The CBD market in France is at a pivotal juncture. Recent political developments have cast uncertainty over cannabis reform, yet the country’s high consumer demand for CBD suggests a bright future for the industry.

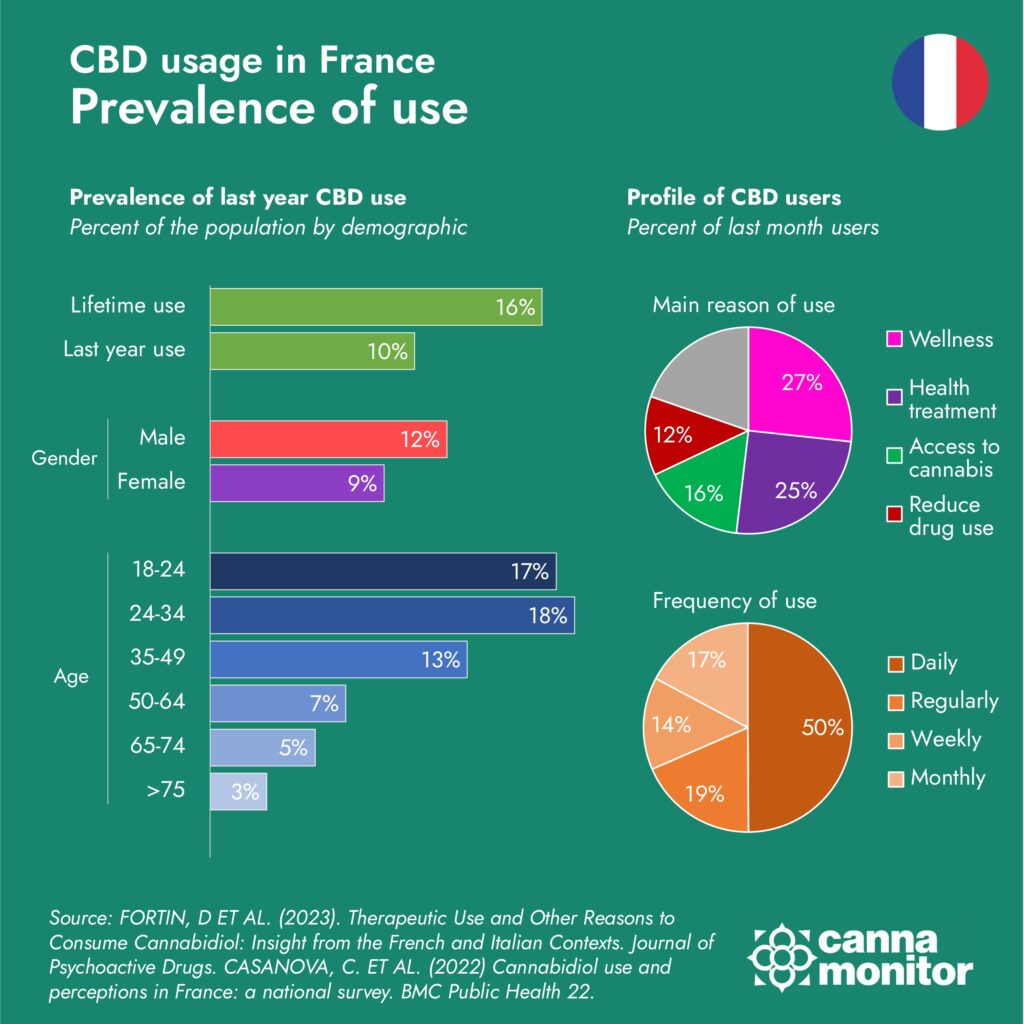

France has emerged as the largest CBD market in Europe, with over 10% of adults and up to 18% of young adults using CBD in 2022.

This blog post delves into the past, present, and future of the CBD market in France, drawing insights from Cannamonitor’s data and exploring opportunities for growth and innovation.

Table of Contents

France’s journey with CBD has been marked by legal and cultural challenges. The country has held one of the most stringent approaches to cannabis-derived products in Europe.

