Medical cannabis in Italy has reached a pivotal moment. Despite being a pioneer in the European medical cannabis landscape, Italy’s market has seen a decline in sales in 2023 for the first time in a decade.

This article delves into the realities and challenges facing the Italian medical cannabis sector, exploring the reasons behind the stagnation and discussing potential pathways to revitalization.

From unreliable supply chains and high levels of bureaucracy to the lack of prescribing doctors, the Italian market’s stagnation calls for a comprehensive overhaul. By addressing these issues and adopting a more liberalised approach, Italy can unlock substantial market potential and provide much-needed relief to patients.

Table of Contents

Medical cannabis in Italy has reached a pivotal moment. Despite being a pioneer in the European medical cannabis landscape, Italy’s market has faced a significant setback in 2023, with a decline in sales for the first time in a decade. This article delves into the realities and challenges facing the Italian medical cannabis sector, exploring the reasons behind the stagnation and discussing potential pathways to revitalization.

Sales trends of Medical Cannabis in Italy

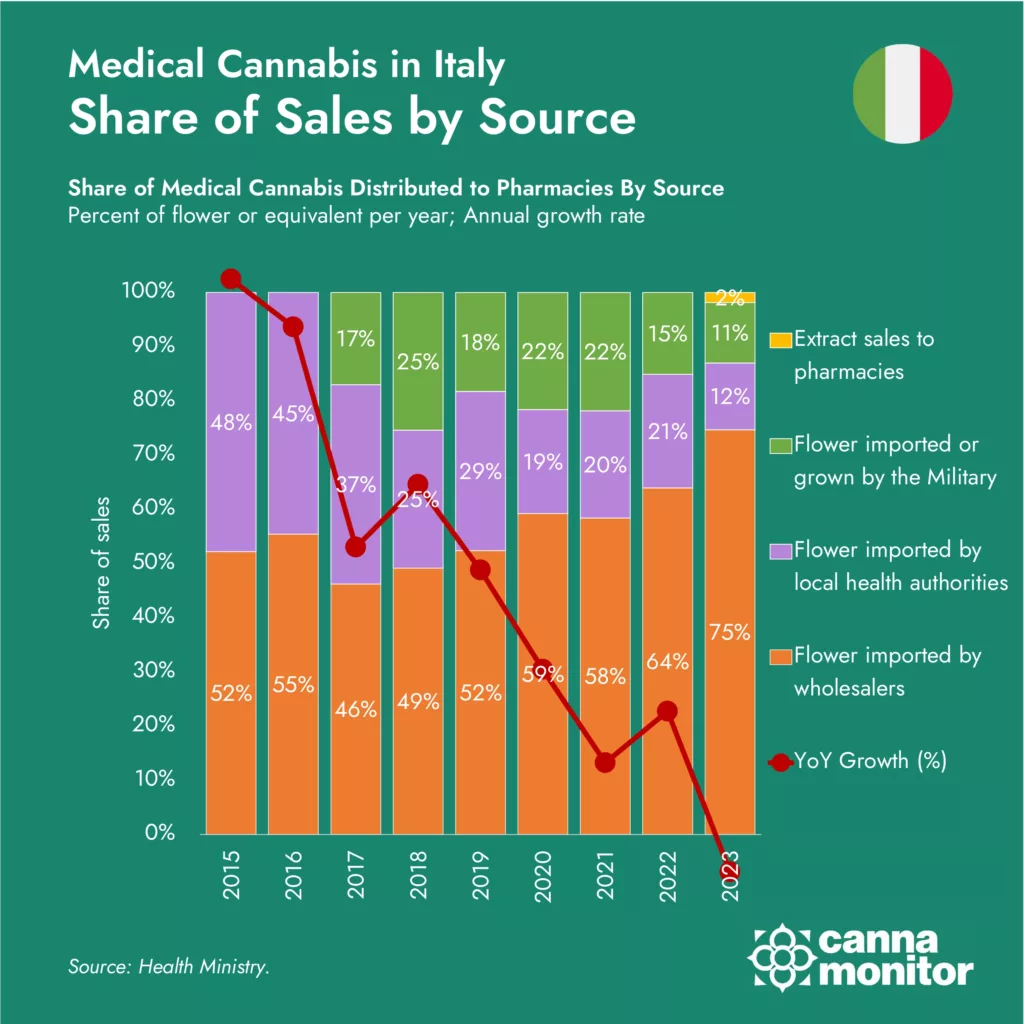

In 2023, Italian medical cannabis sales experienced a decline, a stark contrast to the previous trend of steady growth. Italy, once the leader in the European market, now lags behind countries like Germany, the UK, and Poland in terms of patient access to cannabinoid medicine. Despite governmental efforts to enhance both domestic and foreign supply, the market has stagnated at approximately 1.5 tonnes distributed annually.:

