Since becoming the first nation to legalise cannabis in 2013, Uruguay has witnessed significant growth in its cannabis industry.

By 2023, the Oriental Republic celebrated its sixth consecutive year of cannabis exports, amassing over USD 27 million in revenue. With more than 100 active companies in the field, Uruguay’s cannabis expansion is driven by both high-THC and CBD flower exports.

This article explores the evolution of Uruguay’s cannabis exports, the diversification of products and markets, and the future potential of this burgeoning industry

Table of Contents

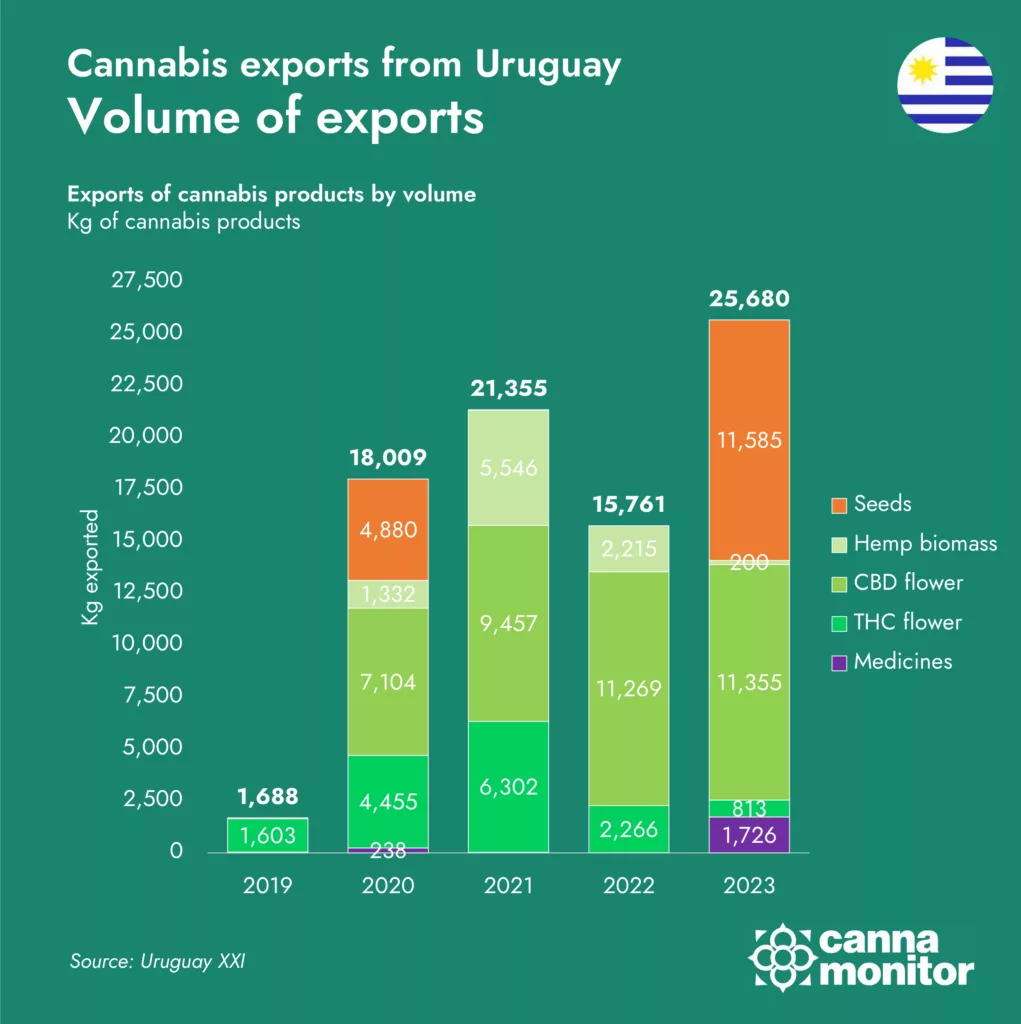

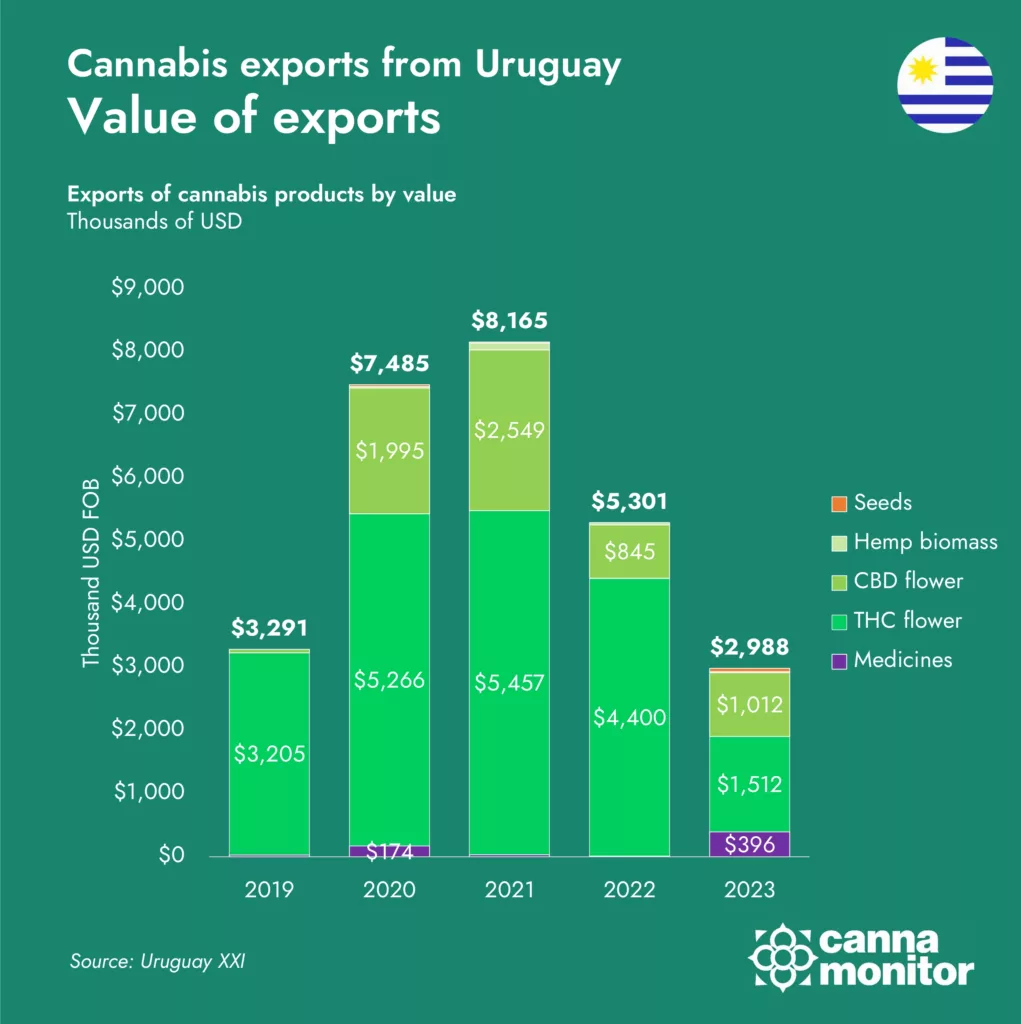

From 2018 to 2023, Uruguay exported a variety of cannabis products, including seeds, biomass, and hemp flowers for non-medical use, as well as high-THC flowers for medical use and finished products. The medicinal sector, particularly high-THC flowers, has driven much of the export activity. Recently, finished products have also gained prominence. Industrial hemp represented an average of 23% of exports, peaking at 36% in 2023. This surge was attributed to a recovery in international prices between 2022 and 2023, alongside a more moderate performance in the medicinal sector. Hemp flower exports for non-medical use and high-THC flowers for medical use consistently exceeded 80% of the total export value in 2023.

