In 2024, Portugal’s medical cannabis export industry has broken previous records and highlighted its potential. From 709 kg exported in 2019, the country is now expected to export over 25 tonnes in 2024, surpassing other European contenders like Denmark and Macedonia.

This isn’t just explosive growth – it’s a calculated transformation built on three pillars: Excellent growing conditions and human capital, a conducive regulatory framework, and strategic positioning as one of the top suppliers to leading European markets like Germany, the UK, and Poland.

This article explores Portugal’s journey to becoming a cannabis export powerhouse, examining its record-breaking export achievements, industry dynamics, and the challenges of unlocking its domestic market potential, alongside future growth opportunities.

Table of Contents

Portugal’s cannabis industry thrives on a powerful mix of natural advantages, skilled human capital, and a forward-thinking regulatory framework.

Its Mediterranean climate mirrors California’s, offering ideal growing conditions with abundant sunlight reducing energy costs and mild winters enabling year-round production. These natural assets are complemented by deep agricultural expertise and a skilled workforce adept in both traditional farming and modern pharmaceutical practices, ensuring high-quality production at competitive costs.

Portugal’s regulatory framework, led by INFARMED, has set a benchmark for licensing efficiency and adaptability. The system ensures rigorous EU-GMP compliance while offering flexibility in export requirements, allowing producers to cater to diverse markets with varying standards. This has enabled Portuguese companies to export to high-compliance markets like Germany and more flexible markets like Israel, maximising their global reach.

Strategically positioned within the EU, Portugal benefits from harmonised production standards, streamlining international trade and serving as a gateway between European markets and global producers. These combined advantages have solidified Portugal’s role as a cannabis supply hub—but to sustain long-term success, the focus must shift toward innovation and value-added growth.

Record-Breaking Cannabis Exports Have Transformed Portugal into Global Leader

Portugal’s progressive cannabis reform policies have established it as a European leader. Despite allowing the production for exportation early on, with the first license awarded to Terra Verde in 2014 and the first exports in 2016, it wouldn’t be until the legalisation of medical cannabis in 2018 that a comprehensive regulation for production, importation, and sales would be formalised.

Since then, dozens of production projects have made Portugal their home and the sector has seen a dramatic surge. A consolidated look at company licensing data reveals that Portugal currently has 56 companies licensed across various activities: 37 for cannabis cultivation, 24 for manufacturing, 46 for import, 47 for export, and 11 for trade and distribution. Among these, 20 are EU-GMP certified, highlighting the high-quality standards upheld by the industry. Moreover, there are 125 companies in phase 2 of licensing with necessary documentation, while 94 are awaiting inspection for cultivation, 39 for processing, 100 for import/export, and 20 for distribution.

The increase in licensed companies at the pre-licensing phase highlights a promising pipeline for expanding trade networks. This robust pipeline underscores the potential for the number of licensed companies to surpass 200 in the next two years, reinforcing Portugal’s position as a global cannabis hub.