However, a combination of rising public interest in wellness products and growing evidence of CBD’s therapeutic benefits led to a gradual adoption of these products, starting by the online channel and then also through specialised shops and mainstream retail, such as tobacco and convenience stores.

By the early 2020s, CBD was becoming more widely available, though the market remained under strict surveillance to ensure compliance with low THC levels. Two landmark policy decisions significantly altered the legal landscape for CBD products:

- The 2020 Kanavape sentence by the Court of Justice of the EU recognised that the French company could import vapes from the Czech Republic, given that CBD is not a controlled substance subject to restrictions according to international law: member states of the EU cannot limit freedom of trade with CBD products legally produced elsewhere in the single market.

- In 2022, the State Council overruled an attempt by the government to decree a total ban on CBD flower sales, noting that they are ‘devoid of narcotic properties’ and therefore could be lawfully marketed in France.

Today, France is a leading market for CBD in Europe. The data from 2022 shows that CBD use is prevalent among adults, with a significant 10% of the population using it primarily for health and wellness purposes. This is reflective of a broader European trend where CBD is increasingly seen as a part of a healthy lifestyle rather than merely a medicinal product.

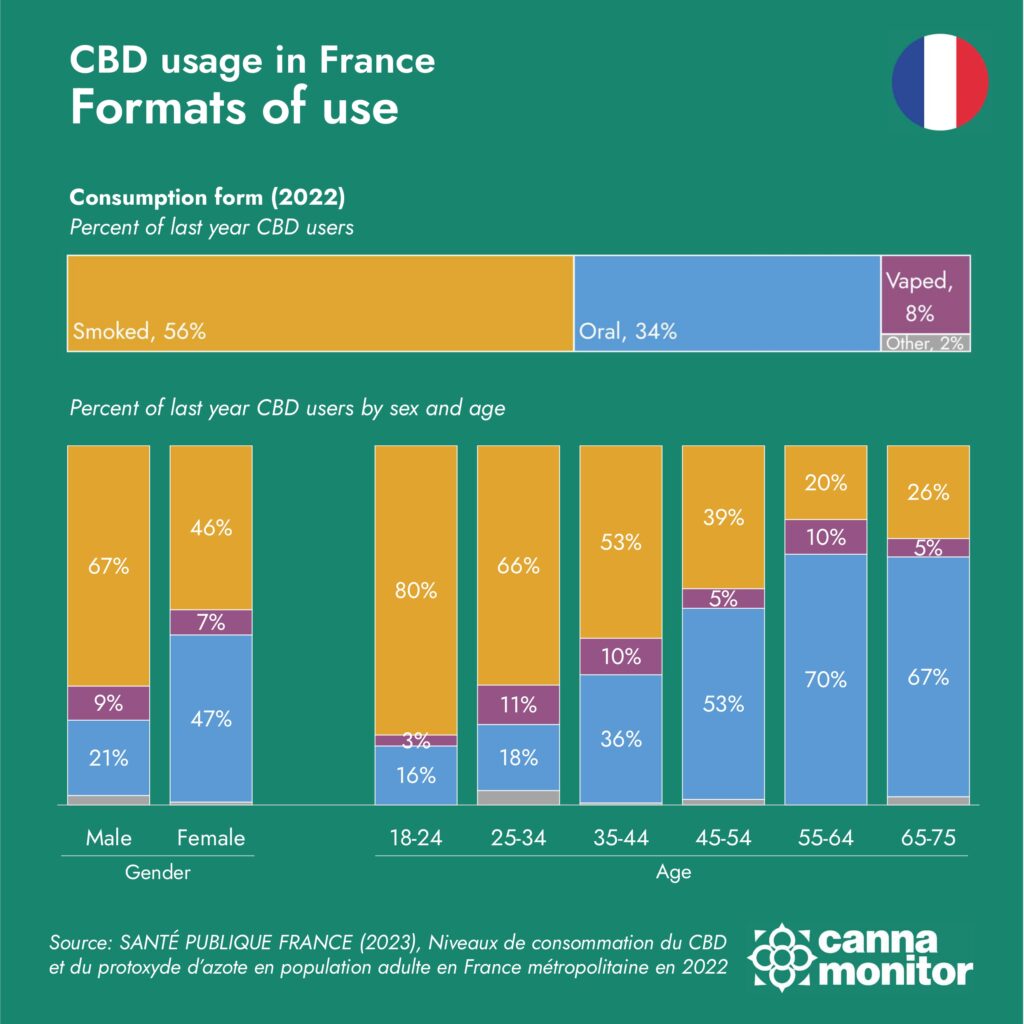

The data shows that a significant number of users consume CBD daily or regularly, which indicates strong user retention and potential for high customer lifetime value. Flower, oils, tinctures, edibles, and topicals are the most popular formats, reflecting a demand for versatile and easy-to-use products and a highly segmented market with a lot of opportunities for differentiation.

Prevalence of CBD use in France

Limited Access to Cannabis Drives Market Growth

It is not surprising that CBD has garnered so much attention in the Republic, given that France maintains a very restrictive approach to other products derived from cannabis sativa. Indeed, 1/4 of monthly CBD consumers claim to be using it to treat chronic health conditions or their symptoms, while another 1/4 say that their main reason to use it is improving their general wellbeing.

The French medical cannabis scheme is currently undergoing a 1 year extension of the previous experimental model, with only around 2,000 patients receiving treatment, primarily for neuropathic pain, but also for spasticity in multiple sclerosis, palliative care or symptoms associated with cancer treatment.

Efforts to include a revamped medical cannabis scheme in the 2024 social security budget have been stopped short due to President’s Macron call for snap legislative elections, in a context of great polarisation in the French political landscape, which is to have uncertain effects on cannabis policy.

