In a remarkable display of agricultural and pharmaceutical innovation, New Zealand—a nation of just 5 million people—has transformed itself into a global pioneer of medicinal cannabis, achieving a staggering 14-fold increase in product demand since 2020 and demonstrating how a small nation can become a sophisticated player in a complex global industry. In the last year, medicinal cannabis sales have increased 2.5 times year-on-year, driven by a combination of shifting patient preferences, a flourishing domestic industry, and regulatory reforms that have cultivated a supportive environment.

In this article, we delve into the key elements shaping New Zealand’s medicinal cannabis landscape. We examine the surge in patient numbers, the evolving trends in product preferences, the country’s reliance on imports despite increasing domestic production capacity, emerging export opportunities, and the critical role of regulatory support in fostering growth. Together, these factors position New Zealand as a key player in a rapidly expanding industry, with significant potential for future growth and a model for other small nations navigating the complexities of medicinal cannabis.

Table of Contents

Rapid Expansion of Medicinal Cannabis Prescriptions

The medicinal cannabis market in New Zealand has traced a remarkable trajectory since the 2018 amendment to the Misuse of Drugs Act, which carefully carved a legal pathway for production, distribution, and prescription. Pivotal metrics reveal the dynamic pace of this expansion, fueled by escalating patient demand and an increasingly sophisticated regulatory infrastructure.

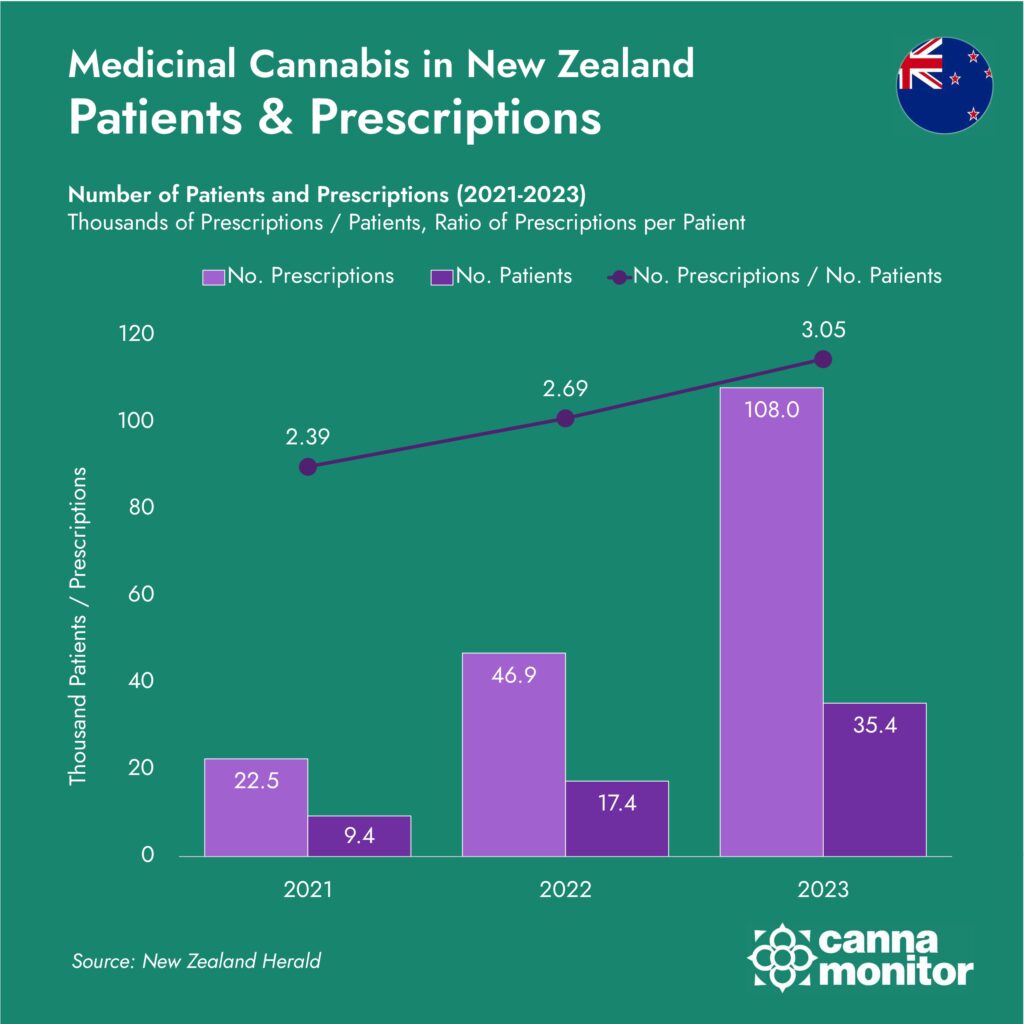

Patient numbers have surged, starting with 9,401 individuals prescribed medicinal cannabis in 2021, rising to 17,416 in 2022, and further accelerating to 35,359 by 2023. Prescription volumes reflect this rapid growth, climbing from 22,506 in 2021 to an extraordinary 108,000 in 2023—a 130% increase from the previous year. This upward momentum continued into 2024, witnessing a dramatic 14-fold increase in medicinal cannabis product demand under the Medicinal Cannabis Scheme since its 2020 inception.