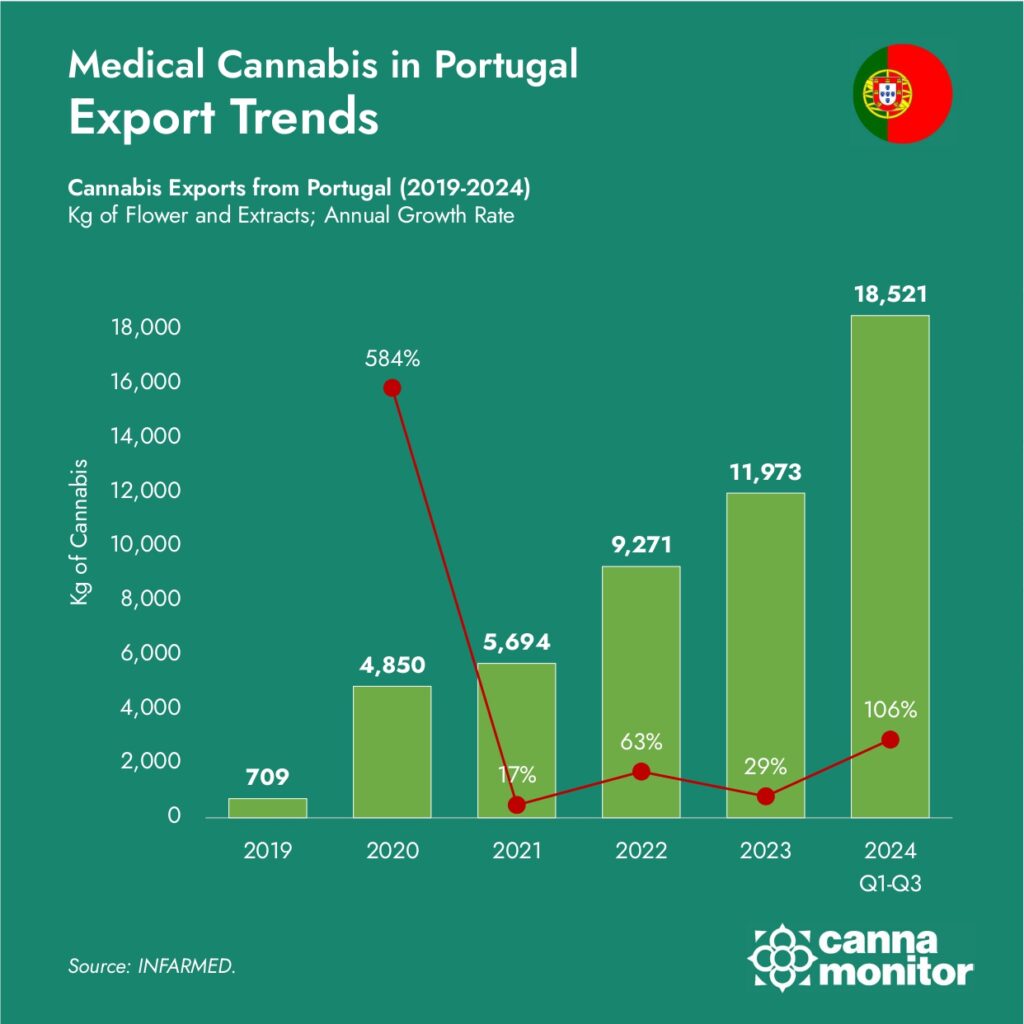

Portugal’s medical cannabis exports have jumped to unprecedented levels in recent quarters. Up to Q3 2024, the country exported over 18.5 tonnes of cannabis flower and extracts, marking a 106% increase from 2023. Projections for year-end volumes exceed 25 tonnes, affirming Portugal’s status as the world’s second-largest exporter, trailing only Canada.

This upward trajectory reflects consistent annual growth rates since 2019, when exports were a mere 709 kg. By 2023, exports had reached nearly 12 tonnes, with 2024 set to double that output, demonstrating a remarkable annual growth rate of over 80% from the industry’s nascent stages.

Medical Cannabis Exports (2019-2024)