The main political coalitions have excluded the future of the medical scheme -or cannabis reform more broadly- from their political platforms, leading to concerns over the future of medical cannabis legalisation which has been pushed out of the mainstream agenda.

Moreover, in recent months the supply of flower to patients has been stopped, with insiders claiming interference from the Interior ministry, which fears that generalised supply to medical, high-THC flower could undermine its illicit market curtailing efforts..

The medicinal regulator of the country, ANSM, has until the end of 2024 to approve the first extract-based products that will be available under a temporary marketing authorisation of 5 years. However, important aspects such as the financing, price and definitive list of indications are still in the open.

Despite some municipalities of the country exploring the possibility to enact Swiss-style experimental recreational supply chains to test the impacts of adult-use legalisation, the political mainstream remains opposed to reversing the failed prohibitionist policies of the country by legalising cannabis.

Only CBD sales, as well as the cultivation of hemp mostly for fiber (France has been a global leader in hemp production for decades), are therefore currently allowed in the European country with more cannabis consumers. This muddy situation is not likely to resolve in the short or mid-term.

Methods of consumption of CBD in France

Flower, Smokables Dominate French CBD Market

Survey data highlights that younger adults, which are the bulk of the consuming demographic, have a strong preference for smoking as a consumption method, with over 2/3 of the youth choosing smoked flowers and pre-rolls as their preferred format to use CBD, particularly among males.

It is no wonder that most tobacco shops in the country have adopted CBD, given that over 20,000 ‘buralistes’ in the country possess a capillar distribution capable to reach all the corners of the territory.

In recent quarters, CBD concentrates and hash have been increasingly expanding their share of the market, given the fact that it is a smokable product format with a long tradition of use in the country, which has been supplied by illicit Moroccan hash for decades.

Against this trend, older generations as well as female consumers tend to show a preference for oral dosage forms in order to intake their CBD. Oils, capsules and edibles are the preferred options by this demographics. This has eased the entry of pharmacies in the CBD business as a health-minded commercial channel.

In recent quarters, edibles with CBD have been gaining ground in the market, despite the uncertainties caused by EU Novel Foods regulations. Both gummies and CBD drinks have been gaining ground in the country’s supermarkets and health stores, serving a distinct consumer demographic that seeks more novel and advanced forms to consume CBD, as opposed to smoking CBD joints.