Patients and Prescriptions in New Zealand

This growth fundamentally reflects a growing clinical recognition of cannabis-based treatments as credible interventions for managing conditions such as chronic pain disorders. Although New Zealand’s market remains compact relative to larger national ecosystems, its rapid development signals robust domestic potential and hints at substantial future expansion.

The emergence of private cannabis clinics has been a transformative force in this landscape. Operating nationwide through telehealth platforms, these clinics effectively circumvented traditional GP referral processes. By addressing the hesitancy of general practitioners in prescribing cannabis, they expanded patient access, with consultations ranging from NZ$50–150. However, this “privatised” model simultaneously triggered critical discussions about potential profit-driven care, financial accessibility, and underlying ethical considerations.

Despite New Zealand’s modest population of just over five million, the market remains largely unexplored. Insights from Cannamonitor reveal that merely 10% of medicinal cannabis users currently access prescribed products, underlining significant latent growth opportunities as public awareness expands and access barriers dissolve.

Sally King, Executive Director of the New Zealand Medicinal Cannabis Council, maintains an optimistic perspective despite challenging macroeconomic conditions: “NZ is in the midst of a very serious economic downturn and these medicines are not funded so it would not be unreasonable to see some slow-down in the rate of growth, but I am expecting further growth in the NZ market.”