Watch our webinar in collaboration with Uruguay XXI (in Spanish)

Opportunities for Uruguayan exporters

Flower has dominated Uruguayan Exports

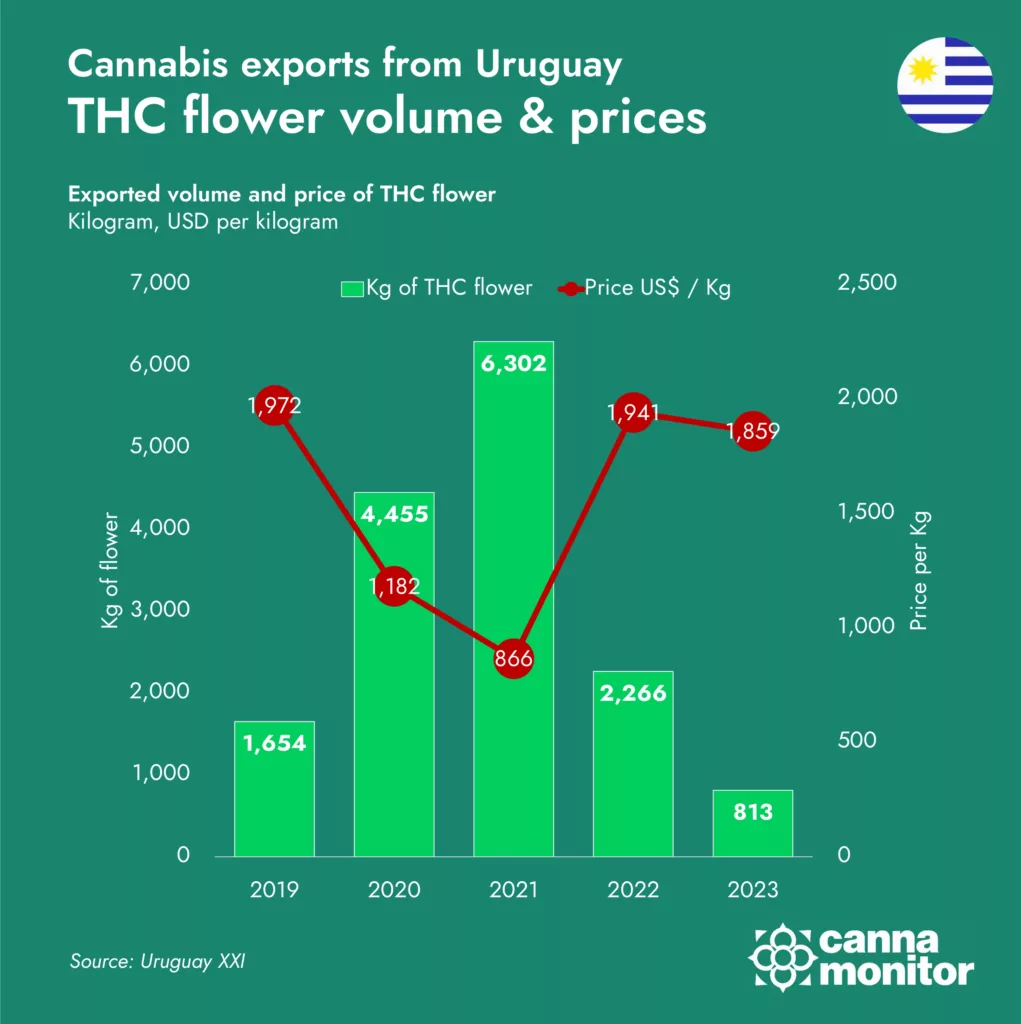

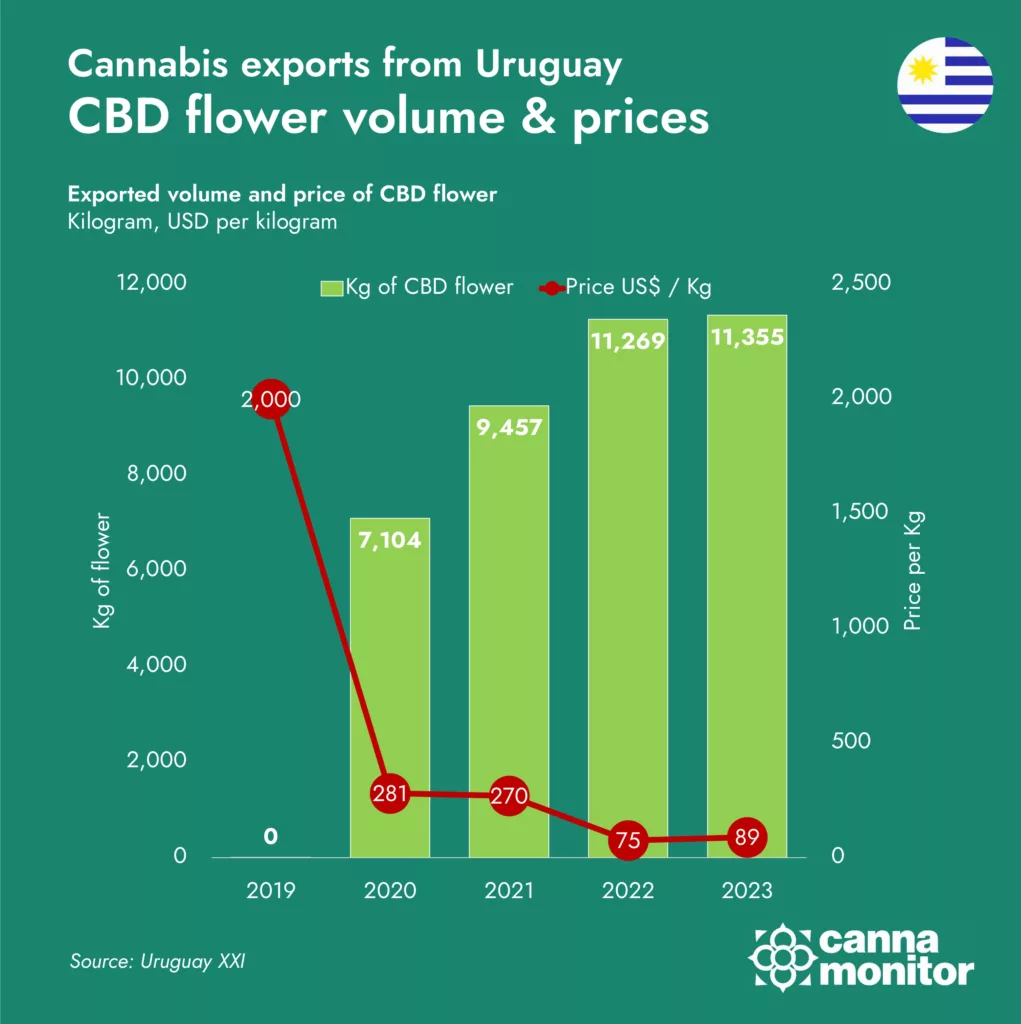

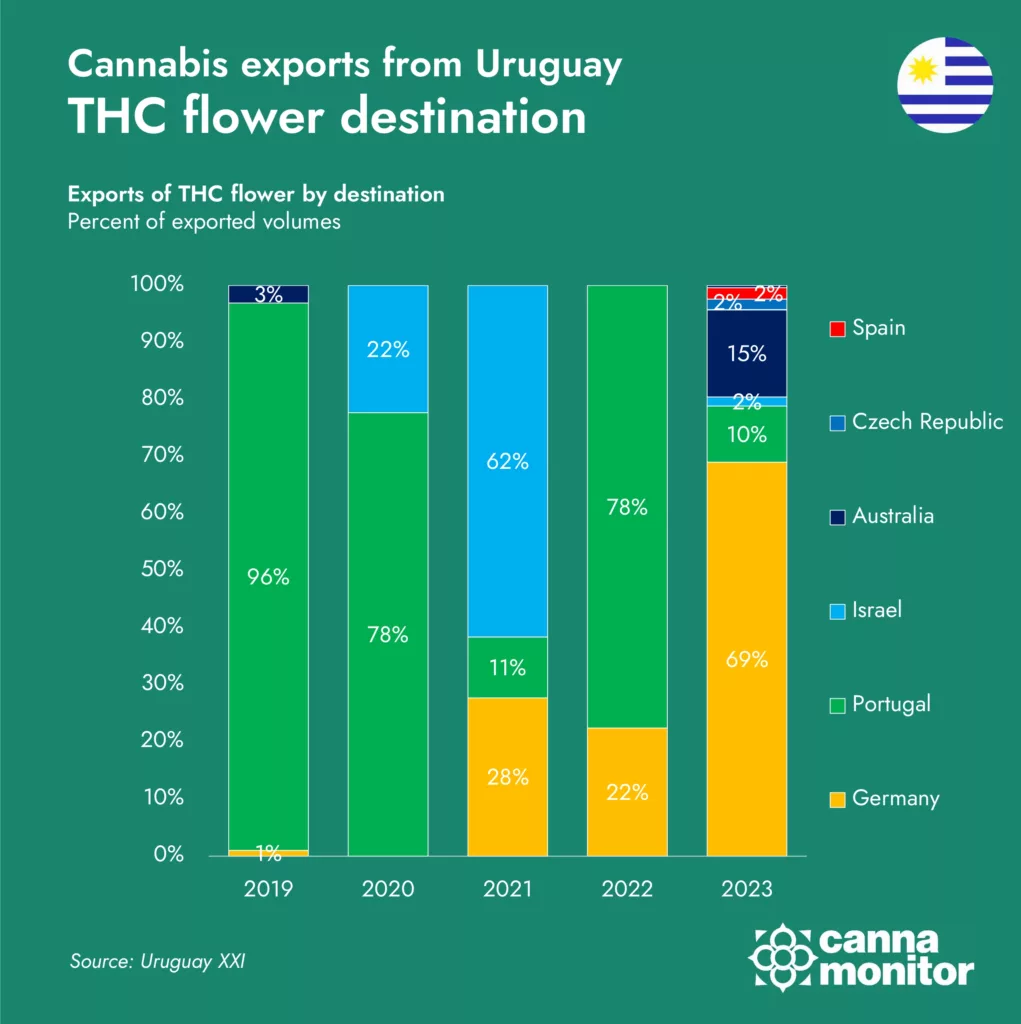

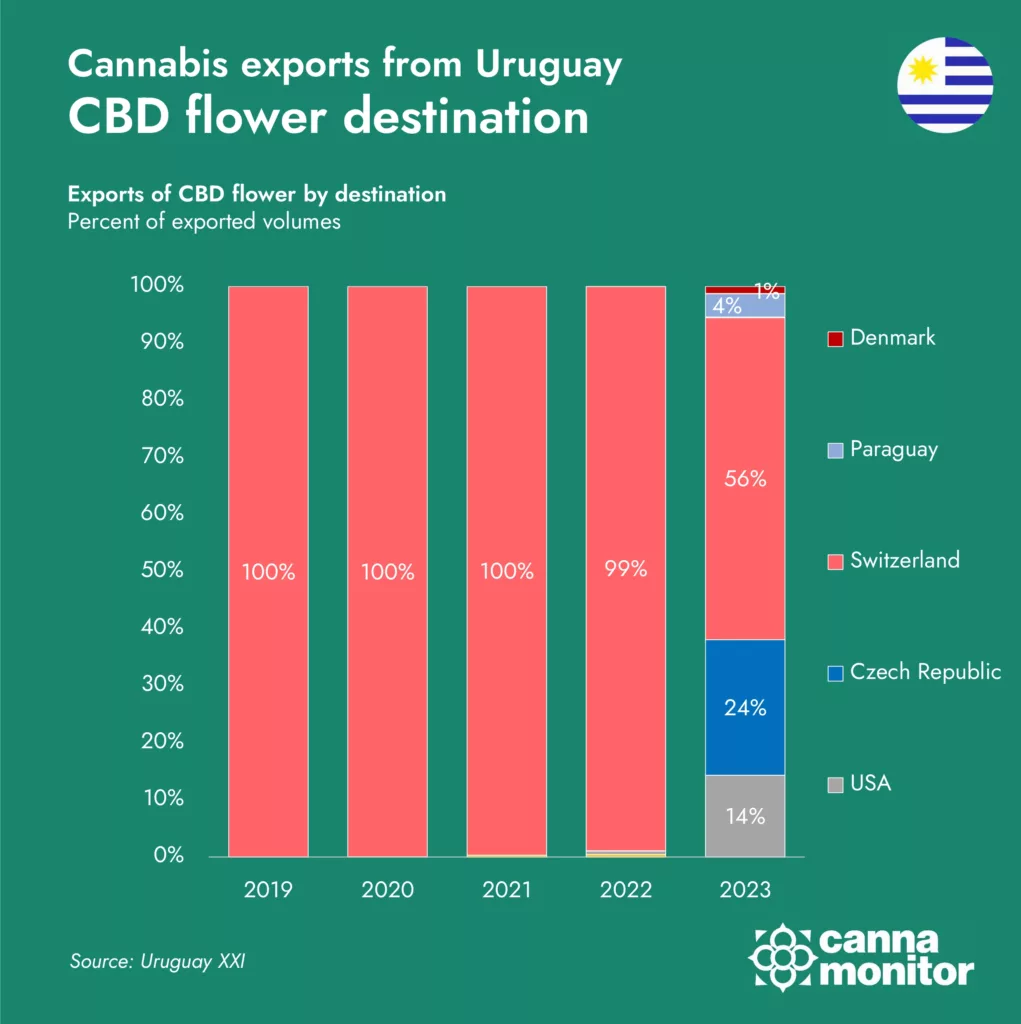

Flower exportation has been at the forefront of Uruguay’s international cannabis trade. Since 2020, the country has consistently exported over 10 tonnes of cannabis flowers annually. High-THC flowers have primarily targeted medical markets in Germany and Israel, often through intermediaries in Portugal or Spain. Meanwhile, CBD flowers, which are unregulated by narcotic control treaties, have been shipped mostly to Switzerland, supplying the European CBD consumer market.