Vapes and topicals are other product formats that have captured part of the demand by catering to subsets of consumers in their own specialised supply chains, through thousands of e-cigarrete and cosmetic stores in the country being prime retail outlets for the distribution of CBD-infused items.

Trends suggests a strong resonance with alternative medicine and wellness products among younger populations. Marketing efforts, therefore, need to be tailored to appeal to this group through digital channels and social media platforms. The primary driver for CBD use in France is wellness. Consumers are incorporating CBD into their daily routines for its perceived benefits in stress relief, sleep improvement, and overall well-being. This positions CBD as a lifestyle product, opening up opportunities for partnerships with fitness centers, spas, and wellness retreats among others as opportunities to expand distribution reach in the space.

Despite these general trends, survey data further breaks down consumer demographics of CBD in France into 4 consumer clusters with distinct user characteristics, providing valuable insights for targeted marketing and product development. Relevant segmentations of the CBD market include:

-

Habitat: impacting commercial channels available to different demographics.

-

Education and Income: affecting price-consciousness and purchase drivers.

-

Drug use: determining co-consumption trends and atittudes to different CBD formats.

-

Health Status: different reasons to use CBD depend on the existance of chronic health problems.

-

Alternative Medicine: Attitudes to conventional vs naturopathic medicine

By mapping French CBD users according to these variables, 4 consumer archetypes emerge:

-

Typically residing in rural areas, Female Boomer CBD users with limited education and money to spend, chronic health problems, and an ambivalent attitude towards alternative healthcare.

-

Living in suburban areas, the typical middle-age male consumer smokes tobacco and drinks alcohol above the average, suffers from chronic health conditions and does not trust alternative medicine.

-

Middle-aged Female users, however, have higher educational levels and disposable incomes, do not generally suffer from health problems and tend to trust alternative medicine methods.

-

Young, urban male CBD users do usually smoke tobacco and cannabis in addition to the CBD. With high educational and income levels, they prefer alternative medicine over traditional healtcare.

Client personas of CBD users in France

Insights to Unlock the French CBD Market

Despite the regulatory challenges, the CBD market in France is poised for significant growth. The high prevalence of use among younger demographics, steady daily consumption rates, and the demand for a variety of product formats indicate a robust and diversified market with substantial potential for further expansion and brand differentiation.

The regulatory environment remains a key challenge, requiring companies to ensure compliance with legal requirements and maintain high product quality. Investing in rigorous quality control processes and transparent sourcing practices is essential to build consumer trust and loyalty. Companies should implement top-tier quality control processes and transparent sourcing practices to reassure consumers about the safety and efficacy of CBD products. Staying informed about legislative changes and engaging with legal experts and industry associations can help navigate this complex landscape.

Skepticism and lack of information are significant barriers to CBD adoption, particularly among older adults. To address these issues, companies should launch comprehensive educational campaigns that highlight the benefits and safety of CBD. Collaborating with healthcare professionals and obtaining endorsements from trusted figures can help dispel myths and build consumer confidence. Educational initiatives should focus on the benefits and safety of CBD, include personal testimonials and endorsements, and involve collaboration with healthcare professionals.

As competition increases, businesses must differentiate themselves through unique value propositions, innovative products, and exceptional customer service. Continuously expanding product lines to cater to evolving consumer preferences and exploring new formats like patches and beverages can help companies stay ahead of market trends and maintain a competitive edge.

Targeting younger demographics presents a clear growth opportunity. Companies should leverage digital marketing and social media influencers to reach younger consumers effectively. Additionally, addressing barriers among older demographics through targeted educational initiatives and endorsements can open new market segments. Tailoring marketing strategies to different demographic segments and consumption patterns is crucial for capturing a diverse consumer base.

In conclusion, the CBD market in France offers numerous opportunities for growth and innovation. By leveraging insights from Cannamonitor’s data, businesses can navigate the market effectively, tailoring their strategies to meet consumer needs and regulatory requirements. A focus on product quality, targeted marketing, and educational initiatives can unlock the full potential of the CBD market in France, driving future growth and establishing a strong foothold in the wellness industry.