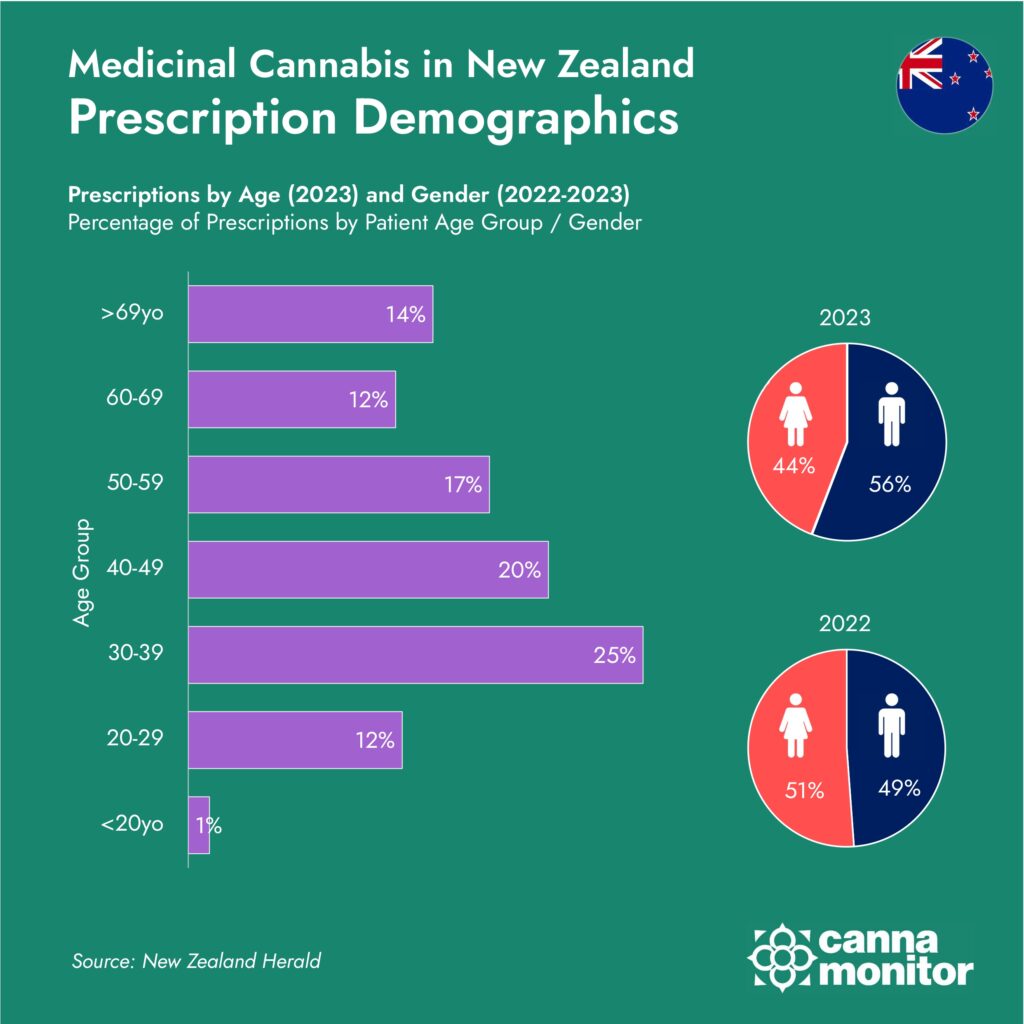

Younger, Male Patients Rise, But Barriers to Access Remain

Patient Demographics in New Zealand

As the market has grown, the composition of patients has shifted substantially. By 2023, younger men had become a predominant group, with prescriptions for men nearly tripling from 22,863 in 2022 to 60,232 in 2023, compared to a doubling for women from 23,952 to 47,633 during the same period. This shift is tied to rising demand for THC-dominant flower products, favoured for their fast-acting therapeutic effects and appeal among younger patients seeking relief from conditions such as chronic pain and anxiety.

According to a Massey University study led by Marta Rychert, ethnic disparities reveal persistent inequities in access. Māori patients accounted for only 12.9% of prescriptions in 2023, despite 17.4% of the population identifying as Māori and higher overall rates of medicinal cannabis use among this group. In comparison, Asian patients received 3,873 prescriptions, Pacific Peoples 1,716, and the majority category (including European and other origins) dominated with 87,576 prescriptions.

Geographic differences further illustrate uneven access. The Northern Region leads in prescription numbers, followed by Te Waipounamu (South Island), the Central Region, and Te Manawa Taki (Midland Region), which consistently lags behind. These regional disparities reflect variations in infrastructure, availability of clinics, and socioeconomic factors, all of which influence patient access.

Rychert, in its study on the implementation of the Medicinal Cannabis Scheme, identified three groups less likely to access prescription cannabis: low-income individuals, those who grow their own cannabis, and Māori patients.

The impressive growth in supply highlights the expanding accessibility of medicinal cannabis, yet significant barriers remain. Economic and logistical challenges disproportionately impact lower-income and rural populations. Addressing these issues could not only unlock further market growth but also help normalise cannabis-based treatments within the broader healthcare landscape.