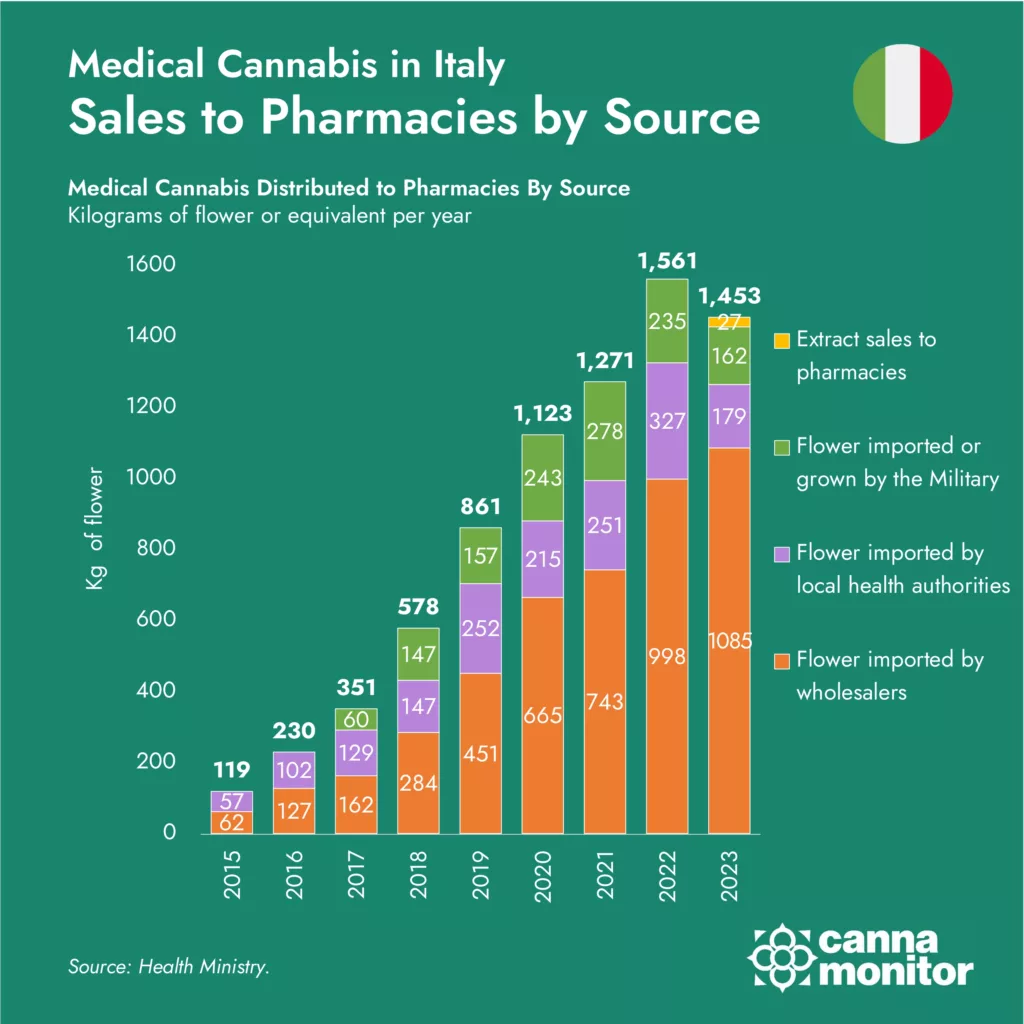

Sales to Pharmacies by Source

Sources of Medical Cannabis in Italy

The graph depicts the varied sources of medical cannabis in Italy, including imports from Bedrocan through the Dutch government, a military public tender currently held by Spanish Linneo Health, and the limited production by the Italian military. Only a limited number of pharmaceutical raw material wholesalers are licensed to distribute products in addition to the military. The dependency on imports and the restricted domestic production highlight the vulnerabilities within the supply chain.

Italian Military / Ministry of Defense

- Stabilimento Chimico Militare de Firenze (SCFM): The center, originally tasked with producing medicines for the military, currently holds a monopoly of medical cannabis production in Italy, growing two cultivars (FM1 and FM2) bred in the CREA-CIN of Rovigo. Despite the SCFM’s historical significance, it can only produce 150 kg of cannabis annually, far below Italy’s demand. This shortfall has led to reliance on imports, although Italy has the potential to produce cannabis domestically at a lower cost.

- In April 2022, the Ministry of Defense issued a tender to allow private companies to expand cannabis production. Dolomitigrow, a Trentino start-up, won the tender along with four other companies. These companies are currently undergoing evaluation to ensure their production facilities meet standards, aiming to eventually supply 500 kg of cannabis per year to the SCFM.

