollback remains unlikely.

In this context, the Remexian–High Tide deal is more than a market entry — it is a case study in the risks and rewards of fast-scale expansion in a politically sensitive, compliance-heavy market. The outcome may well shape how the next wave of capital is deployed across Europe.

Germany’s cannabis ecosystem is no longer just expanding — it is evolving into a mature, globally integrated market. The transatlantic triangle of Canada, Portugal, and Germany remains central, but its internal balance is shifting. As Germany consolidates its role as the gravitational centre of global medical cannabis, its policy decisions and sourcing architecture will shape the next generation of international supply chains.