Product Trends: Evolution from Oils to THC-Dominant Flowers

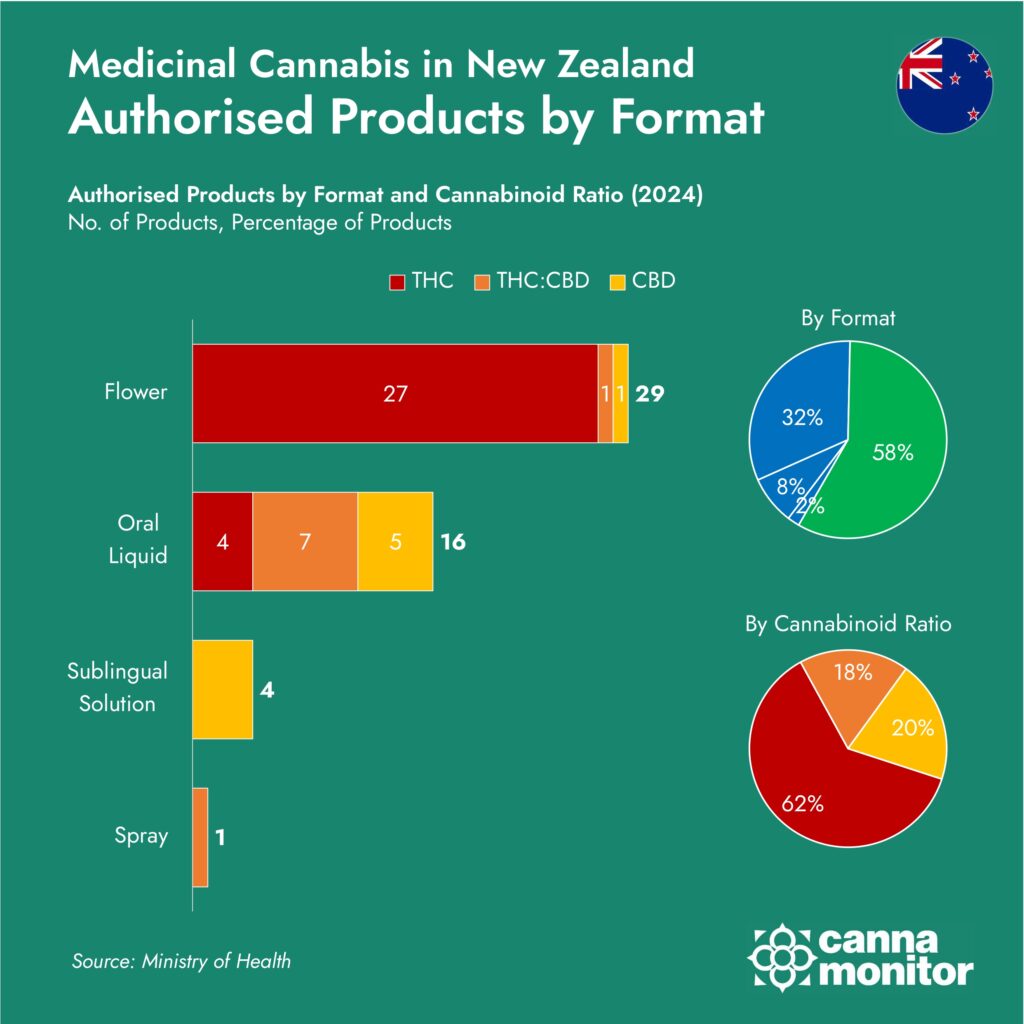

The evolution of product offerings in New Zealand’s medicinal cannabis market reflects a decisive shift towards dried cannabis flower products. Of the 50 products approved under the Medicinal Cannabis Scheme (MCS), 29 are dried cannabis flowers intended for vaporization or tea. This marks a departure from the early focus on oral liquid formulations, with flower products now accounting for 58% of approved products. While vaporisation is considered less harmful than smoking, this trend raises concerns about challenges in dosage standardisation.

High-potency dried flower products have become dominant in the market, with higher THC concentrations becoming available. By 2024, 62% of the approved products under the MCS are THC-dominant, including all but 2 of the 29 dried cannabis flower options, ranging from 14% THC to as high as 26% THC. This reflects patient demand for stronger formulations and aligns with the global trend toward high-THC cannabis for faster therapeutic effects. Cannabis cultivation specialist Josiah Spackman from Chill Division consultants observed: “It’s almost entirely going towards high-THC here… It’s what the value-chain requires at the moment.”

The competitive dynamics of the market, driven by both local and international competition, have significantly reduced product prices. Locally manufactured CBD oils are now available for as little as NZ$100–120 for a 30mL bottle in 2024, compared to NZ$150–350 for imported equivalents in 2019. Similarly, THC flower products are priced between NZ$11 and NZ$14 per gram, aligning closely with the illegal market average of NZ$12 per gram. However, despite these price reductions, affordability remains a challenge given the lack of public financing of treatment. Low-income groups continue to face barriers due to the additional costs of clinic consultations and prescriptions, limiting access to medicinal cannabis for some of the most vulnerable populations.