European Trade Networks: How Portugal Dominates Continental Supply

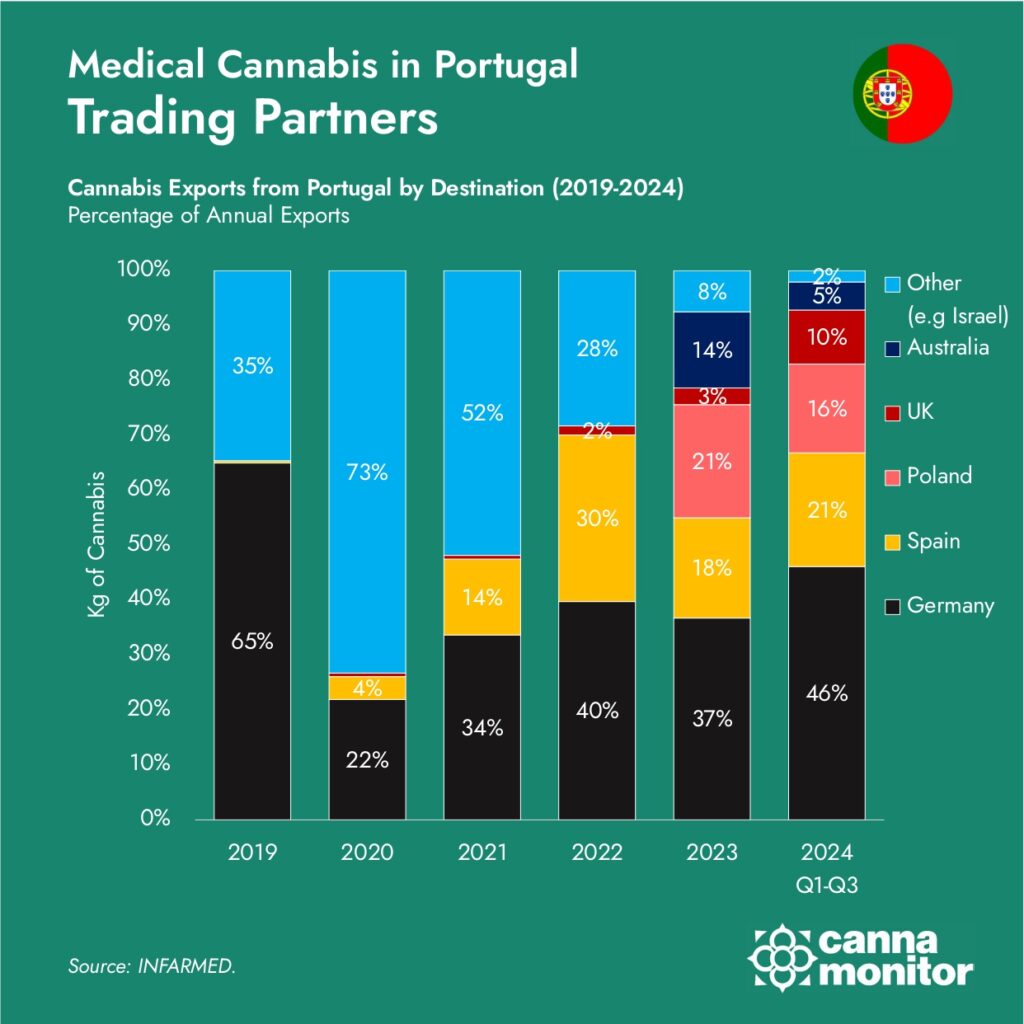

Medical Cannabis Exports by Destination Country

Medical Cannabis Exports by Destination Country

Portugal’s role as the premier EU supply hub has been carefully cultivated through strategic development of its production and processing capabilities. The country now hosts dozens of GACP and EU-GMP licensed producers, multiple EU-GMP processors, extractors and manufacturers; as well as a range of pharmaceutical service providers ranging from consultancies and validation services to genetic starting material providers.

This comprehensive industrial ecosystem has created sophisticated trade networks spanning the whole world, but focused particularly in the European continent. Portugal has become Europe’s “weedbasket” or its leading supplier, with production and exports remaining above many contendents for the role, such as Denmark, the Netherlands, Spain or Greece.

Germany is the largest importer of Portuguese products, accounting for approximately half of Portugal’s cannabis exports. The predominance of Germany has been further enhanced in 2024 by its recent adult-use reforms coming into force in April 2024, which have significantly increased medical demand, with 40 tonnes already imported this year. Portuguese operators have been instrumental in meeting supply needs of the German market, firmly establishing it as its second largest supplier and increasing its contribution in recent quarters.

The UK is next, representing between a significant fraction of Portuguese exports, in some cases after transformation in Spain. The United Kingdom’s expanding medicinal cannabis program led by private clinics has emerged as a second demand market in the continent, while recognising the adherence to stringent EU-GMP standards.

Over the last two years, growing demand in Poland has seen it emerge as a another significant partner, rerepresenting between 16% of exports in the last period. Successful product registrations in Poland of Portuguese-manufactured products have facilitated market penetration, capitalising on the country’s growing acceptance of cannabinoid medicines.