- Public tender by the ministry of defense: given the limits of production by the military, the ministry of defense has issued multiple tenders allowing foreign companies to supply it with EU-GMP medical cannabis flower:

- The last of these tenders from April 2023, corresponding to 630kg of flower, was awarded to Spanish licensed producer Linneo Health. Previous winners of the tender included Little Green Pharma from Denmark (2022) and Aurora from Canada (2018).

- Local Health Authorities (ASLs), including hospital pharmacies, can import products from abroad upon request of a particular doctor, despite the complex bureaucratic procedure that requires them to submit a request to the Central Narcotics Office of the health ministry.

- 5 pharmaceutical raw materials wholesalers (FL Group, ACEF, Galeno, Farmalabor and Fagron) can import cannabis flower exclusively from the Dutch Ministry of Health, produced by Bedrocan, which currently represents the largest share of products available to Italian patients.

- In 2022, the Ministry of Health started allowing wholesalers to import standardised cannabis extracts to be supplied to pharmacies in order to produce magistral preparations easier than from flower. Currently 3 international companies supply Italy with extracts of different compositions:

- Tilray through distributor FL Group.

- Curaleaf through Farmalabor.

- Avextra through Fagron.

- In 2022, the Ministry of Health started allowing wholesalers to import standardised cannabis extracts to be supplied to pharmacies in order to produce magistral preparations easier than from flower. Currently 3 international companies supply Italy with extracts of different compositions:

Overall, the supply situation in Italy is overly complex in comparative terms with other European markets. By introducing domestic licenses for production and allowing wholesalers to import products from any suppliers, the market would get significantly streamlined contributing to easier access for patients.

Supply chain issues plaguing the Italian market

The graph above highlights the trends in medical cannabis distribution in Italy from 2015 to 2023. The steady growth observed up to 2022, with a peak of 1,561 kilograms, sharply reversed in 2023, falling to 1,453 kilograms. This downturn marks a critical juncture for the industry and prompts a closer examination of the underlying causes.

One of the most significant challenges facing the Italian medical cannabis market is the unreliable supply chain. Despite a decade since the initiation of the medical cannabis program, patients continue to experience frequent product shortages. This issue is exacerbated by the limited number of preparations available in galenic pharmacies, making consistent treatment difficult for many patients.

- Bureaucratic Hurdles: The high level of bureaucracy is another major impediment to the growth of the medical cannabis market in Italy. The government tightly controls which companies can import and distribute products, the types of products that can be imported, and who can produce domestically. Additionally, each region imposes its own rules regarding prescription and reimbursement, creating a fragmented and often confusing regulatory environment.

- Impact on Prescription and Access: The bureaucratic hurdles extend to prescribing doctors, where limitations on private actors and insufficient physician education have kept the number of prescribing doctors low. This, in turn, has restricted the number of patients accessing medical cannabis to around 20,000, despite millions of Italians claiming to use cannabis for therapeutic purposes.

- Lack of Physician Engagement: A significant barrier to patient access is the lack of engagement from the medical community. Many doctors are either unaware of the therapeutic potential of cannabis or are deterred by the complex regulatory framework and bureaucratic hurdles involved in prescribing it. This has led to a situation where, despite the legal framework supporting medical cannabis, patient uptake remains low.

- Role of Extracts and Reimbursement: In recent years, companies like Tilray and Curaleaf have introduced extracts into the Italian market, aiming to facilitate magistral preparations and increase prescription rates. In regions such as Lombardia and Emilia-Romagna, these extracts have been approved for public reimbursement. However, this has not significantly boosted penetration, indicating that further steps are needed to educate and engage the medical community.

Share of sales to pharmacies by source

The need for streamlined access and an open market

Despite leading Europe in CBD production and having one of the highest cannabis usage rates on the continent, Italy’s government-led model is failing to keep pace with other European countries in terms of medical cannabis access. A more liberalised approach, with streamlined access and an increased number of suppliers, could create substantial market opportunities and provide much-needed relief to patients.

For Italy to regain its position as a leader in the medical cannabis market, several key changes are necessary:

- Streamline Bureaucratic Processes: Simplify the regulatory framework to make it easier for companies to import, produce, and distribute medical cannabis.

- Enhance Domestic Production: Increase support for domestic growers and producers to ensure a more stable supply and allow them to diversify its revenue avenues.

- Engage the Medical Community: Implement educational programs and incentives to encourage more doctors to prescribe medical cannabis, and allow private companies to contribute.

- Expand Patient Access: Broaden the scope of conditions eligible for medical cannabis treatment, simplify the prescription process to increase patient numbers, allow specialised private clinics to flourish.

The Italian medical cannabis market stands at a crossroads. Addressing the challenges of supply chain reliability, bureaucratic complexity, and physician engagement is crucial for revitalizing the sector. By adopting a more liberalised and streamlined approach, Italy can unlock significant market potential and better serve the therapeutic needs of its patients.