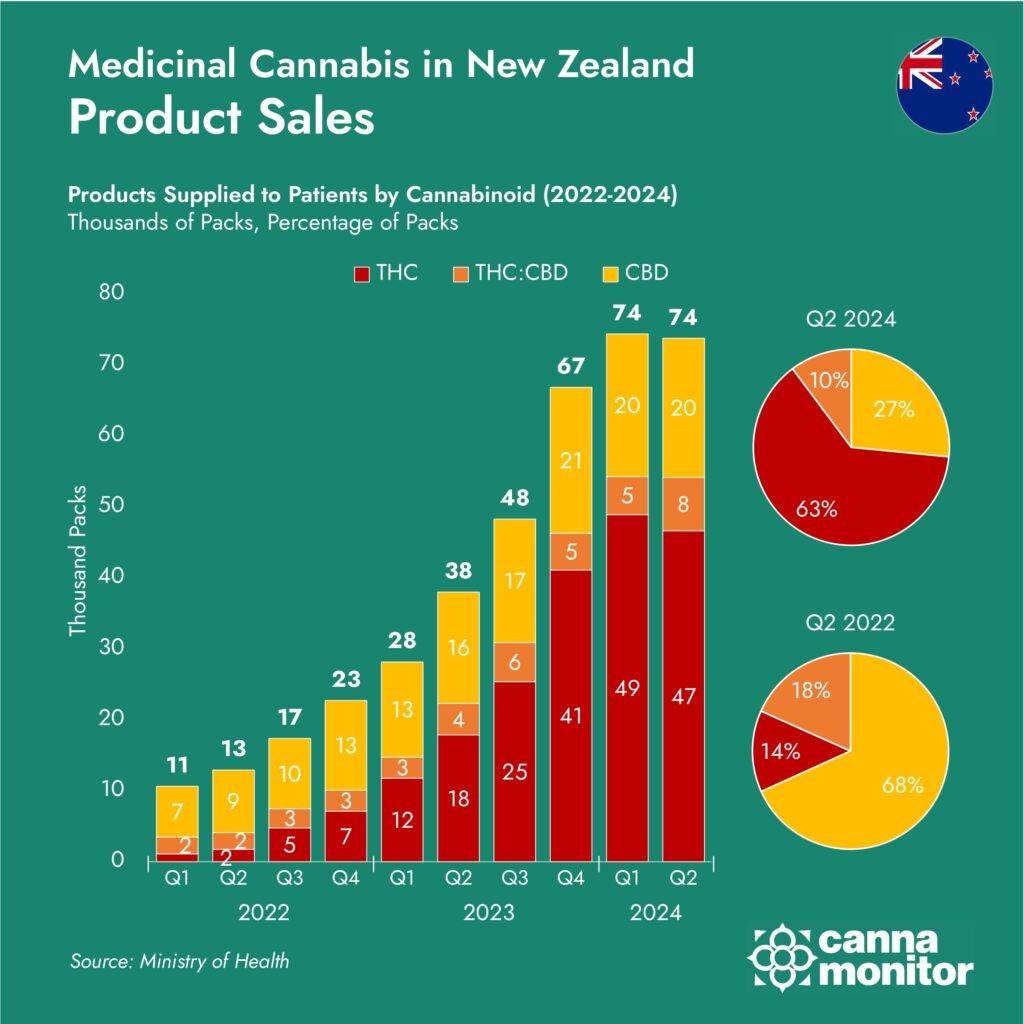

Shift to High-THC, Larger Volume Options Drive Market Growth

Product Sales by Cannabinoid Ratio

theThe supply of medicinal cannabis products under New Zealand’s Medicinal Cannabis Scheme has increased 14-fold since its inception in 2020, with quarterly product supply rising from 4,827 packs in Q2 2020 to 73,725 packs in Q2 2024. This remarkable growth underscores the expanding accessibility and evolving preferences within the market.

Initially, CBD-dominant products—mostly oils—dominated the market, representing approximately 68% of sales in Q2 2022. However, by 2023 THC-dominant flower products had become the dominant choice, accounting in Q2 2024 for 63% of pack unit sales, up sharply from just 14% in 2021, whereas more balanced products containing both THC and CBD have increased in absolute terms but lost share from 18% to 10% in the last 2 years.

However, according to the implementation analysis by SHORE & Whariki Research Centre of Massey University, most prescriptions are still for cannabis oils and liquid formulations, with just 40% of prescriptions in the 12 months leading to April 2024 being for flower products.

While the share of CBD and oil products has declined, the overall market volume has grown significantly. Importers have begun offering larger pack sizes, such as 30-gram options for flowers and 50ml flasks for oil, a notable shift from the 10-gram packs commonly prescribed until 2022, reflecting the need for more cost-effective options.

The preference for THC-heavy flowers is driven by patient demand for faster-acting therapies, particularly for managing chronic pain, anxiety, and sleep disorders. This shift mirrors global trends favouring high-THC formulations. In New Zealand, the rise in THC-dominant products has also been shaped by supply-side factors. Cultivators and manufacturers have prioritised flowers due to their faster production cycles compared to extract-based products, meeting both patient preferences and market efficiency demands.