Beyond Europe, smaller markets for Portuguese production that recognise the European standards include the Australian market, which imported 42 tonnes in 2023, with Portugal in fourth position as the top exporter.

Over time, Israel has lost ground as a destination for Portuguese production, key high-demand markets with markets where EU-GMP compliance is a critical requirement.

Spain is the second most important destination, despite the fact that it doesn’t yet possess a domestic market. Spain’s integral role in the Portuguese supply chain is due to Medalchemy, Curaleaf’s group manufacturing facility, as well as pharmaceutical services such as the irradiation plant of Ionisos. These facilities serve as crucial links in the supply chain, processing Portuguese cannabis for distribution throughout Europe and highlighting the importance of regional cooperation in building a robust industry.

Portugal has emerged as a global powerhouse in the medical cannabis industry, transforming itself from a modest exporter to one of the world’s leading suppliers in just a few years. As 2024 draws to a close, the country stands at a critical juncture: while its export success is unprecedented, the challenge now lies in avoiding the commodity trap and developing a robust domestic market that can fuel innovation and sustainable growth.

The Local Market Gap: Export Success vs Domestic Access Challenges

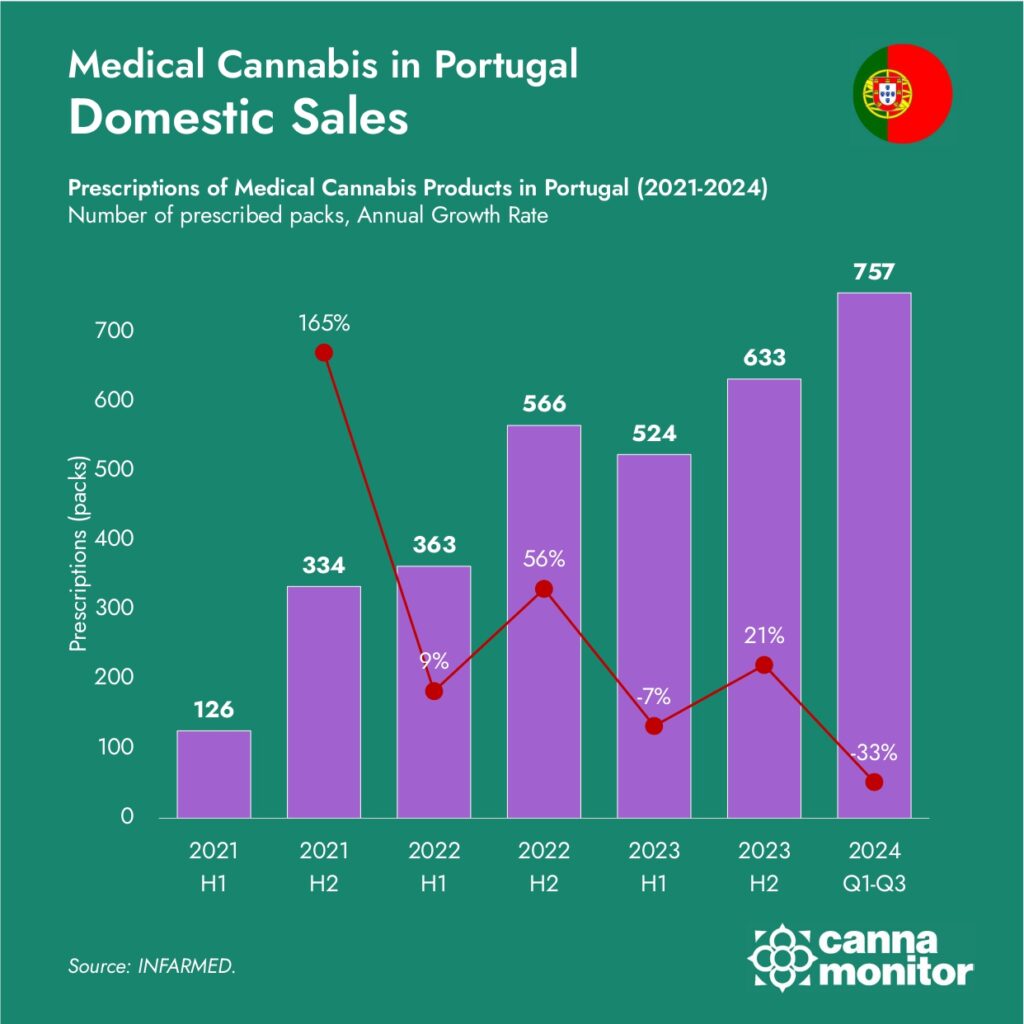

Despite its dominance in exports, Portugal’s domestic cannabis market remains underdeveloped. In the first 9 months of 2024, only 757 prescription packages were distributed, reflecting a 33% decline in prescriptions compared to H2 2023.

Recent surveys have revealed encouraging support within Portugal’s medical community, with most healthcare professionals acknowledging the therapeutic options of medical cannabis and 80% of healthcare professionals expressing support for cannabinoid treatments, including anesthesiologists and nurses. This level of acceptance should theoretically translate into broader adoption, but several barriers have created substantial obstacles to patient access. Many doctors lack comprehensive training in cannabis medicine, leading to hesitation in prescribing these treatments. The prescription process itself is often cumbersome, requiring additional paperwork and approvals that discourage both physicians and patients from pursuing cannabis-based treatments. Furthermore, Portugal lacks robust networks linking producers, physicians, distributors, pharmacies, and patients, streamlining the whole process.

The absence of public funding for medical cannabis presents a significant financial barrier for many potential patients. In a country where healthcare spending is already constrained relative to income levels, the out-of-pocket costs for cannabis medications can be prohibitive. This financial hurdle particularly affects vulnerable populations who might benefit most from these treatments but cannot afford them without public support.