From 2018 to 2023, Uruguay exported a variety of cannabis products, including seeds, biomass, and hemp flowers for non-medical use, as well as high-THC flowers for medical use and finished products. The medicinal sector, particularly high-THC flowers, has driven much of the export activity. Recently, finished products have also gained prominence. Industrial hemp represented an average of 23% of exports, peaking at 36% in 2023. This surge was attributed to a recovery in international prices between 2022 and 2023, alongside a more moderate performance in the medicinal sector. Hemp flower exports for non-medical use and high-THC flowers for medical use consistently exceeded 80% of the total export value in 2023.

Volume of exports by product type

Value of exports by product type

The Evolution of Uruguay's Cannabis Exports

Diversification of Products and Markets

In recent years, there has been a notable diversification in both the types of products exported and the international commercial partners involved. This diversification includes:

1. Increased Value-Add Production: By conducting more stages of the production process within Uruguay, the value-add of the produce has increased. This includes the development of extract-based and finished product offerings, enabling entry into high-potential markets like Brazil.

2. Expansion to New Markets: High-THC flowers have found new markets in countries with growing medical cannabis demand, such as Australia, the UK, and New Zealand. Additionally, CBD flower exports have diversified to manufacturing and distribution hubs like the Czech Republic, and even to the US herbal hemp market.

THC flower export volumes

CBD flower export volumes

Key Export Destinations of Uruguayan cannabis

Brazil: A Top Priority Market for Medicinal CBD

The export of medicinal products to Brazil, particularly under compassionate use regimes and through registered products sold in pharmacies, has been substantial. In 2023, Argentina emerged as a major market for hemp seeds, driven by recent regulatory changes aimed at positioning the country as a global industrial hemp producer.