Supply Chain is Dependent on Canadian and Australian Imports

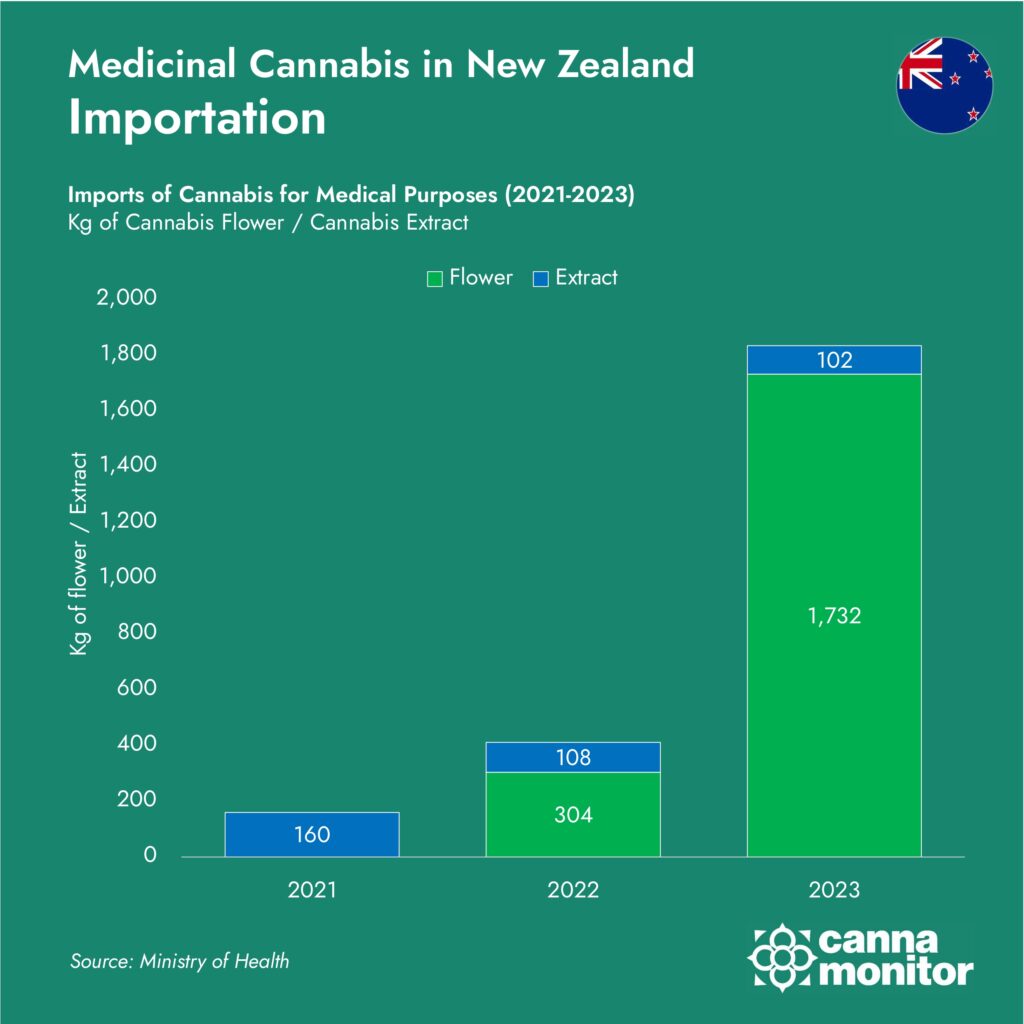

New Zealand’s medicinal cannabis market remains heavily dependent on imports, despite ongoing efforts to establish domestic production capacity. According to exclusive data supplied to Cannamonitor by the Ministry of Health, over 1,732 kilograms of medicinal cannabis were imported in 2023—a sharp rise from the 304 kilograms imported in 2022 and none in 2021. In contrast, extract imports have dwindled, dropping from 160 kilograms in 2021 to 108 kilograms in 2022, and further to 102 kilograms in 2023, reflecting a shifting preference towards flower products and the emergence of local extract supply.

Global producers in Canada, Australia, and Denmark dominate New Zealand’s medicinal cannabis supply chain. Data from the Australian Office of Drug Control (ODC) indicates that Australia accounted for approximately 33% of imports in 2023, supplying 587 kilograms. However, it remains unclear how much of this consists of Kiwi-grown flower processed abroad, as stringent quality standards, stability study requirements, and the absence of local irradiation facilities mean that much of New Zealand’s cannabis must be processed overseas. This has led to reimportation dynamics, where Aotearoa-grown cannabis is sent to Australia for processing before returning, adding supply chain complexity.

Sally King highlights the infrastructural gap: “Most flower is imported because NZ does not have irradiation facilities in NZ that can bring it to the very low microbial level required to vape by our medicinal cannabis scheme.” However, imported flower often meets less stringent ‘tea’ microbial standards, which do not need to comply with the high standards for inhalation mandated by the scheme.