The growing portfolio of approved medicinal products offers potential to expand domestic availability if regulatory and prescribing frameworks are improved. Currently approved products include Tilray’s flowers and oral solutions (THC 10mg/ml + CBD 10mg/ml and THC 5mg/ml + CBD 20mg/ml), high-THC flowers and extracts by Portocanna (20%, 22%, and 25% THC formulations), and the Satalliv line of oral solutions featuring THC-CBD combinations. These products provide a variety of options for patients but remain underutilised due to systemic barriers in domestic market access.

2025 and Beyond: Growth Opportunities in Global Cannabis Trade

Portugal’s cannabis industry is poised for continued growth as it explores untapped markets and adapts to evolving regulations. Diversification into high-value derivative products, such as advanced formulations, represents a promising avenue for capturing premium market segments. Companies are increasingly investing in research and development to enhance their innovation pipelines, ensuring competitiveness in a dynamic global landscape.

Public initiatives like the Portugal 2020 Program have been instrumental, funding nine key business innovation projects—such as Somaì, AceCann, and Cannexpor Pharma—with €22.43 million in public support, leveraging a total investment of €84.59 million. Additionally, cannabis projects have been recognized as Projects of National Interest (PIN), attracting hundreds of millions in overall investment and further positioning Portugal as a global cannabis leader.

Expanding the local market is vital for several reasons. A stronger domestic market would diversify revenue streams, reducing dependency on volatile global markets. It would also foster innovation by creating faster feedback loops for product development. Moreover, integrating cannabis medicines into Portugal’s healthcare system could accelerate clinical research and improve patient outcomes. Addressing these barriers requires streamlining prescription processes and raising physician awareness, aligning domestic access with international success.

Domestically, simplifying prescription pathways could unlock significant growth, benefiting both patients and industry stakeholders. Building local demand would also enhance the sector’s resilience against global market volatility. However, challenges remain, including intensifying international competition and navigating regulatory changes. To sustain its trajectory, the industry must adopt adaptive strategies, foster international partnerships, and commit to sustained innovation. By addressing these challenges, Portugal can solidify its position as a leader in the global cannabis trade.