Expanding the Reach on European and Global Medical Markets

Other notable markets include New Zealand, Australia, the Czech Republic, and Spain. Switzerland, historically a key market for CBD flowers, saw reduced dominance (47.8% of sales) with increased exports to the US (18.6%) and the Czech Republic (18.4%). The Czech Republic’s increased THC limit to 1% has positioned it as a competitive logistics hub within Europe, benefiting from EU membership.

Medicinal cannabis remains pivotal, with an increase in the number of exporting companies suggesting a potential rebound in 2024. Key markets like Germany and Portugal are expected to continue, alongside new entrants such as Australia, New Zealand, and Spain.

High-Quality CBD Exports to More European Countries

The industrial hemp sector is experiencing market diversification and a reduced dependency on Swiss intermediaries. Despite this, few companies dominate exports, indicating either a division of roles within the production/commercial chain or challenges in accessing foreign commercial channels.

The introduction of industrial processing plants offers new avenues for exporting extracts or isolates and the remediation of flowers for markets with lower THC thresholds. Regulatory frameworks in destination countries remain crucial for creating commercial opportunities in this still-volatile international market.

Volume of exports by product type

Value of exports by product typealue

Uruguay's Position in the Global Market

Uruguay’s pioneering legalisation of cannabis, coupled with its stable economic and political environment, innovative ecosystem, and strong public-private institutional framework, continues to position the country as an attractive destination for foreign investment. These factors also bolster Uruguay’s ability to position its export offerings in new international markets.

Uruguay’s cannabis industry has made significant strides since its legalisation in 2013. The diversification of products and markets, combined with advanced manufacturing processes and a focus on quality, have positioned Uruguay as a key player in the global cannabis market. As the industry continues to evolve, the partnership with Uruguay XXI and ongoing regulatory developments will be critical in sustaining growth and capitalising on new opportunities in 2024 and beyond.

Future Prospects and Strategic Considerations

The trajectory of Uruguay’s cannabis industry is set on a path of continued growth and diversification. To maintain this momentum, several strategic considerations must be addressed:

Regulatory Adaptation: As international markets evolve, so too must Uruguay’s regulatory framework. Keeping abreast of changes in major markets like the EU, the US, and Brazil will be essential. Regulatory agility will allow Uruguayan exporters to swiftly adapt and maintain compliance, ensuring uninterrupted market access.

Investment in Technology and R&D: Advanced manufacturing technologies and robust research and development (R&D) initiatives will be key drivers of innovation. Investment in these areas will not only enhance product quality but also lead to the development of new product lines, such as edibles, topicals, and other cannabis derivatives.

Strengthening Public-Private Partnerships: Continued collaboration between the public sector and private enterprises will be crucial. Entities like Uruguay XXI can facilitate market intelligence and export promotion, while private companies can leverage this support to expand their global footprint.

Market Diversification: While current export destinations have shown significant growth, further diversification into emerging markets will mitigate risks associated with market dependency. Exploring new markets in Asia and Africa, where regulatory landscapes are beginning to shift, could present lucrative opportunities.

Brand Building and Marketing: Establishing strong, recognizable brands will help Uruguayan cannabis products stand out in the increasingly competitive global market. Marketing strategies that highlight Uruguay’s pioneering role in cannabis legalisation, combined with the quality and safety of its products, will resonate with international consumers.

Uruguay’s export cannabis industry has undergone remarkable transformation since its legalisation in 2013. The strategic efforts in diversifying products, expanding into new markets, and enhancing manufacturing processes have positioned Uruguay as a formidable player on the global stage. The ongoing collaboration with Uruguay XXI and the country’s proactive stance in regulatory adaptation will be pivotal in sustaining this growth trajectory.

Looking ahead, the industry’s focus on innovation, market diversification, and brand development will be essential in capitalizing on emerging opportunities. Uruguay’s stable economic and political climate, coupled with its strong institutional support, ensures that the country is well-equipped to navigate the complexities of the global cannabis market. As we move into 2024 and beyond, Uruguay’s cannabis industry is poised not only to maintain its current momentum but also to achieve new heights in the international arena.