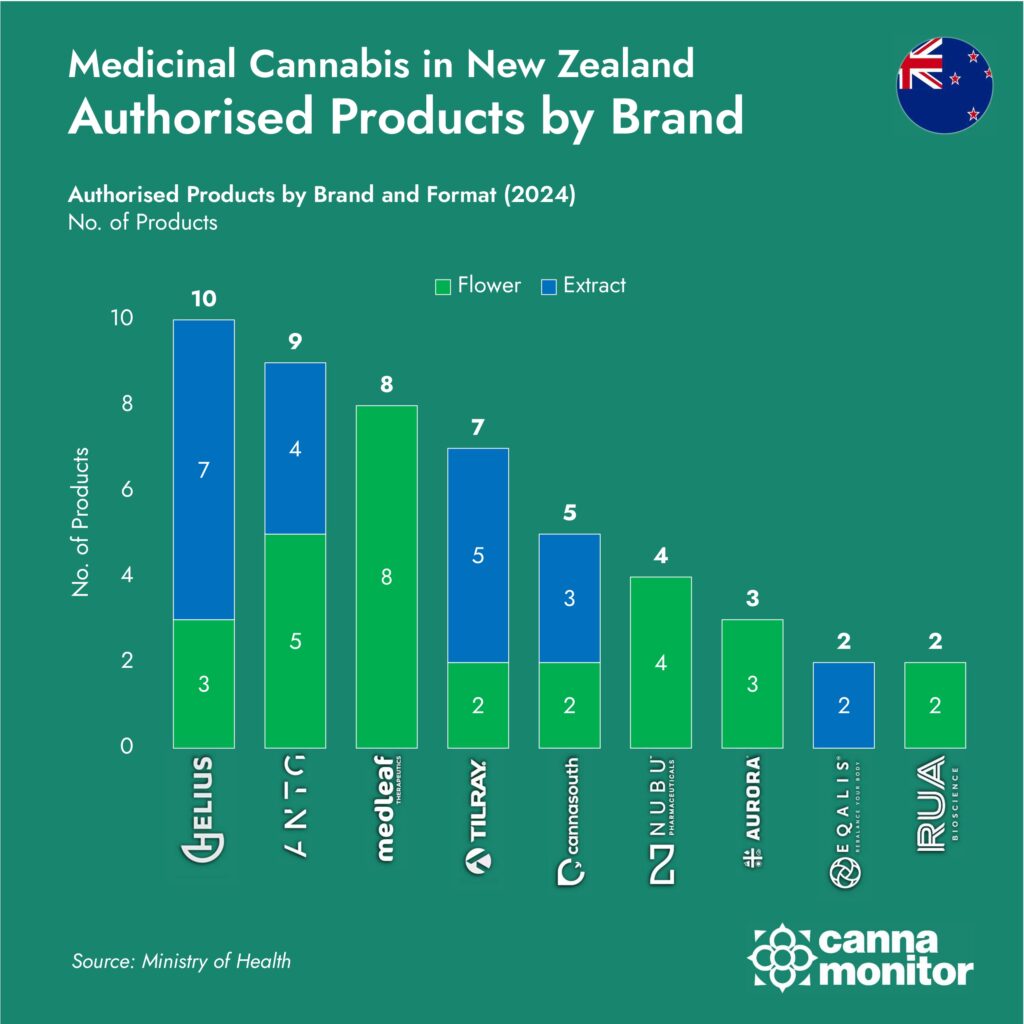

In the fiscal year ended in March 31, 2023 Canadian companies shipped 354kg of flower to New Zealand. International companies have been quick to capitalise on New Zealand’s reliance on imports. Tilray established operations in 2021, followed by ANTG in 2022, and Aurora in 2023. Other players, such as Curaleaf, are shipping product to B2B partners and prepare for market entry. According to Juan Martinez Pavón, head of Curaleaf’s international division, “New Zealand has specific monographs and requirements, such as allowing only a limited number of approved pesticides, but we already comply with these standards.”

Major importers dominate the supply chain, partnering with global producers to distribute products under both their own brands and those of the producers. For example, NUBU Pharmaceuticals distributes ANTG’s Australian brand and markets Victoria’s ECS Botanics flowers under its own Kikuya range. Additionally, the Auckland-based company also distributes 4 synthetic CBD oils under its Green Standard label, which fall under a different access scheme for unapproved medicines.

Similarly, Medleaf Therapeutics primarily sources popular Canadian cultivars from the likes of Northern Green, a Canadian indoor producer fully owned by Curaleaf.

Helius Therapeutics employs a mixed sourcing strategy: on the one hand, it is a vertically-integrated company, breeding, cultivating and extracting oils, sprays and products for inhalation in-house. On the other hand, it procures cannabis from third-parties both locally and internationally, including flower from Danish supplier Schroll Medical, which also supplies Rua Bioscience.

Imports have been crucial in meeting demand as New Zealand’s domestic production scales up. However, this reliance underscores the challenges of developing local infrastructure. Industry players remain hopeful that the regulatory reforms enacted in 2024 will reduce these barriers, paving the way for greater reliance on locally produced cannabis.

Reforms Boost Local Production, Expand Global Market Access

Since the legalisation of medicinal cannabis, New Zealand’s domestic production has expanded significantly. Licensed cultivation areas grew from 1.3 hectares in 2020 to 53 hectares by 2023, reflecting a substantial increase in capacity. The launch of New Zealand-grown products in 2022 marked a critical milestone for the industry, with ongoing product development leading to new extract and flower launches in 2023 and 2024. However, domestic producers face considerable challenges, including stringent quality standards, stability studies, and the absence of local irradiation facilities, which continue to favour international sourcing.

Despite these obstacles, exports are emerging as a promising growth area. In 2023, according to data releases of the importing countries, New Zealand exported 306 kilograms of cannabis to Australia, 101 kilograms to Germany, and smaller quantities to the UK. These exports signal the country’s potential to establish itself as a significant supplier of cannabis raw materials and processed goods to both the Asia-Pacific and European markets. Carmen Doran, CEO of Helius Therapeutics, manifested that “we’ve started exporting to Australia, Europe and South America, so more people know the Helius name around the world now”.

The 2024 medicinal cannabis export reform simplifies the export process, allowing products to meet only the importing country’s regulations rather than New Zealand’s standards. Licensing has been streamlined, cutting administrative costs, and the range of exportable products expanded to include cannabis-based ingredients, CBD products, and seeds. Additionally, testing and laboratory requirements have been reduced, lowering costs and easing regulatory hurdles, which should facilitate access to international markets. However, short-term reliance on imports is expected to persist.

Looking ahead, Josiah Spackman predicts: “I think 2024 will still see 90%+ imported flower into NZ. 2025 may be a bit of a change.”

A select group of domestic producers is driving the growth of local production. Puro, leveraging expertise in vine cultivation, operates both indoor and outdoor facilities for THC and CBD. It received a NZ$13 million public grant from the government’s Sustainable Food and Fibre Futures fund and recently secured a supply agreement with Heyday in Australia.

Helius Therapeutics continues to expand its range of flowers and extracts, from its own production as well as from local producers like Puro while maintaining its international agreements. In 2024, Helius announced its first export agreements, including partnerships with Danish distributor Balancial and Novachem in Australia, which also collaborates with Aether Pacific, operating as Medical Kiwi, which reached a second distribution agreement with Alliance Healthcare Australia.

Cannasouth, following its merger with Eqalis in June 2023, has launched local products and agreed to supply active pharmaceutical ingredients (API) to Novachem. Rua Bioscience, meanwhile, is commercialising Aotearoa genetics internationally, partnering with companies like Cannprisma in Portugal, and in August 2024, launched its first branded flower product in Australia.

Other producers focus heavily on export markets. Ora Pharm supplies cannabis to Canngea in Australia while offering its export platform to other New Zealand producers seeking access to international markets. Pure Isolation targets European markets like the UK, as co-founder Mike Breeze explains: “Having a presence in both NZ and the UK lets us take unique advantage of both emerging markets.”

Sally King emphasised the evolving role of local production: “NZ-grown options will continue to increase their volume, and over time I am expecting that prescribers and patients will appreciate the quality and specific formulations made available by our Kiwi cultivators and manufacturers.”

As the industry matures, there will likely be greater emphasis on export-focused strategies, particularly targeting high-growth markets such as Australia and Germany. Successfully balancing domestic and international demands will be crucial for both local and international players in shaping the future of New Zealand’s medicinal cannabis market.

A Diversified Market Well-Integrated in the Global Supply Chain

New Zealand’s medicinal cannabis market has evolved significantly since the legalisation of medicinal cannabis in 2018, transitioning from nascence to a dynamic, diversified industry. The country has demonstrated remarkable progress in patient adoption, product development, and export potential while grappling with unique challenges posed by its unique position in the supply chain and regulatory demands.

In the coming years, the Kiwi population accessing cannabinoid treatments may grow over 100,000 patients. While reliance of imported products is unlikely to stop growing in the mid term, domestic production is poised to represent a larger share of the market than it is now, and the availability of Aotearoa-grown products in international markets is likely to grow, fulfilling a potential in the hundreds of NZ$ annually.

New Zealand’s geographical isolation has not deterred its emergence as a key player in the global medicinal cannabis supply chain. Instead, it has become a strength, fostering two-way trade that integrates domestic production with international expertise. Imports have provided the backbone of supply, ensuring high-quality products meet patient demand, while exports signal a burgeoning opportunity for Aotearoa-grown cannabis.

The diversity of strategies adopted by New Zealand companies reflects the sector’s dynamism. Some producers focus on domestic cultivation and manufacturing, ensuring a steady local supply of flowers and extracts. Others adopt an export-led approach, targeting high-growth international markets with premium products. The market also includes those specialising in the importation of high-quality products, ensuring availability of a wide range of medicines. Additionally, the supply of unique Aotearoa genetics, active pharmaceutical ingredients, and tailored formulations further highlights the breadth of capabilities within the sector.

The country also exemplifies the role of a responsive and supportive regulator. By maintaining stringent quality standards, the scheme ensures patient safety and product efficacy, while recent regulatory reforms highlight adaptability to industry demands with changes such as simplifying export requirements, expanding allowable products, and reducing testing costs to boost the industry’s global competitiveness. The government’s financial support mechanisms for local producers further underscore its commitment to fostering a thriving, innovative sector.

Systemic inequities, particularly among Māori and low-income populations, remain barriers to equitable access. As Marta Rychert emphasises: “The MCS offers valuable lessons for other nations but must address inequities and barriers to fulfil its potential as a model framework.” To ensure sustainable and equitable growth, researcher recommends introducing financial assistance for medicinal cannabis products, allowing limited personal cultivation for palliative care patients, and expanding access for marginalised groups.

New Zealand’s balanced approach—leveraging imports to ensure immediate access, scaling exports to establish its global presence, and fostering local production to secure self-reliance—demonstrates the power of adaptability and foresight. This dual focus on global engagement and local strength positions New Zealand as a rising leader in the medicinal cannabis landscape, one whose story has the potential to inspire nations far beyond its shores. In embracing the challenges and opportunities of this new frontier, the country is not merely building an industry—it is cultivating a model of possibility and progress for the world to follow.

The Land of the Long White Cloud is emerging as a beacon of innovation and resilience in the South Pacific, crafting a medicinal cannabis industry that bridges local potential with global opportunity. By cultivating a thriving domestic market while seamlessly integrating into international supply chains, New Zealand offers a compelling blueprint for other small nations seeking to navigate the complexities of this burgeoning sector.